As we near the end of 2020, ‘lessons in hindsight’ become more mouth friendly. In notion & motion, it is always the learners who become the earners.

The year of 2020, even post being unexpectedly different has given expectedly similar results vis-à-vis December’s of years past.

In riding through the Covid Crisis, markets have come out super strong breaking All-time highs on an almost daily basis.

In fact, in December itself, markets closed 13/14 times in the Green, making new All-Time Highs on 12 out of those occasions!

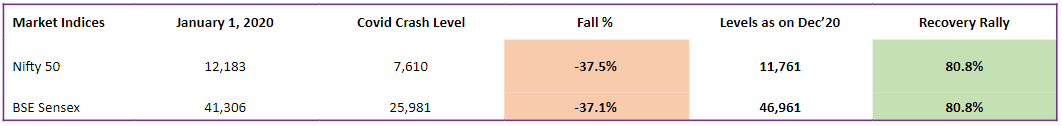

The table below highlights the markets journey from the start of the year to date:

After looking at the table above, most investors are asking themselves 1 of the 2 questions:

- Why didn’t I invest!

- I did invest…but why did I withdraw earlier!

This emotional cry, cause of lacking tries, is what sets the High Net-Worth Individuals (HNI) apart from the retail investors.

The statement, often generalized, has drawn merit from highly accoladed cross-border research-oriented individuals and institutions across times.

The latest acknowledgment for the same comes from “The Wealth Report 2020” published by Knight Frank.

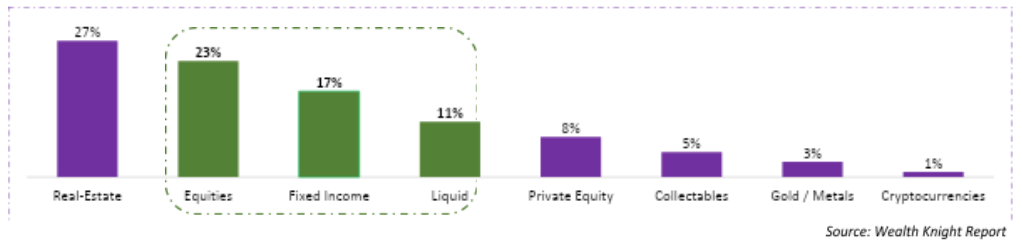

The 14th edition of the report shines light on wealth patterns observed across hierarchical net-worth of clients. The same is shown below:

It is aptly clear from the graph above, just how much importance the wealthiest people in the world give to investing. In a financially volatile year like none before, investments across asset classes still contribute 50%+ of a HNI’s portfolio.

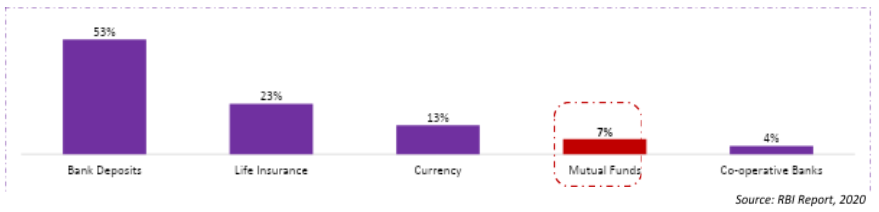

In encouraging investing amongst the Indian diaspora, RBI conducted a similar wealth distribution study earlier this year. The results of the same are highlighted below:

As can be seen, India has a long way to go in catching up with the ways-&-craze for affluence seen in the western sisters.

However, it is not all that bad as it appears to be…

The govt. in recent past has actively promulgated the idea of shaping India into a more fiscally-savvy body and bank. The sentiment is reflected in the growing millennial foray into financial assets from physical assets.

Easing of doing business while simultaneously welcoming digital payment interfaces has incentivized people and policies to augur higher financial inclusion.

A direct result of the action has been the growth of online commerce and broking companies. As reference, India saw unparalleled growth of demat accounts in Q1FY20 (24 Lakh – 10% of total live accounts in the country!) as investors looked to capitalized on iceberg-hit prices of titanic-like companies.

The latest move in easing norms for FinTech companies to set up their own AMCs is a step-ahead in the direction of India becoming the land of appreciation-&-action.

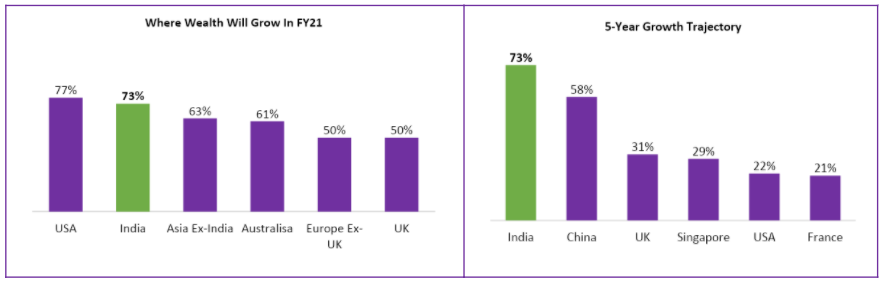

Knight Frank and its survey participants are wary of the same as India is set to cherish one of the highest growth rates in the forthcoming year and similarly over the next 5 years.

The table below highlights the same:

It is fair to make 2 observations from the comments made in the note so far:

- Indians are keen to capture the opportunities that markets present before themselves

- India is designed to be a mine of opportunities in the coming times

When the markets open come Monday, make sure you are the first in line to invest.

Pro Tip – with the fisdom app, you can be investment-ready in less than 5 minutes. And in 5 after, you can have made your 1st successful investment via our recommended funds in the app!

That will still save you 20 minutes from the pizza coming your way to celebrate the initiation of your financial journey.

Most importantly you will have acted in-line with the true intentions of writing this note :– which is to re-define your behaviorism in accordance with the bigger-pocketed counterparts.

As we have said through all of 2020 and will say through all of 2021 – The right time to invest was yesterday, the next best time is now.

Follow principles of sound asset allocation and math magic of systematic investment plans (SIP) to invest into markets in a disciplined manner.

Also, remember, it is not when you invest into the markets, but how long you stay invested for.

The biggest proof of this pudding is seen in Warren Buffett’s life story. The investing genius garnered majority of his USD billions in wealth after the age of 65!

And if there is one common goal all investors harbor, then that is to become the next Buffett. To do that, you need to invest today.

If you think you have missed out on market runs, then worry not for that is not the case. And if it were, how would we explain the FII flows we have witnessed through the FY21 YTD.

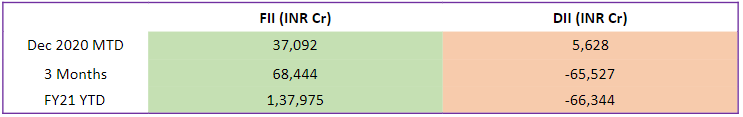

The graph below highlights investing pattern between FII and DII:

The DIIs finally turn the trend around buying into the New India – The India of tomorrow.

As the country targets USD 5 Trillion as GDP target, make sure your bank account amplifies with the same volume.

As India focuses on innovation, equities look to capture its benefits.

Your weekend quote – Get invested, Get richer. Stay Invested, Stay Richer

Till then, Wish you a happy weekend.