1. The 2 Decade – $2 Tn Tirade

Indian and global banks find themselves in hot waters, as Financial Crimes Enforcement Network (FinCen) unearth massive, red-flagged transactions b/w 2010 and 2017 amounting to over $2 trillion. Exposing the depth of global corruption, this is at least the 5th major leak over last 6 years. There are 400+ transactions involving Indian banks, including country’s largest lender in SBI, and others such as BOB, PNB, HDFC Bank etc.

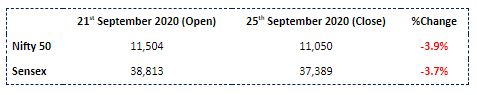

Banking’s Big crime of “Bad Money” takes center stage in the Corona year, as one layer of the orange is unpeeled. Beginning with Offshore & Swiss leaks, to Panama Papers, to this, the crime watchdog once again sniffs a foul smell. The borderless law-less transactions has caused shocks across the world, with markets tanking and banks like HSBC seeing biggest share fall in 25 years! What’s next will depend in what’s found.

2. RBI Evolves From A Watch-Dog To A Guide-Dog

RBI has been creating new stones, for its left no stones unturned in generously applying oil onto India’s growth gears. Announcing moratoriums, declaring dividends, conducting OMO’s, standing accommodative, allowing loan restructuring and most recently identifying workarounds for 11 key matrices, the nation’s bank has been putting bite into its barks!

RBI has been at the forefront in tackling the virus and teasing and testing the economy. As Covid breaks the long-standing economic shackles, so does RBI, by adopting a foot-loose approach. In bidding adieu to the old, RBI has donned a 2020 Meme, “Modern times require modern solutions”.

3. India’s Imported Irritant Is Pixelating Country’s Curated Picture

The sharpest economic contraction on record and across the world has investors worried about India’s promise as an investment-favorite destination. Economic agencies across borders slash GDP estimates to reflect current economic climate more correctly, and bank on more govt.-induced policies/reforms to clot bleeding economy.

Covid 19, now in 2020, and in 2021 in 3 months’ time, continues to be bearer of bad news. Causing shockwaves across the world, India’s GDP correction reflects economic infections. Like before, reforms are being merited as economical vaccine, with individuals and institutions awaiting govt.’s possible Relief package 2.0 announcement between October-November 2020.

4. The Financiers of Growth Can Neither Finance Nor Grow

Banks: World’s largest banking countries, including >50%+ of G20’s, to recover to pre-COVID-19 levels only after 2023. The overhang of NPAs will make India a late-exiter from the slump taking toll on being new global supply chain manufacturer. Lag between economic recovery and credit strength to expound if not for early discoveries in vaccines.

NBFCs / HFCs: AUM growth to be flattish for NBFCs vs earlier estimate of 8-10% YoY, and in lower single digits for HFCs in 2020-21. Sector’s capitalization, and RBI’s provision to restructure loans can comfort increased credit costs, providing better liquidity channels and smoothening asset quality beyond FY21

As institutions grapple with the after-effect of Covid 19, those who lend find themselves in similar waters with those they lend to! Even post policy support from the top, money flow is working like a malfunctioned pipe. However, as we continue developing into the New Normal, the temporary stop-gates will be weeded out, allowing us to bid adieu to current conservative climate

5. FIIs Seem To Adapt A Common Investment Approach – Invest In the 4Th Richest Person In The World

After Silverlake’s Rs.7,500 Cr. Investment for 1.75% stake, KKR steps in with its 2nd big bet in RIL after Jio, valuing India’s biggest brick-and-mortar retail business at 4.2 Lakh Crore. Today, its in over 7,000 towns with 28.7 million sq ft of retail space and serving close to 640 million footfalls. From yesterday’s future retail to tomorrow’s Reliance Retail, and armed with Gas, Food and Phone, it can by itself carry India into post-covid era.

FIIs find their favorite Hindi word in Reliance, as its fervor from Jio expands into retail. Onboarding domestic infrastructure and foreign money is the best strategy in any Indian business playbook. The Veteran in Reliance carries its legacy from yesterdays legend to tomorrows leader