The market witnessed a sharp sell-off on Friday after hitting new milestones in the last month. The recent market correction needs to be looked at from a context of strong performance since March 2020.

There are times when one needs to bullish, i.e., go all-in on the markets, and then there are times when one needs to stay away from the markets. We are in neither phase as of now. So, what exactly needs to be done in the current market situation? We will try to cover the exact actionable that investors need to do but first, let us try to answer a few questions that will clarify the market behaviour.

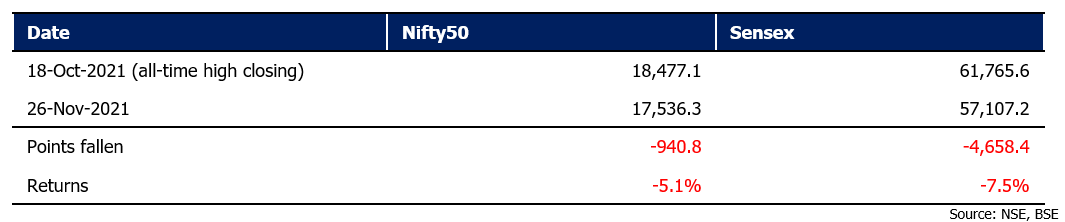

How much have the indices fallen?

While the Sensex has fallen by 4,658 points from its all-time at 18,47, Nifty 50 has lost nearly 940 points to end at 17,536.3 on Friday. Within this week itself, the Sensex has lost around 2,500 points or 4.2% since its high on October 18, 2021.

Why are the markets falling?

Various factors weigh down markets. Below are some of them:

- Entry of new coronavirus variant in South Africa, Hong Kong, and Botswana.

- Rising coronavirus cases in Europe and other geographies. Recently Austria became the first country in western Europe to impose a complete lockdown to tackle a new wave of infections.

- Besides this rising inflation in the US and expectations of US Federal Reserve going in for faster than expected tapering of its stimulus and earlier than expected hike in interest rate is another factor impacting emerging economies.

- Over the last three trading sessions, FPIs have pulled out a net of INR 14,700 crores from Indian equities and thereby resulting in a sharp decline in indices.

- The plethora of IPOs hitting the markets is also a concern as it is causing a strain on liquidity.

What about India?

While the broader economic fundamentals remain intact, markets are expected to remain under pressure over the coming weeks because of the factors mentioned above. The chart below indicates the current state of India’s high-frequency indicators.

What should investors do?

The recent market decline is driven by near-term concerns and is something that investors should not bother about. These dips should be seen as good entry points as per the asset allocation of the investors. Long-term investors should continue their SIPs and try not to time the markets. SIP is a tool that ensures disciplined investing. A key aspect is to check upon your asset allocation and align with your risk appetite and time horizon.