Bharat Heavy Electricals Ltd

1. Bharat Heavy Electricals Ltd

| Counter | BHEL LTP83.09 |

| Call | Buy on dip |

| Target 1 | 94 |

| Target 2 | 100 |

| Stop Loss | 75 or 68 |

| Time Horizon | 3-4 weeks |

| Notes | Buy-on-dip towards 82 & 78 |

BHEL is one of the largest engineering and manufacturing companies of its kind in India engaged in design, engineering, construction, testing, commissioning and servicing of a wide range of products and services with over 180 product offerings to meet the ever-growing needs of the core sectors of economy.

| Previous Close | 82.0 | TTM EPS | 1.4 |

| 52 Week High | 91.6 | TTM PE | 60.7 |

| 52 Week Low | 41.4 | P/B | 1.1 |

| Sector PE | 21.5 | Mkt Cap (Rs. Cr.) | 28,970 |

(Source: Moneycontrol, BSE, Fisdom Research)

Technical Outlook

(Source: Fisdom research)

- As of June 2021, BHEL’s share price reached a high of 80, and since then, the counter has entered “Price & Time” consolidation.

- Based on current trends and price analysis, it appears that BHEL is poised for an upward trend in the coming days.

- In April 2023, the counter showed a “Bullish Engulfing” candlestick pattern on the monthly chart and closed just below the 80 mark.

- Over the past two months, the stock has established a solid base above 80 and is currently maintaining above 68. The stock is expected to initially reach 100, followed by significant milestones of 110 and then 116 in the next few months.

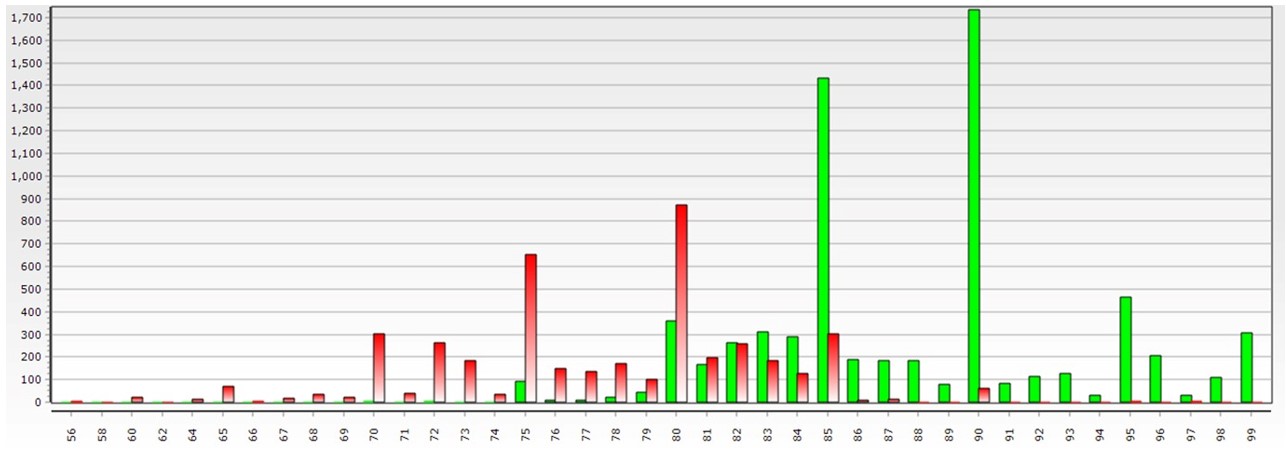

Open Interest Study

(Source: Fisdom research)

- The most significant concentration of Call Options (CE) for the June series is at the 90 strike price, closely followed by the 85 CE.

- Conversely, the majority of Put Options (PE) are built up at the 80 strike price. This level is also a critical battleground between buyers (“Bulls”) and sellers (“Bears”) for the upcoming months.

- If the trading price stays above 80, it indicates a positive trend and could mean that buyers or “Bulls” may have an advantage according to price study.

F&O Strategy

| Scrip | BHEL LTP 83.09 |

| Risk | Moderate |

| Ratio | 1:1 |

| Bias | Range to pull back |

| Max Reward Expected | ₹79,800 |

| Max Risk Expected | ₹35,700 |

| Action | Scrip | QTY | IP | LTP |

| BUY | BHEL JUN FUT | 10500 | 83.75 | 83.75 |

| SELL | BHEL JUN 83 PE | 10500 | 2.65 | 2.65 |

|

2. Ambuja Cements Ltd

| Counter | AMBUJACEM LTP 437.75 |

| Call | Buy on dip |

| Target 1 | 472 |

| Target 2 | 484 & 505 |

| Stop Loss | 418 or 400 |

| Time Horizon | 4-5 weeks |

| Notes | Buy-On-Dip towards 432 & 422 |

Ambuja Cement was founded in 1983 by Narotam Sekhsaria and Suresh Neotia, two traders with very little knowledge of cement or manufacturing. What made up for this lack was their farsightedness: Anticipating that cement would be a critical resource for a developing economy like India, they invested in a state-of-the-art cement plant in Gujarat and went on to build a trusted cement brand that has become synonymous with quality and strength.

| Previous Close | 429.2 | TTM EPS | 9.7 |

| 52 Week High | 598.0 | TTM PE | 45.2 |

| 52 Week Low | 315.3 | P/B | 2.7 |

| Sector PE | 45.1 | Mkt Cap (Rs. Cr.) | 86,981 |

(Source: Moneycontrol, BSE, Fisdom Research)

Technical Outlook

(Source: Fisdom Research)

- Ambuja Cement’s stock price has risen from a low of 301 in February 2023 to a high of 440 last week.

- The 400 level, which was a major resistance point for the last four months, has now become a significant and critical support level for potential increases in price.

- If the price stays above 400, it is likely to remain stable or even increase. If it holds above 440, this could stimulate new buying interest, pushing the price towards 480 and the major resistance level of 505.

- For the coming weeks, a cautious yet optimistic approach is suggested for this stock. If the price remains above 420, the trend for the coming week could be rangebound to upward.

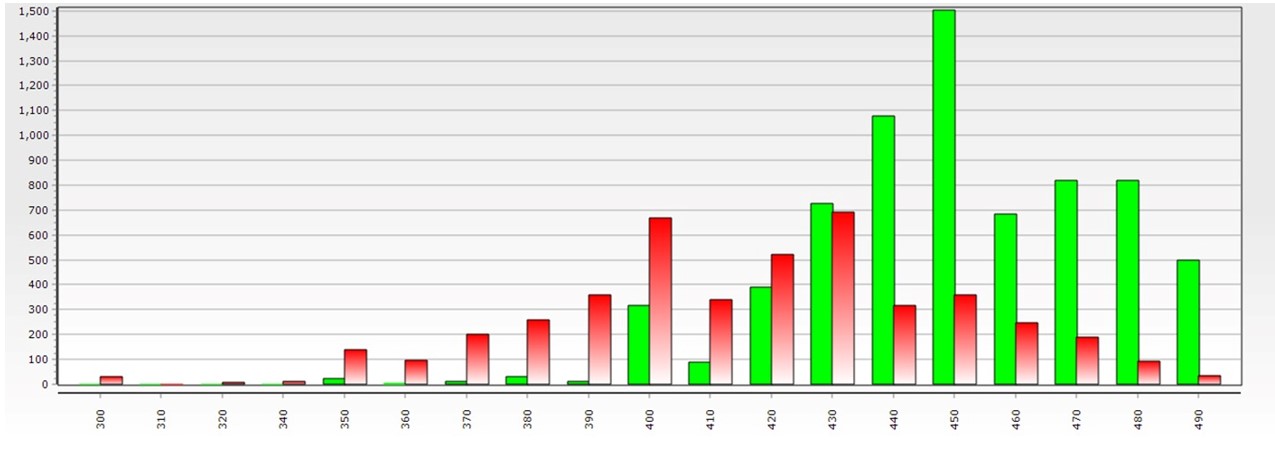

Open Interest

(Source: Fisdom Research)

- According to an analysis of Ambuja Cement’s option chain, there’s solid support at 400 and next at 430 levels, as shown by the accumulation of Put Options. However, the largest concentration of Call Options is at 450 and 440, which are immediate challenges.

- If the counter trades above 440/450, it could trigger a mix of short covering and new buying interest in the upcoming weeks.

- For the coming week, keep a close eye on the 430 and 450 levels as they will be crucial.

F&O Strategy

| Scrip | AMBUJACEM LTP 437.75 |

| Risk | Moderate |

| Ratio | 1:2 |

| Bias | Range to pull back |

| Max Reward Expected | ₹57,330 |

| Max Risk Expected | ₹14,670 |

| Action | Scrip | QTY | IP | LTP |

| BUY | AMBUJACEM JUN 440 CE | 1800 | 14.55 | 14.55 |

| SELL | AMBUJACEM JUN 480 CE | 3600 | 3.2 | 3.2 |

|

Disclaimer: This document is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. If you have received the publication in error please notify the sender immediately. If you are not the named addressee, you should not disseminate, distribute or copy this document. You are hereby notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. This document has no contractual value and is not and should not be construed as advice or as an offer or the solicitation of an offer or a recommendation to take action in consonance in any jurisdiction. Finwizard Technology Private Limited (“Fisdom”) makes no guarantee, representation or warranty and accepts no responsibility or liability for the accuracy or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will Fisdom be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document, even if you advise us of the possibility of such damages, losses or expenses. Fisdom does not undertake any obligation to issue any further publications or update the contents of this document. The information stated and/or opinion(s) expressed herein are expressed solely as general commentary for general information purposes only and do not constitute advice, solicitation or recommendation to act upon thereof. Fisdom does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. Fisdom may have issued other similar documents that are inconsistent with and reach different conclusion from the information presented in this document. The relevant offering documents should be read for further details. You should make such researches/inspections/inquiries as it deems necessary to arrive at an independent evaluation of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks involved. Fisdom makes no representations that the offerings mentioned in this document are available to persons of any other country or are necessarily suitable for any particular person or appropriate in accordance with their local law. Among other things, this means that the disclosures set forth in this document may not conform to rules of the regulatory bodies of any other country and investment in the offer discussed will not afford the protection offered by the local regulatory regime in any other country. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. The historical performance presented in this document is not indicative of and should not be construed as being indicative of or otherwise used as a proxy for future or specific investments. The relevant product documents should be read for further details. Fisdom does not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at anytime.