From late 2019 to late into month 9 of 2020, markets have leapt between extremes in setting record all-time highs-&-falls respectively. In roller-coaster like fashion, markets have served loops in a ‘big begets bigger’ style, to all investors and traders.

We, at Fisdom, serving as this theme park’s guards, watch over your portfolios, letting you know of all developments – new and old.

If You Can Smell What the Market Is Cooking

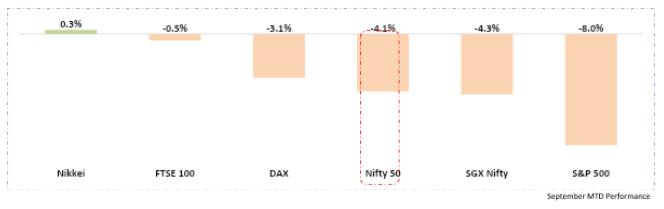

Coming into September, markets have worn newer clothes apart from their COVID overalls. In fact, this month’s developments alone can fill news headlines for the entire year. Let us look at a few of them and their daunt-&-dent on the markets:

1. The Crime of Continuous COVID Count

Nearing the 10th Month, COVID headlines have found permanent dwelling in our lives and lines. The viral virus landlocked the world, both, literally and economically, in a fashion never seen like before.

India is climbing the COVID hill at rapid pace, as it becomes 2nd highest infected country in the world. India has recorded 83K+ new cases in 20/23 days this month, with highest new daily case figure at ~1 lakh!

India seeks urgent relief in govt. policies and RBI actions, apart from taking comfort in rising recovery rates.

2. New Day – Old Story: Lockdown on The Brink

The viral virus’ capture gets stronger as respite from vaccines gets delayed. The economy unlocking has undone much of what the lockdown attempted to do. Abiding by duty, Govt.’s talk of shutting shop to curb virus spread in the interests of its citizens.

UK to become the 1st country to bite the bullet, with similar actions lined up across borders and ponds

3. Banking Goes Bad

The world’s money system has new troubles brewing apart from COVID 19 in big-ticket fraudulent activities to the tune of $2 Tn. Beginning with Offshore & Swiss leaks, to Panama Papers, to this, crime watchdogs once again sniff a foul smell.

For India, there are 406 transactions involving major banks, including country’s largest lender, SBI, and BOB, PNB, etc among others. What is next will depend in what is found!

4. FII Flow Changes from Favor to Fever (?)

If It were not for Reliance, India would be reliant and not resilient in finding favorites amongst the who’s-who of finance.

As international tensions rise, countries impose digital doorstops by banning companies to operate in their countries. If this trend were got to more traction amidst current political and economic scenario, countries could look to opt for domestic growth rather than via its trade books.

5. Valuation Voes

India’s slashed GDP at -24% bears unseen circumstances in skewing valuations to higher end of the curve. The Market-cap/GDP ratio at 75, was already above historical average of 73. The new lower base is set to push this ratio even higher.

However, if markets take, then they give too. Drawing from the Financial crisis, the ratio fell to 55, but bounced back to 95 in 1-year timeframe! Remember, only those who stay invested, stand a chance to win.

As days wait in wait-ing for the economy to catch-up, the disconnect between itself and the markets continue to grow louder.

Or at least that is what most of the market participants say. Maybe that is why it’s the minority who make the money!

Markets are fair to all, in that, be old-age or new-age, each is guessing about where the market will be tomorrow holds equal weight. There is no right/wrong, but opinions. As News and noise become harmonious, market’s old testament of “Staying Put is Staying Ahead” has never been truer.

Valuing vantage over vintage, markets have fallen previously and will fall again indefinitely. The disconnect lies in the divided gap between markets euphoric rise and investors realised lies (read as: Short-changed returns)

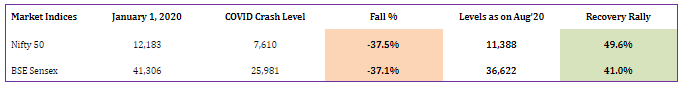

When COVID hit unexpectedly, the headlines hit expectedly, painting market shocks as the Gen-Z apocalypse. As the crashes continued, fear found its voice making its mark with heavy investor exits.

Where are the same periodicals now? What are they saying now? They are saying what Fisdom has been saying since day 1 – ‘Timing in the market’ will always trump ‘Timing the market’.

The ~50% recovery rally was a hidden opportunity-, i.e., the true face of Indian markets.

In the playground of Indian markets, opportunist have sat on the swings and slides making most of their playtime.

Today, like was yesterday, the periodicals are coming out again repeating the same story of Markets not being fateful & faithful.

However, this time you are 1 chapter smarter on what is being shown Vs what you should see. Opportunity is knocking again, as subdued September has wrung the markets with new pains.

Making Money from the Markets OR Markets Taking Money from You – The Choice Is Yours. And This Time, A Simple One.

No See – No Tell – No Listen: How Being Senseless Is Being Senseful

“Every Action Has an Equal & Opposite Reaction” – These Golden words best describe the do’s-&-don’ts in today’s times. The sustained market volatility levels (all-time high in March at 80+) is demanding investor reactions. What might they be? We say stillness, for it is better than surprises (read as: unexpected outcomes).

Markets have always bet best on those who meditate. It’s in the erroneous nature of human behaviour to react more than act, with unsilenced and unprofound degree of intensities.

Rudyard Kipling, in his poem “IF” taught us about how to treat losses and wins in the same manner. Today, his learnings can translate to earnings for those who choose to side with reason over treason (read as: erratic behavior).

As COVID continues its stronghold, moving from 2020 to 2021, its only apt that investors portfolio be modulated too changing scenarios.

2 pillars of finance, “Asset Allocation” and “Time in Market Over Timing the Market” have always and will continue to shape your portfolio’s risk-return index. It is only fair then that we briefly look at the 2 mantras:

a. Asset Allocation

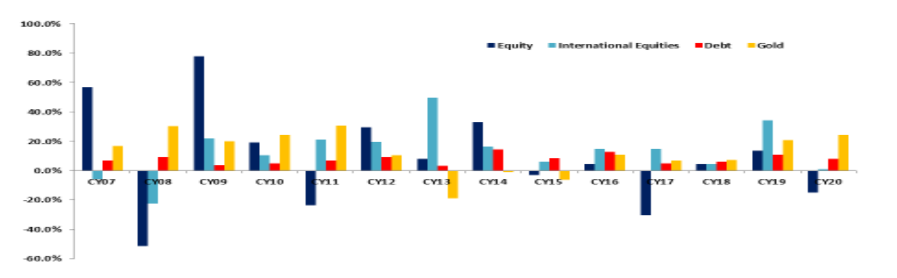

The greats from Ray Dalio to Warren Buffet have echoed its principles as being a cornerstone for financial success. Every asset class has its “season”, serving as maximizers (returns) and minimizers (risk). Striking the delicate balance between this mix, is where the optimal portfolio lies.

As can be seen, individual asset classes excel at individual times, but a smart low co-related bundle can amplify return potentials while not cannibalizing on component contributions.

Re-jig your portfolio today so it can jog this marathon to completion and not exhaustion!

b. Patience Is A Virtue

“The stock market is designed to transfer money from the active to the patient” –> Warren Buffet. At 93, Mr. Buffett has sworn by these words since age 11, and look at where he stands today.

Fun-fact: Mr. Buffett had majority of wealth created after the age of 65!

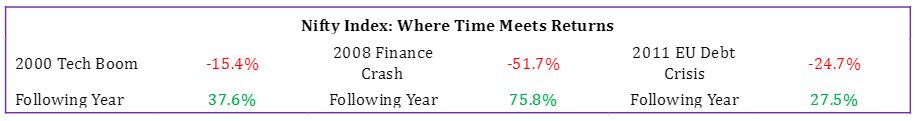

Nifty has the quality to help you become an investing titan if you possess the right set of skills. The bellwether index has seen many turbulences but has bounced back stronger and quicker. The table below highlights this observation:

As the saying goes, “When going gets tough, the tough gets going”. Reflect this sentiment in words and wallet with smart and tactful portfolio structures.