The world’s hogging on rate cuts,

Driving investors across the world nuts.

We all want cheaper loans and growth,

But is this the only way to get both?

You must have already heard about the 35-bps rate cut by the RBI in its monetary policy meeting, but here’s something you would have missed – India was not the only to surprise with a deeper-than-expected rate cut. The Reserve Bank of New Zealand caught the market off-guard with a rate cut of 50 bps (which is twice the expected cut) bringing its official cash rate to an all-time low of 1% while Bank of Thailand cut its rate by 25 bps for the first time since 2015. This has happened only in the next couple of days following a rate-cut announcement by the U.S. Federal Reserve.

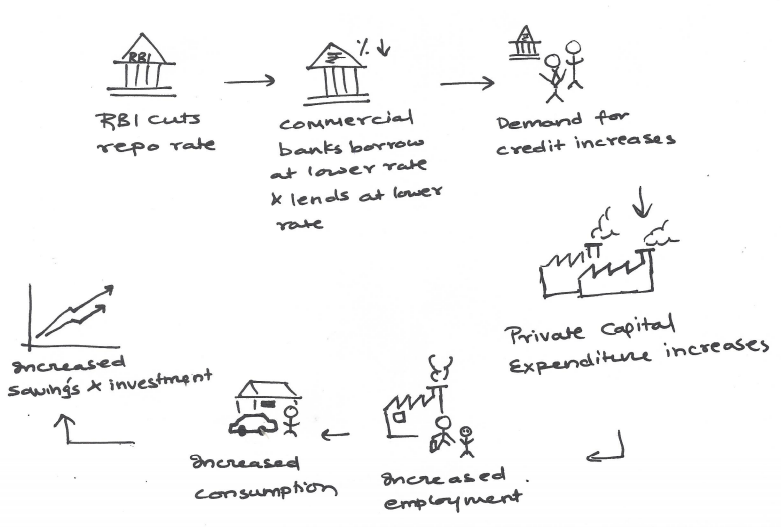

Before we delve into analytical insights on the move, there seems to be merit in first understanding the basic dynamics that a rate cut is expected to trigger – generically speaking.

In a nutshell, a rate-cut is generally expected to inject liquidity and consequently spur economic activity through improved credit, consumption and investment.

Now, let’s talk more about what’s in store for the global economy as major economies ease their base rates and what does the rate-cut imply in India’s context.

Globally, as trade tensions and other developing geopolitical episodes escalate, economies are bracing for the imminent global slowdown through sharp monetary policy actions like the rate cut. This is perhaps the first time since 2013’s taper tantrum that the world is seeing a unanimous, synchronized monetary policy action being implemented – only this time, the move seems to be rolled out proactively with significant time in hand to foster growth and mitigate slowdown risks.

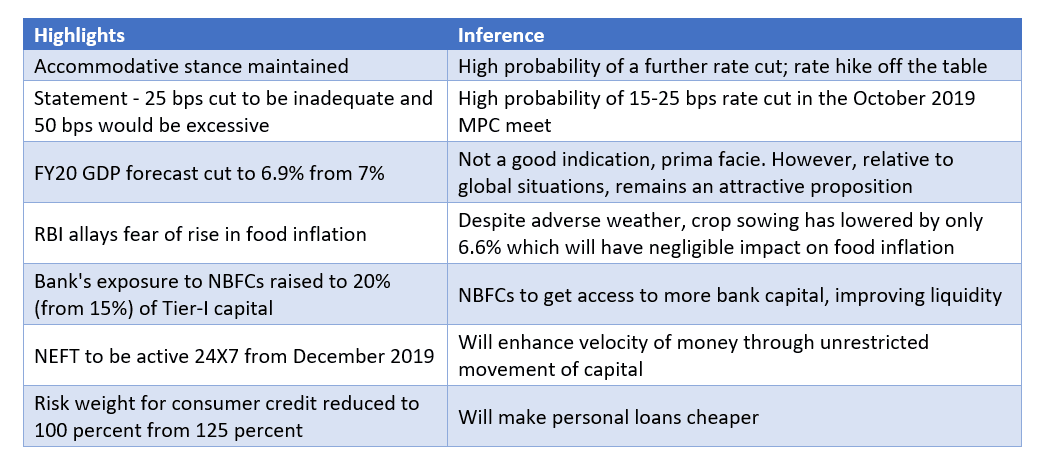

Back home, here are a couple of key highlights apart from the fact that the rate has been cut to a nine-year low level:

While the monetary policy has expressed intent to reinvigorate the Indian economy through its words and measures, it is imperative that the measures are transmitted effectively through the economy. On that note, RBI has assured that it continues to engage with banks to transmit the rate-cut to customers – an effective transmission would essentially translate into relatively cheaper loans across the spectrum of loan products.

Your next move?

For equity investors: All this while, we have been speaking about volatility and the fact that one needs to sit tight during such volatile times because that’s when real gains are made. Well, the time has come when every investor’s patience will be put to test. The tides may seem rough, but as long as your portfolio is well-constructed & aligned with your goal and you believe that this is NOT the end of the world, sit tight – or even better, invest more. (Remember Warren Buffett’s most popular piece of wisdom – “be greedy when all are fearful, and fearful when all are greedy”)

For debt investors: We recognize an opportunity in the short to medium duration space, with a bias towards sovereign and prime-rated papers. Banking and PSU debt is an interesting segment of debt funds which we expect is well-positioned to capitalize on the situation unfurling.

Is it a great time to redeem or stop SIPs?

We strongly recommend you try to make the decision yourself basis these facts:

Fact #1: Markets are moving to lower ranges and your investments could probably be in red (‘probably’ being the keyword).

Fact #2: The only rule to make profits is “Buy Low, Sell High”