INDIGO LTP 1914

| Counter | INDIGO LTP 1914 |

| Call | BUY-ON-DIP towards 1860 – 1780 |

| Target 1 | 2000 |

| Target 2 | 2080 |

| Stop Loss | 1720 |

| Time Horizon | 2-3 weeks |

| Notes | BUY-ON-DIP towards support proportionately |

Interglobe Aviation is India’s largest passenger airline with a market share of 56.7% as of October 2022. The company was incorporated in August 2006 on the foundation of three pillars – offering low fares, being on-time, and delivering a courteous and hassle-free experience. With a fleet of 280 aircraft and growing, we connect people across the globe to a network of over 100 destinations worldwide.

Quick Check

| Previous Close | 1977.1 | TTM EPS | — |

| 52 Week High | 2282.1 | TTM PE | — |

| 52 Week Low | 1511.8 | P/B | — |

| Sector PE | 55.17 | Mkt Cap (Rs. Cr.) | 73,789 |

Technical Outlook

- The counter formed a “Bullish Weekly” candle a week before & made six months “Double Top” high at around 2100 levels.

- The counter holds “Range to Positive” outlook above 1800 levels.

- Since the broader market is weak Initially Dips towards 1860 followed by lower 1780 can be looked for “Proportionate” Delivery buying.

- On the higher-end the counter can re-attempt towards 2000 & 2080 levels.

- Fresh higher break-out levels of 2300 can be expected once the counter sustains above 2100 on closing basis.

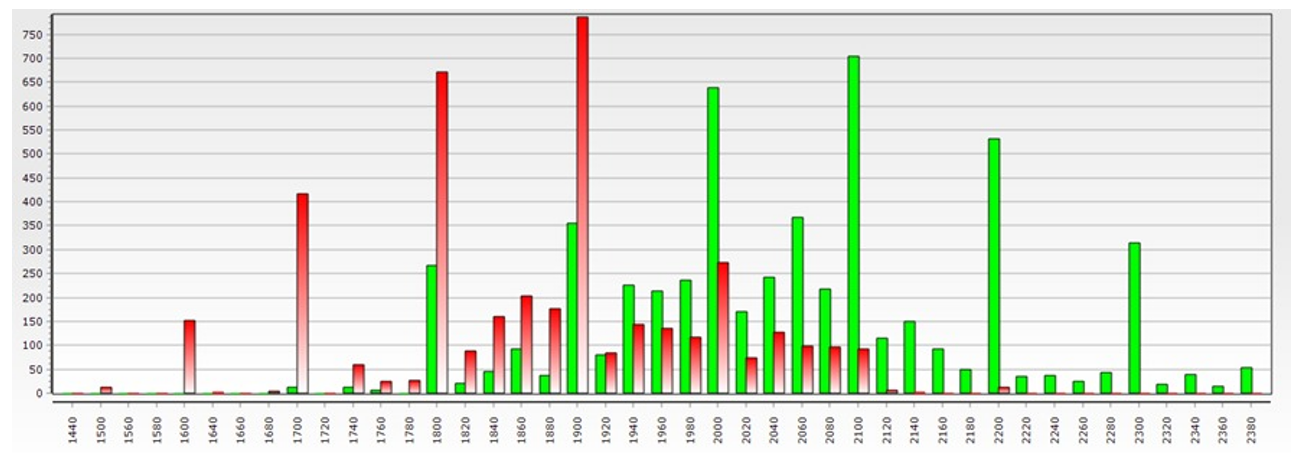

Open Interest Study

- As per Dec Open Interest Study the counter has decent Put Build-Up at around 1900 & 1800 Strike Prices indicating immediate supports where fresh buying interest can emerge.

- On higher-end 2000 & 2100 Call Build-ups are Highest indicating resistances for the counter. Overall, conclusion is mentioned 1900/1800 can be looked as supports for the coming week while 2000/2100 can be looked as pull-back targets cum resistances

|

__________________________________________

HINDUNILVR LTP 2630

| Counter | HINDUNILVR LTP 2630 |

| Call | BUY-ON-DIP towards 2570 – 2510 |

| Target 1 | 2700 |

| Target 2 | 2840 |

| Stop Loss | 2440 |

| Time Horizon | 2-3 weeks |

| Notes | BUY-ON-DIP towards support proportionately |

HUL is a subsidiary of Unilever, one of the world’s leading suppliers of Food, Home Care, Personal Care and Refreshment products with sales in over 190 countries. The Company has about 21,000 employees and has sales of INR 50,000+ crores (financial year 2021-22). With nearly 90 years of heritage in India, Hindustan Unilever Limited (HUL) is India’s largest fast-moving consumer goods company. On any given day, nine out of ten Indian households use one or more of the company’s brands.

Quick Check

| Previous Close | 2645.4 | TTM EPS | 41.06 |

| 52 Week High | 2741.6 | TTM PE | 63.84 |

| 52 Week Low | 1901.6 | P/B | 12.55 |

| Sector PE | 63.96 | Mkt Cap (Rs. Cr.) | 615,851 |

Technical Outlook

- The Counter made 52-Weeks High at 2756 couple of weeks ago & thereafter slipped down due to Broader Market Weakness.

- The counter formed a “Bullish Monthly Candle” in Nov-22 indicating retracement should be looked for fresh entries.

- Technically, the counter continues to hold “Buy-On-Support” outlook. On Immediate basis the counter has support at around 2560 & 2480 levels while the resistances remain at 2700 & thereafter higher 2850 levels (which is around it “All Time High” levels.

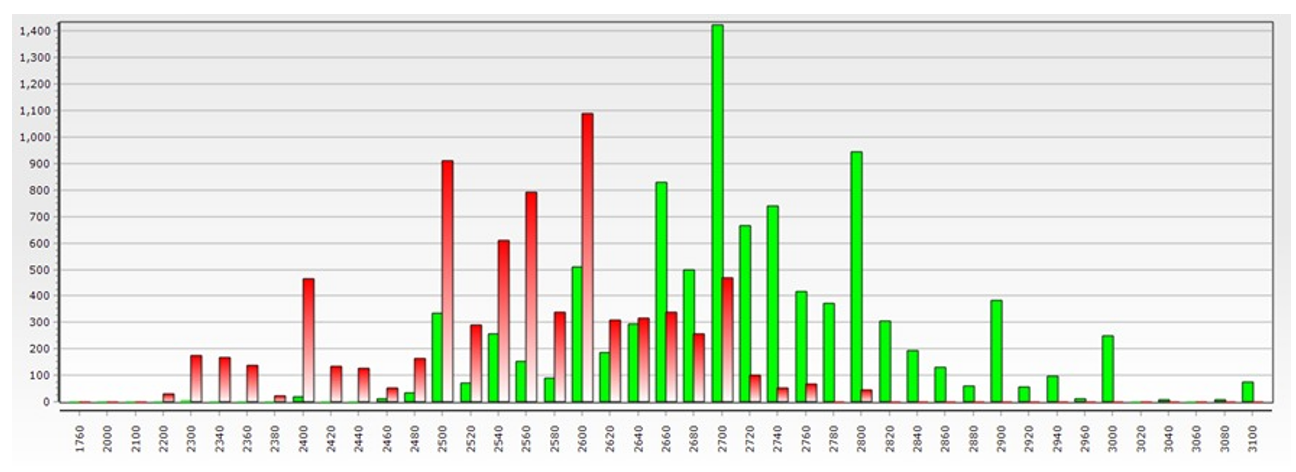

Open Interest Study

- As per Dec-22 Open Interest Study the counter has immediate hurdle at around 2700 levels which need to be held for fresh buying interest cum short-covering.

- On the flip-side the counter maximum Put build-up is visible at around 2600 & 2500 levels which should act as immediate crucial supports cum fresh trading buying levels maintaining strict stops.

- P/C Ratio is 0.79 with Total Call build-up of 9424 Lots while Total Put Build-up of 7461 Qty.

- Overall, 2700 can be looked as “Tug-Of-War” point between “Bulls & Bears” in short-term under which immediate bias is slightly “Range to Down”. Holding above 2700 once can add long positions.

|

_________________________________________

Disclaimer: This document is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. If you have received the publication in error please notify the sender immediately. If you are not the named addressee, you should not disseminate, distribute or copy this document. You are hereby notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. This document has no contractual value and is not and should not be construed as advice or as an offer or the solicitation of an offer or a recommendation to take action in consonance in any jurisdiction. Finwizard Technology Private Limited (“Fisdom”) makes no guarantee, representation or warranty and accepts no responsibility or liability for the accuracy or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will Fisdom be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document, even if you advise us of the possibility of such damages, losses or expenses. Fisdom does not undertake any obligation to issue any further publications or update the contents of this document. The information stated and/or opinion(s) expressed herein are expressed solely as general commentary for general information purposes only and do not constitute advice, solicitation or recommendation to act upon thereof. Fisdom does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. Fisdom may have issued other similar documents that are inconsistent with and reach different conclusion from the information presented in this document. The relevant offering documents should be read for further details. You should make such researches/inspections/inquiries as it deems necessary to arrive at an independent evaluation of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks involved. Fisdom makes no representations that the offerings mentioned in this document are available to persons of any other country or are necessarily suitable for any particular person or appropriate in accordance with their local law. Among other things, this means that the disclosures set forth in this document may not conform to rules of the regulatory bodies of any other country and investment in the offer discussed will not afford the protection offered by the local regulatory regime in any other country. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. The historical performance presented in this document is not indicative of and should not be construed as being indicative of or otherwise used as a proxy for future or specific investments. The relevant product documents should be read for further details. Fisdom does not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at anytime.