Since the past month, equity markets have been significantly choppy. While many savvy investors have taken it in stride and are harping on the correction as an opportunity to buy more at discount prices, there is a large faction of mutual fund investors for whom the sweat on the brow has not dried since over a month.

Investors who have started investing in mutual funds only a year back or so are experiencing the real stomach-churns for probably the first time. All this time, novice investors had been exposed to only the bright side of the world of equities with overwhelming returns, many may even have regretted not investing more before the uptick. However now, as the cycle changes, the regret has switched sides because of the “red numbers” in the investment reports.

So, what’s the way ahead for a common Indian investor whose only goal to invest in mutual funds was to build wealth over a longer term? Tried & tested across periods, successful investors swear by these principles for investing during choppy times.

“Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” -Warren Buffet

‘Market Cycles’ are called cycles for a reason – Don’t react as if you did not know that equity markets are volatile.

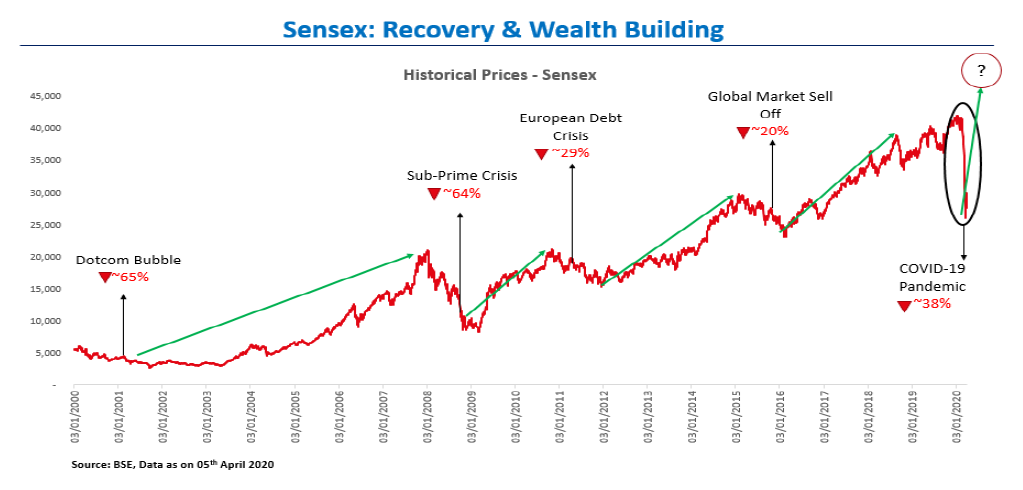

Equity markets are sensitive to multiple factors including macro-economic environment, geopolitical scenarios, sectoral stress and similar. The markets react and reflect people’s expectations in the very distinct near term and quite often than not in an exaggerated manner. “Kneejerk reaction” is among the most used phrases on Dalal Street for a reason. However, those who stood the test of time and believed in investing discipline emerged with bountiful wealth.

Sure, the current pandemic has led to a steep decline in trade & commercial activities. But, do you really think that all businesses are going to come to a grinding halt, and more importantly – remain so forever? If not, there is no reason for you to not believe in a recovery of equities – which is nothing but reflective of business health in the longer term.

Right from the 2009 financial crisis to European crisis, North Korean missile tests, Fed Rate hikes and similar global tantrums, equity markets have survived it all and yet delivered spectacular returns over the period.

Ever wondered why?

Simple, do you believe that many years down the line, the world (includes national economies, sectors, companies, humans, art, music and everything) will reach a pedestal at least some place higher than now?

Basically, do you believe that mankind will continue to progress?

If your answer is yes, you must realise that equities are nothing but a reflection of economic progress (driven by mankind, obviously) and so has a direct correlation and reason to grow with the rest of the world.

“We continue to make more money when snoring than when active.”

-Warren Buffett

The ability to time the market right each time is not just a matter of intellectual ability, it also requires some amount of psychic abilities

Equity markets fluctuate basis the demand and supply by millions of entities.

Can you read a single mind? If not, why try read millions of them and time the market?

Millions of minds and algorithms maintain the demand-supply and consequent pricing in capital markets. What is the likelihood that you would be able to fathom the direction in which the majority decisions would flow?

Even when you think you can make some sense out of the chaos, let me tell you, very often even the entire market gets things wrong – hence the term “correction” instead of “decline” is used to describe such scenarios when sudden enlightenment reverses the effect of overtly optimistic valuations previously placed by the market.

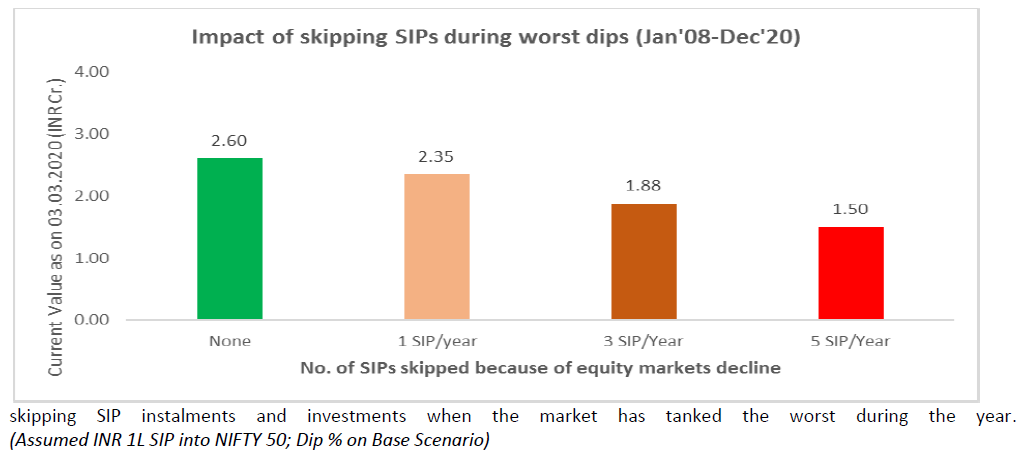

Following is a classic illustration of what would have happened if your parents did what you are contemplating now –

Honestly, nobody – literally nobody in the world can time the market while many are paid to try. The best way to go about investing is through a periodic investment (think SIP) just so that you manage to average your purchase cost across cycles and benefit from the rupee-cost averaging.

“Most People don’t plan to fail. They fail to plan.”

-John L. Beckley

Plan right & believe in it – That’s the reason you had a plan in the first place

Times like now are testing times where many novice investors get shaken by volatility and choose to step out of the markets instead of riding the tides till, they reach their goals. Statistically, an investor can expect failure 100% of the times he invests without thinking it through.

Asset allocation and financial planning are key to being profitable and building wealth. Let’s say you start exercising to get fit – you have a planned schedule, workout routine and diet plan. While planning, you knew it would take at least 8 months of perseverance before you achieve your target body. Now, what happens if you follow the regime regularly but don’t see much of an impact in one month? Would you stop? If you stop, you know who is to blame when eight months have passed, summer has begun, and you can’t get into your summer outfit on the beach.

Quite often in life, you will not be able to achieve goals (financial as well as non-financial) if you give up way before the time comes when you were expecting to reap the benefits.

It is extremely important that you plan extremely well, keep reviewing and make situational alterations – not a revamp.

Please understand, there’s a fine line between being reactive & course-correction.

While these principles are not a definite guide to becoming Uncle Scrooge wading through an ocean of gold coins, but it sure can help you achieve your financial goals.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F2y5d823||target:%20_blank|” button_position=”button-center”]