“You pay a very high price in the stock market for a cheery consensus”

-Warren Buffet, Forbes magazine (1979)

TL;DR: For every seller who feels a stock price is overvalued, there’s a buyer who believes it is undervalued. The demand-supply keep tugging till they start trading within a narrower range. The only one winning is the one who continues to bet on the game instead of any side in this game of tug-of-war.

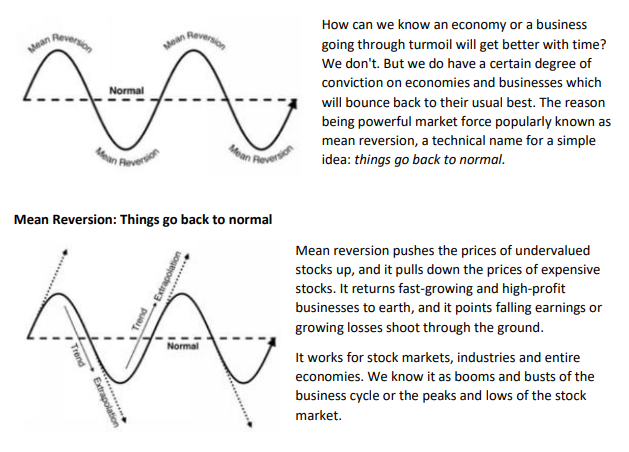

But, most investors focus on extrapolating instead of considering the probability of mean reversion.

Extrapolation is another technical term which simply means: We find the trend and extrapolate it.

Mean reversion is the expected result. But we don’t estimate mean reversion. Rather, our instinct is to find a trend and extrapolate it. Psychologically we think it will always be winter for some companies and for others it will always be summer. Eventually, fall follows summer and spring follows winter – which, though counter-intuitive, most seem to miss.

What causes mean reversion? How does beaten-down companies’ stock price rise over a period of time?

Benjamin Graham once referred to this as “one of the mysteries of our business”. The microeconomic answer is rather simple.

Undervalued assets and profits attract investors. Value investors and other fundamental investors start to buy stocks and so push up the stock prices. High prices and expensive assets cause investors to sell. The continuous selling pushes down the stock prices.

While the crowd imagines the downwards trend in the stock market will continue, value investors and contrarians or rather smart investors continue to stay on the course and grab these opportunities. This push-pull continues till the prices reach a range where there’s consensus of it being the fair price range, thus creating an equilibrium; or in other words – reverting to the mean.

Investor Takeaways:

• Mean reversion is a part and parcel of investing in equities, in the long run it all moves to a range which includes the fair price point of the stock.

• Mean reversion enables a great opportunity for long term investors to purchase the asset at a lower cost and bring down the average cost of acquisition.

• Mean reversion does not mean that at a certain given point a beaten down stock will resurrect or a blue-chip company will go down the drain.

• Mean reversion cannot be timed, but investors can avail benefits out of it if they continue to systematically invest through the period.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F3cCseel||target:%20_blank|” button_position=”button-center”]