March end is near, meaning It’s that time of the year again. I am not talking of one’s rushing in filing taxes but of the exact opposite – one’s attempt to minimize taxes.

Like is seasonal, people awake in times now and fetch their accountant to mind-hunt ways to indulge in paisa-pinching activities. In this attempt, there are usual 2 observations:

- Either there are too many ways

- Or There are None (at least to the unlearned eye)

The 1st point sounds too good to be true, but only because it is. An example of this section would be Section 80C which is arguably the most familiar and crowded tax-saving avenue of the lot.

Section 80C covers a wide range of line-items such as PPF, ELSS investments, insurance premiums, home loan principal payments and children’s tuition fee among others. The current limit of Rs 1.5 lakh is accrued by canopying various sections in 80C, 80CCC and 80CCD (1).

An interesting but lesser-known fact about limit description is its current deductible amount set in 2014, with only 2 revisions this century. Before 2014, the deductible amount was Rs.1 Lakh set in 2003, thus amounting growth at ~2.5% p.a. Meaning, annual increase in deductions was not even at par with the inflation growth in the same period.

Given the favorability and tax-spread of this section, it is easy to exhaust the Rs.1.5 lakh amount but difficult to extract maximum value for the buck. To allocate amounts within the components requires foresight so as to not drain time value of monies when draining tax.

Inefficient use of monies is set to yield inefficient returns. Make sure to maximize marginal utility of your money within by backing the bank with the brain.

To help make your last-minute tax planning easier, here is one cheat-code you can apply to arrest tax and enjoy healthy market participation. Amongst the entire product suite, it is well known that ELSS Mutual Funds fulfill both requirements mentioned in the statement before.

With only a few weeks to go before finalizing taxes, think of time not as a limiter but as an amplifier. How? Here’s how!

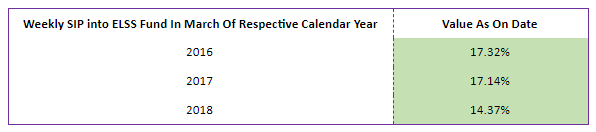

We keep talking of making market entry’s in a staggered format irrespective of market health to maximize investor wealth. Then why not use the same technique here? You have Rs.1.5 lakh and 3 Monday’s ahead of you, which translates to Weekly Systematic Investment Plans (SIP) into an ELSS fund of your choice with each tranche being subject to equal investments.

In back testing our thesis, we observed that weekly SIPs delivered fashionable returns on the upside. Table below highlights the same:

Now that you have a backdrop of how tax can be optimized For returns instead of as a substitute, here are some more ways you can look at not hiding a paise but saving it:

- Tax-Free Education – Learn To Earn

The onset of the pandemic last year saw a spike in web-based educational services. The economic element questioned uncertainty as implied continuum in fees clashed with incomes coming to a standstill. The recurring out-flow made many resorting to Govt.’s soft subsidy in adopting moratorium. On closer discovery, we found a chink in the armor, which is no coverage of educational loans as a pandemic-oriented policy.

So is there any solution to the hefty amounts paid in interest for loans availed to educate oneself? Yes, there is, and it’s existed long before a pandemic brought the world to a standstill.

Section 80E of Income Tax act allows you to avail tax deductions on interest paid on education loans, with no defined limit! The benefit is subject to sourcing from the 1st year of repayment till its 8th year or till the time repayment is complete, whichever is earlier.

As an example, you complete repayment process within 5 years, then benefits can be availed for in the interim. However, the benefits lapse in the completion of the 8th year of payment cycle irrespective if how many payments are due.

- Saving Tax On Health Equals More Money For Making Wealth

The century’s biggest health crisis put the undeveloped health infrastructure on the forefront as individuals and institutions were left at the mercy of time and god-speed innovation to combat the situation at hand. A key observation made in times of treatment was not only the lack of insurance penetration but also its awareness and operational aspects.

In knowledge of many being tested covid positive and the costs involved, we must make all aware about the economic ailments at disposal to lessen such burdens.

Section 80D of the income Tax Act allows you to treat your health premiums as tax deductibles. Befriending versatility, it can be claimed for standard health insurance policy, health insurance riders and top up health cover. Its tax-savviness even expands to preventive health checkups provided within the limits of health cover.

The deductible limit under this section is subject to age and family heads covered under the policy. Sub-sections of the policy make for grander deductibles subject to contingencies.

- An NPS Extra – Additional Deductions Under Section 80CCD (1B)

National Pension System (NPS) is a voluntary retirement scheme to help create a retirement corpus. Regulated by the Pension Fund Regulatory & Development Authority (PFRDA), the NPS can be opted for applicants aged between 18-60 years and carries the lowest operating cost vis-à-vis similar global pension products

On the tax front NPS is equally financially-savvy, offering full & partial tax deductions of up to Rs.1.5 lakh, with tax exemption on 60% withdrawals on maturity. Besides this, additional deduction under Section 80CCD (1B) of Rs50,000 can be traced as deductible.

As an example, if you fall under 30% tax bracket, your tax liability reduces by Rs 15,600 by investing in NPS. The 4 % educational cess is also included within this.

- Affordable Housing Is Housing More Monies

The Govt.’s ambitious and laudable plan of “Housing For All’ got new life breathed into this budget as the financial charter called for an extension of tax benefits by a year.

Section 80EEA of the Income-tax Act calls for deduction of Rs 1.5 lakh in a fiscal year under this section. Introduced in 2019 with maturity in 2020, this flagship programme now has an extended lifeline to March 2022. This deduction is available over and above Rs.2 lakh available on interest payment on housing loan subject to satisfying pre-determined conditions.

Presented above are a few examples how you can get the better of the tax man. With many other similar overlooked and unused avenues in interest accrued from savings account, rent allowance deductibles and senior citizen deposits, it is the lazy and the late who end up paying.

Well, with this document, you can be lazy but cannot be late! In 3 Monday’s from now, we hope to see you treat taxes with a smile and you recommending weekly STPs to those you meet.

This document is solely designed for informational consumption. Please consult your tax consultant before making any material decisions-cum-actions.