Useful Tools To Use On Fisdom App for Personal Finance

Fisdom is a state-of-the-art, user-friendly and intuitive platform for all your mutual fund investments. It is easy to use and comes loaded with features and tools that help you to plan and make better investment decisions without any hassles. Here are some of the major tools and features that Fisdom features, so that you can invest conveniently.

Financial Health Checker: Diagnose Your Finance, on Your Own

Just as you need a medical check-up regularly, a diagnosis of your financial health is required, but is, unfortunately, more than often ignored. On this app, it takes only a few minutes to evaluate the elements your financial health that needs to be taken care of.

How Does the Financial Health Checker Work?

It is extremely easy to use and all that needs to be done is answer a few simple questions within this tool, to get your detailed financial health report. The report will give you not only the state of your finances but also suggest the next step to be taken to ensure that particular aspect of your financial health is treated in time.

Build Wealth Tool: Choose Your Investment Amount to Know Your Projected Wealth

You have set an amount for investment in mutual funds in your mind but you have no idea how much are you going to get in return, over a point of time. Fisdom ’s Build Wealth Tool does that projection for you.

How Does Build Wealth Tool Work?

This highly simple-to-use tool asks for your choice of investment (SIP or one-time) and the amount that you plan to invest. Within seconds it projects your return based on time of investment. You can even choose the percentage of stocks and bonds you want to divide your mutual fund investment in and decide how much risk you are comfortable with.

Smart Recommendation Engine: A.I. Powered Built-in Mutual Fund Smart Selections

The whole app is built on an engine that runs on an AI, to give you recommendations for plans that are best suited for your financial portfolio.

How Does The Smart Recommendation Engine Work?

This engine is built on an artificial intelligence algorithm that has been created through years of accumulated data and research, in the mutual fund market by financial experts and is intuitive enough to suggest the best plans that are suited for your financial history.

Save For A Goal: Mutual fund Recommendations Based on Your Chosen Financial Goal

If you have a long-term financial goal that you need to save up for, you need to know the amount of investment needed to be made for you to be able to afford that goal. Fisdom ’s Save For A Goal tool allows you to know the amount required to be invested and plan your investment accordingly.

How Does The Save For A Goal Tool Work?

It takes a matter of seconds to select your goal on this tool and it will not only project the amount that you need to save for your goal but the amount of investment that is necessary to be made. You can also toggle with your risk appetite and plan your investment to save your particular goal.

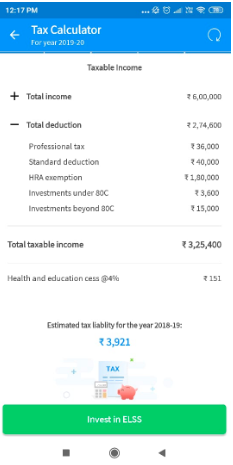

Tax Calculator: Calculate Your Tax Liability Based on Your Own Financial Portfolio

This tool takes care of the overwhelming task of calculating your income tax liability for the fiscal year based on certain information that you provide.

How Does The Tax Calculator Tool Work?

The tool asks you a few basic questions and calculates your income tax liability for that year. It conveniently asks for your income and investment details to give you the complete picture of TDS. It also gives you the customised investment option to save on the remaining taxable amount in your income.

Note: The estimated projected tax liability of this tool is as accurate as the information provided by you.

Risk Analyzer: Get Plans Suiting Your Risk Tolerance in Mutual Fund Investing

Before you invest in mutual funds, it is essential to understand what kind of risk appetite can you handle. This tool allows you to figure out whether you are high, medium or low-risk investor based on which you can choose the plan.

How Does the Risk Analyzer Tool Work?

This tool asks a few questions about your financial history such as your liabilities and appetite for investment and projects the type of investor you are. This further allows this tool to show plans for investment that are suitable for your financial portfolio.

Now that you know that our app can do more than provide you, investment options, it’s time to download the app and use it to its fullest potential.