1. IDFC First Bank Ltd

| Counter | IDFCBANK LTP 65.54 |

| Call | Buy on dip |

| Target 1 | 70 |

| Target 2 | 80 |

| Stop Loss | 60 |

| Time Horizon | 2-3 weeks |

| Notes | Buy-on-dip towards 65 & 62 |

IDFC FIRST Bank was founded by the merger of Erstwhile IDFC Bank and Erstwhile Capital First on December 18, 2018. IDFC FIRST Bank is born to be distinctly different from what it was earlier. It has a renewed focus on retail business with an intent to fast-forward its growth trajectory, and to serve many more customer segments that are growth-drivers of the Indian economy.

| Previous Close | 64.8 | TTM EPS | 3.7 |

| 52 Week High | 65.8 | TTM PE | 17.5 |

| 52 Week Low | 29.0 | P/B | 2.1 |

| Sector PE | 22.2 | Mkt Cap (Rs. Cr.) | 43,388 |

(Source: Moneycontrol, BSE, Fisdom Research)

(Source: Fisdom research)

- In the past six months, the stock price has consistently found strong support around the range of 54-55. Recently, it has shown a breakout from a period of consolidation, surpassing the levels of 60 and 65 last week.

- It is a good opportunity to consider buying the stock at its current levels, as well as on any price declines. The stock has immediate support around the 60-58 range.

- Looking ahead, the stock has a potential target of 70 in the near term, and if it continues to perform well, it could even reach the higher level of 80 in the coming weeks.

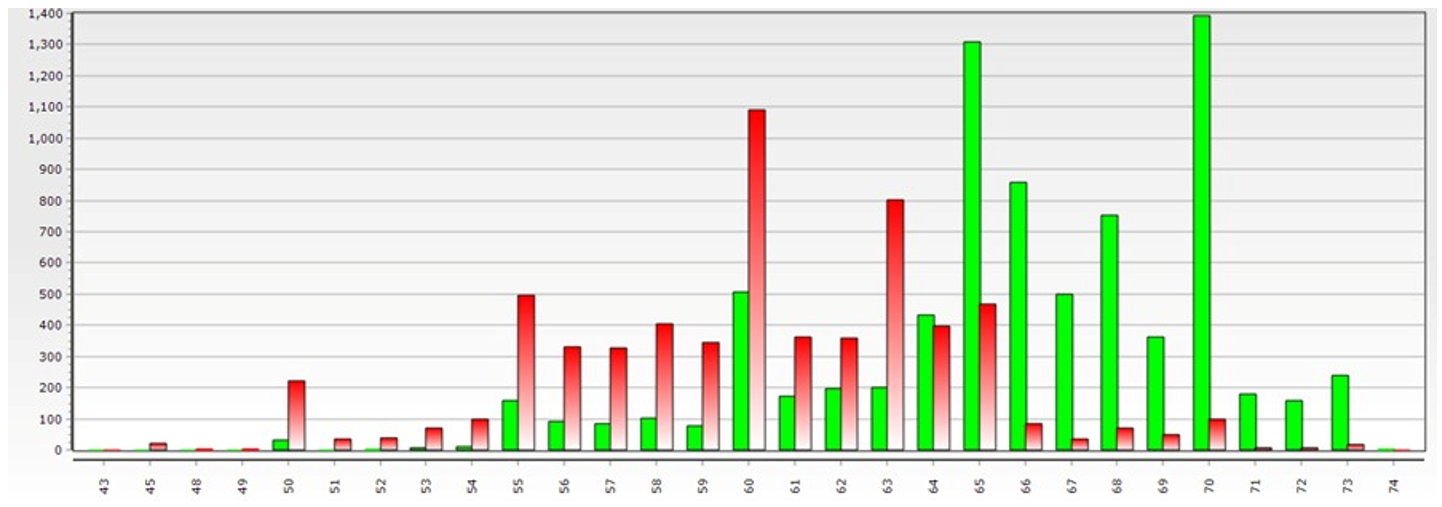

Open Interest Study

(Source: Fisdom research)

- Looking at the Open Interest data for the month of May, we can see that the stock has the highest number of open contracts at the 60 strike price. This suggests that there is strong support for the stock at this level.

- When we look at the Call Options, we can see that the highest number of contracts are at strike prices 65 and 70. These levels can act as resistance for the stock.

- The outlook for the stock suggests that it is favorable to buy the stock when its price dips towards the 60 level.

F&O Strategy

| Scrip | IDFCBANK LTP 65.54 |

| Risk | Moderate |

| Ratio | 1:1 |

| Bias | Range to pull back |

| Max Reward Expected | ₹54,750 |

| Max Risk Expected | ₹20,250 |

| Action | Scrip | QTY | IP | LTP |

| BUY | MAY IDFCFIRSTBK 65 CE | 15000 | 1.75 | 1.75 |

| SELL | MAY IDFCFIRSTBK 70 CE | 15000 | 0.4 | 0.4 |

|

2. Axis Bank Ltd

| Counter | AXISBANK LTP 911 |

| Call | Buy on dip |

| Target 1 | 975 |

| Target 2 | 1050 |

| Stop Loss | 860 |

| Time Horizon | 2-3 weeks |

| Notes | Buy-On-Dip towards 900 & 870 |

Axis Bank is the third largest private sector bank in India. The Bank offers the entire spectrum of financial services to customer segments covering Large and Mid-Corporates, MSME, Agriculture and Retail Businesses. The Bank has a large footprint of 4,903 domestic branches (including extension counters) with 15,953 ATMs & cash recyclers spread across the country as on 31st March 2023.

| Previous Close | 896.0 | TTM EPS | 35.1 |

| 52 Week High | 970.0 | TTM PE | 25.9 |

| 52 Week Low | 618.2 | P/B | 2.4 |

| Sector PE | 22.2 | Mkt Cap (Rs. Cr.) | 280,331 |

(Source: Moneycontrol, BSE, Fisdom Research)

Technical Outlook

(Source: Fisdom research)

- The stock recently broke out of a period of consolidation that lasted for the past three months, and it closed at its highest-level last week.

- From a technical perspective, the stock’s primary trend is considered to be in an upward direction as long as it remains above the levels of 850 and 800.

- Looking ahead, there is a possibility that the stock may gradually move towards the levels of 975, and its next significant target would be around 1050.

- Outlook for the counter is to keep buying the stock when its price dips towards the levels of 900 and 870.

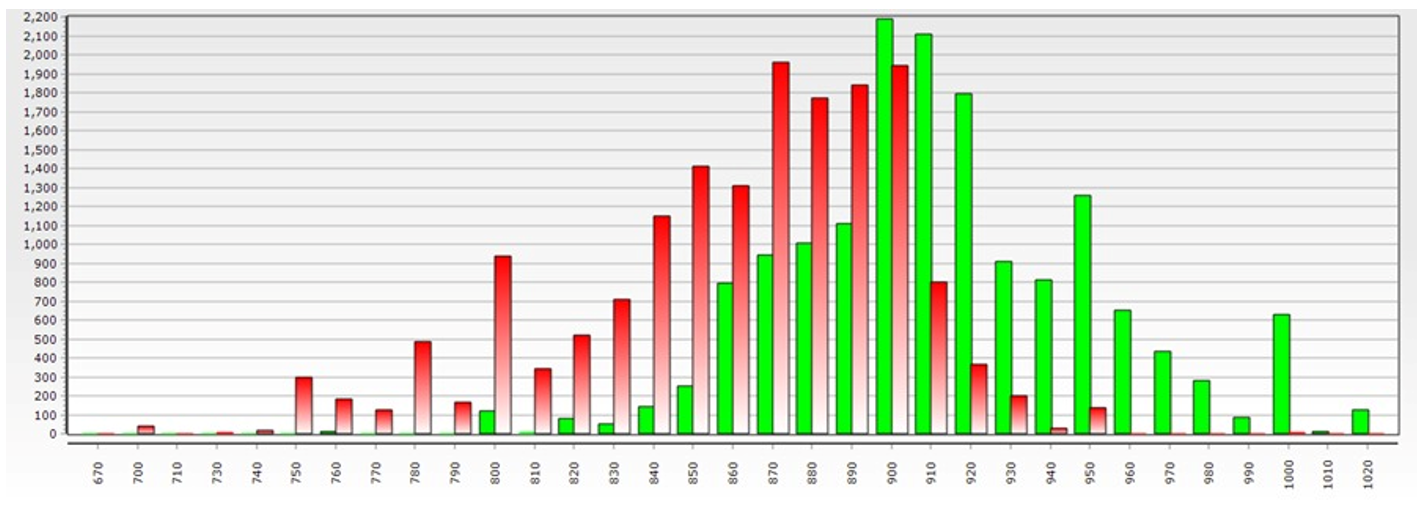

Open Interest

(Source: Fisdom research)

- According to the Option Chain study, the stock has significant support levels when its price falls.

- In the May series, there is a high concentration of Put options at strike prices like 870, 880, 900, and 910. This suggests that the stock is expected to have a positive outlook within a certain range.

- On the other hand, there is a considerable concentration of Call options at strike prices like 900, 910, and 920. This indicates that there is potential for the stock to move higher.

- Overall, the stock is expected to have a positive outlook within a certain range in the short to medium term.

F&O Strategy

| Scrip | AXISBANK LTP 911 |

| Risk | Moderate |

| Ratio | 1:1 |

| Bias | Range to pull back |

| Max Reward Expected | ₹29,160 |

| Max Risk Expected | ₹18,840 |

| Action | Scrip | QTY | IP | LTP |

| BUY | MAY AXIBANK 900 PE | 1200 | 19.25 | 19.25 |

| SELL | MAY AXIBANK 940 PE | 1200 | 3.55 | 3.55 |

|

Disclaimer: This document is not intended for anyone other than the recipient. The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. If you have received the publication in error please notify the sender immediately. If you are not the named addressee, you should not disseminate, distribute or copy this document. You are hereby notified that disclosing, copying, distributing or taking any action in reliance on the contents of this information is strictly prohibited. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. This document has no contractual value and is not and should not be construed as advice or as an offer or the solicitation of an offer or a recommendation to take action in consonance in any jurisdiction. Finwizard Technology Private Limited (“Fisdom”) makes no guarantee, representation or warranty and accepts no responsibility or liability for the accuracy or completeness of the information and/or opinions contained in this document, including any third party information obtained from sources it believes to be reliable but which has not been independently verified. In no event will Fisdom be liable for any damages, losses or liabilities including without limitation, direct or indirect, special, incidental, consequential damages, losses or liabilities, in connection with your use of this document or your reliance on or use or inability to use the information contained in this document, even if you advise us of the possibility of such damages, losses or expenses. Fisdom does not undertake any obligation to issue any further publications or update the contents of this document. The information stated and/or opinion(s) expressed herein are expressed solely as general commentary for general information purposes only and do not constitute advice, solicitation or recommendation to act upon thereof. Fisdom does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. The information contained within this document has not been reviewed in the light of your personal circumstances. Please note that this information is neither intended to aid in decision making for legal, financial or other consulting questions, nor should it be the basis of any investment or other decisions. Fisdom may have issued other similar documents that are inconsistent with and reach different conclusion from the information presented in this document. The relevant offering documents should be read for further details. You should make such researches/inspections/inquiries as it deems necessary to arrive at an independent evaluation of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks involved. Fisdom makes no representations that the offerings mentioned in this document are available to persons of any other country or are necessarily suitable for any particular person or appropriate in accordance with their local law. Among other things, this means that the disclosures set forth in this document may not conform to rules of the regulatory bodies of any other country and investment in the offer discussed will not afford the protection offered by the local regulatory regime in any other country. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. The historical performance presented in this document is not indicative of and should not be construed as being indicative of or otherwise used as a proxy for future or specific investments. The relevant product documents should be read for further details. Fisdom does not undertake any obligation to issue any further publications to you or update the contents of this document and such contents are subject to changes at anytime.