1. GST Revenue Collection Is At All-Time High

1. GST Revenue Collection Is At All-Time High

The GST revenues during January 2021 are the highest since introduction of GST and has almost touched the ₹ 1.2 lakh crore mark, exceeding the last month’s record collection of ₹1.15 lakh crore.

The economy is showing signs of improvement across segments. India witnessed shoots of recovery in tax collection from companies, GST revenue and direct tax collection. GST revenues in January 2021 have been the highest since the introduction of GST. Corporate net profit recorded a multi-fold increase in September 2020 Quarter, and similar momentum is expected to continue.

2. Unprecedented Thrust On Infrastructure

The FM has made a bold move to budget an increase in the capital expenditure by 35 per cent to ₹5.4-lakh crore in FY22 from ₹4.1-lakh crore budgeted last year. The Central government’s capex next year will amount to 2.5 per cent of the GDP from 1.9 per cent in the previous year.

The continuous focus on infrastructure along with focus on real estate is likely to boost sectors which are directly indirectly related to infrastructure. Further, infrastructure projects will gain traction as the government focus on the rural economy and employment generation.

3. India’s Energy Sector Can Attract New Investment

India’s developmental stage engenders a rapid expansion of energy consumption and a need for robust energy security. world’s total primary energy demand would increase at less than 1% per annum till 2040. On the other hand, India’s energy demand would grow at about 3% per annum till 2040. This energy growth would be mainly supported by India and other countries in Asia.

India’s step towards green energy, expansion of capacity for reserves will create an opportunity for investors. The deployment of the latest technologies under Industrial Revolution 4.0 will improve productivity and efficiency. India’s growth story will be a tale of constant adaption, revision, and change.

4. No Magic Pill To Revive Demand Overnight

With such healthy growth rates marking firms selling groceries, staples, health, hygiene and personal care products, the government probably did not deem it fit to offer any magic pill in the budget to boost consumption overnight. No direct handouts were announced to push demand.

The budget took a longer-term view to restart the consumption cycle through structural reforms. Big investments announced in various infrastructure segments such as roads, public transportation and ports are expected to not only boost demand for steel and cement but also for local labor.

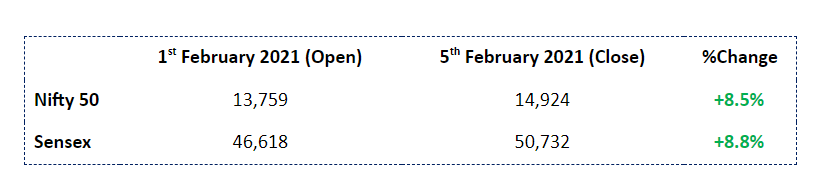

5. New Highs For Sensex

Continued exuberance around the Union budget and positive global cues lifted stocks further, with the benchmark Sensex index closing above the 50,000 mark for the first time, gaining more than 8% in just three days.

The budget is fueling a rally in all economy-driven sectors, along with banking. The uptick in global markets, resumption of foreign inflows, and strong earnings trend coming from December quarter results are other factors that are taking the stock markets higher. Markets are like life—they are chaotic and volatile in the short term.