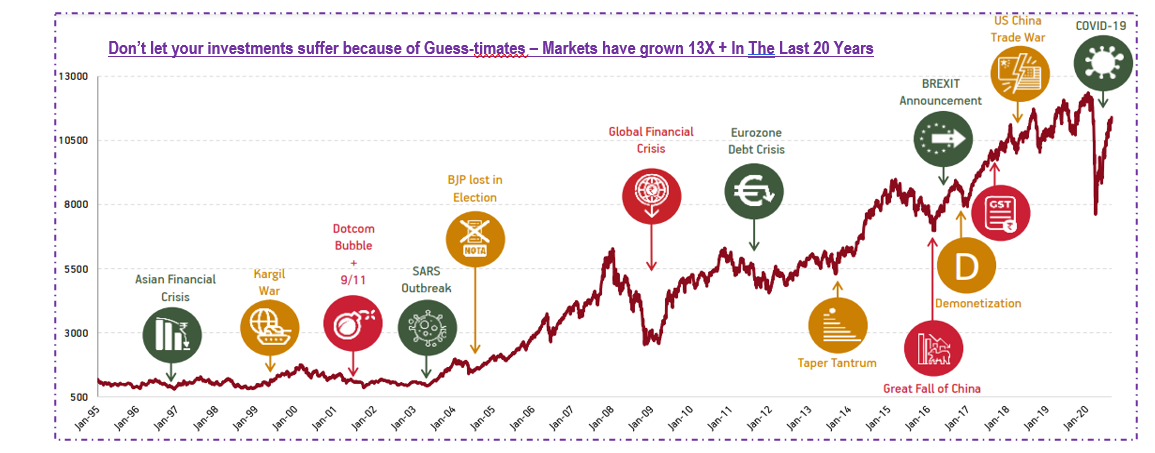

Diwali, the festival of lights, is an extraordinary occasion for Indians. Diwali is even more auspicious for investors and market participants as investors look at emerging trends and themes to invest in for the next many Diwalis. Quantitative tightening and rate hikes are the new firecrackers used by central banks to fight persistent inflation this Diwali. It is time to reflect on the past and see how markets have performed over time. Let’s look at a few trends the market has witnessed from last Diwali to the present.

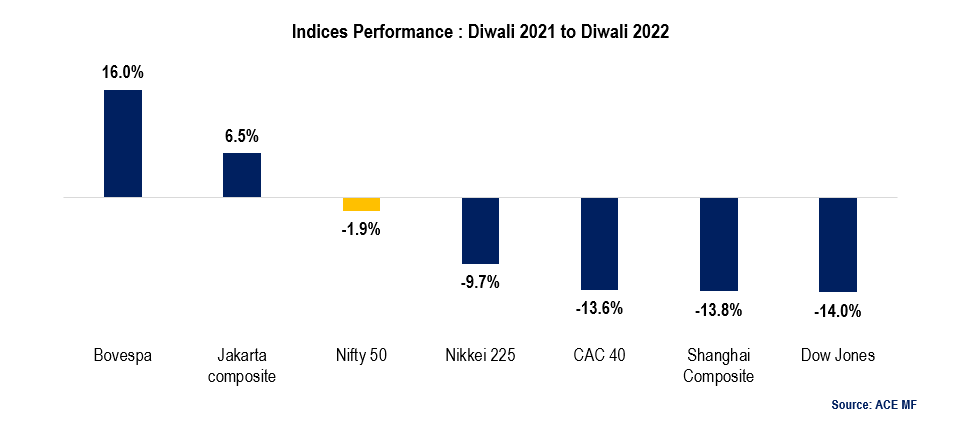

- Indian equities stand tall & strong:

Strong macro fundamentals, proactive monetary & fiscal support and strong corporate balance sheets were a few key reasons behind the resilience of the Indian benchmark indices.

Last year during October 2021, global markets, as well as Indian markets, were hovering around their all-time highs. But soon after Jan 2022, the indices started to decline because of more than expected inflationary prints across the globe, hawkish monetary policies & Russia-Ukraine crisis.

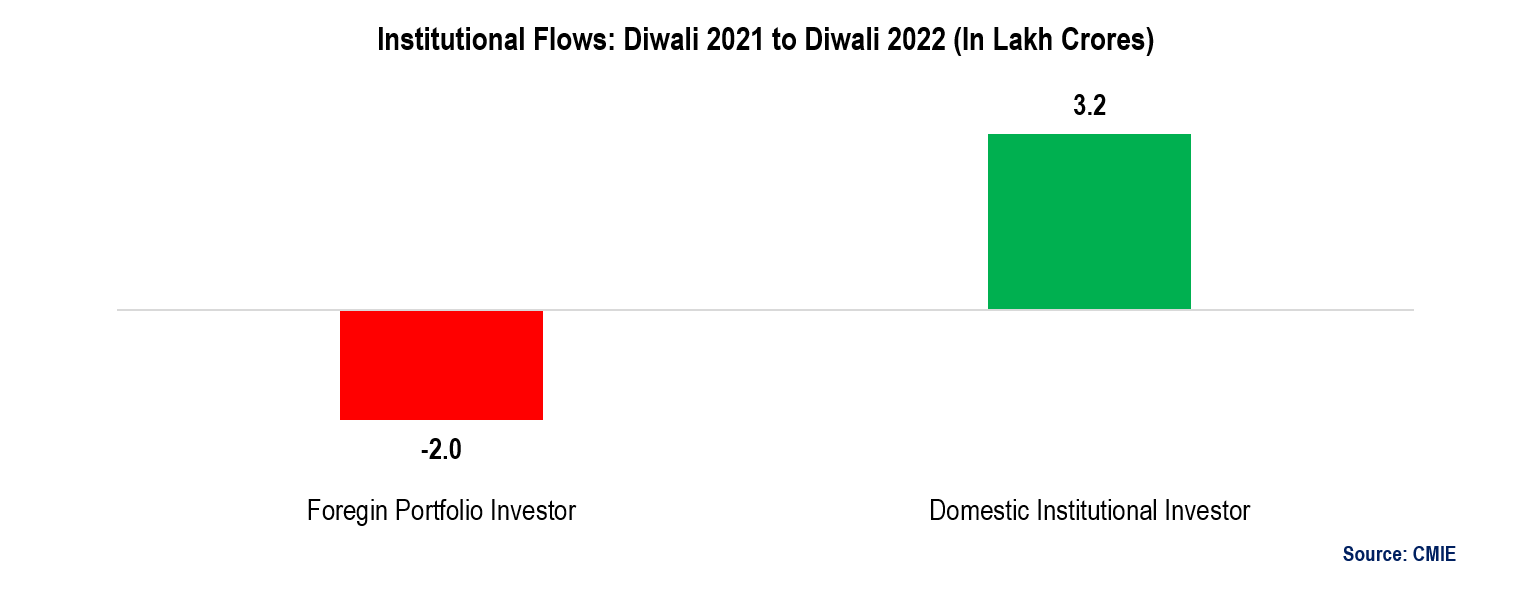

- Domestic investors capture every opportunity foregone by foreign investors amid risk-off

FPI outflow has more to do with rebalancing global portfolios, the global risk-off environment, and international funds’ re-alignment with mandates. The net outflow of FPIs is barely indicative of any deviation in the Indian economy’s growth narrative.

The rising flow of DII is a counterbalancing force against sharp FPI outflows. Even valuations have rationalised significantly from Oct’21 levels, and the fear of a structural increase in inflation is reducing as global commodity prices decline over the recent past, which should build the confidence of slowing down FPI outflows incrementally.

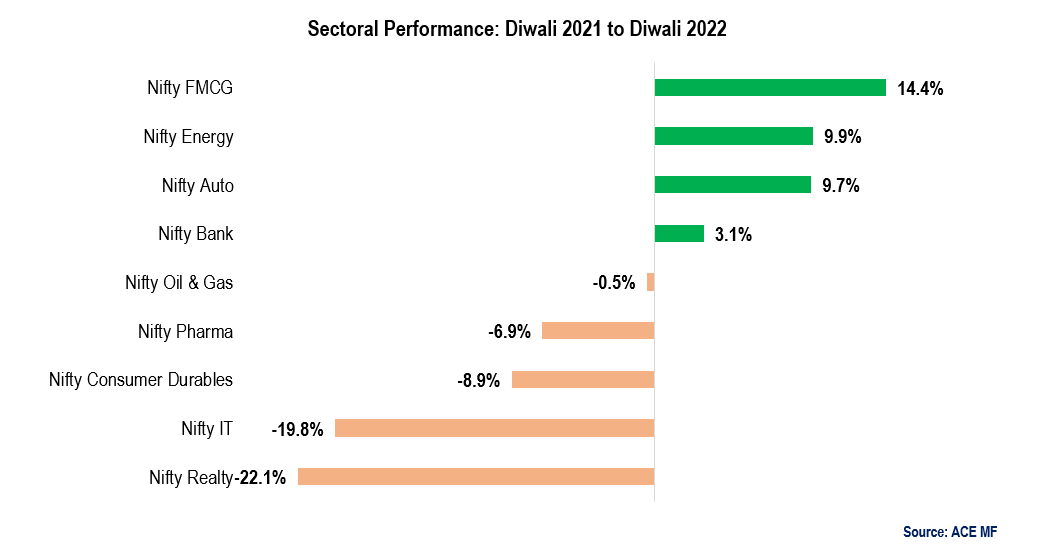

- Dynamic sectoral rotation observed

Winning sectors changed monthly at a rather dynamic pace. The uptick in the year’s first half was supported by energy, oil & gas and auto, while pharma, FMCG & banks started gaining momentum in the second half up to Sept ’22.

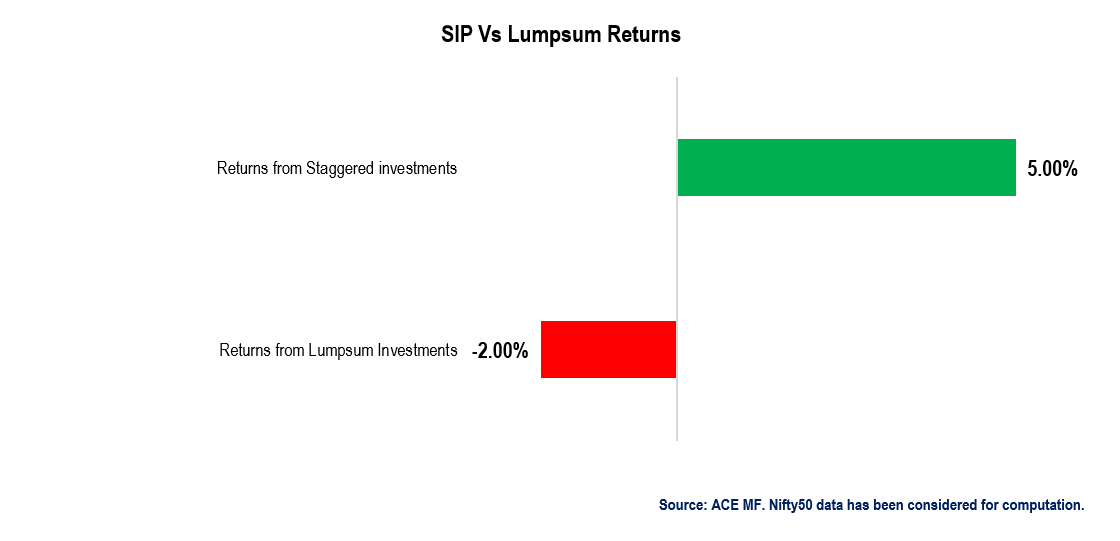

- Discipline investors with a staggering investment approach was the winner from last Diwali to present

Investor Takeaway

There is undoubtedly ambiguity in investors’ minds globally as the probability of volatility remains before stability. However, another school of thought suggests that markets factor into everything. It has been time and tested that long-term investor volatility helps to build a durable portfolio. The game of equity investing is of patience and conviction. Building conviction in the right stocks and sectors and holding on to your investments while ignoring short-term pains is the right approach to building a portfolio that creates wealth.

The chart above shows more predictions of wrong prices than evidence of correct prices.

So, if no price is right, how do investors planning to enter markets during the Diwali festival approach this dilemma?

Simple, by respecting time-tested principles of asset allocation. Remember, Fisdom help is only a call/click away.

To conclude, pick the Magic 8 ball and ask for the right price. Its answer will be as sound as a market veteran or a market novice.

And that should tell you more than any other fact or figure can. If you wish to share your thoughts with us, we eagerly await to hear from you. We wish you a Happy Diwali and A Happier New Year!

Market This Week

|

17th October 2022 (Open) |

21st October 2022 (Close) |

%Change |

|

| Nifty 50 |

17,145 |

17,576 |

2.5% |

| Sensex |

57,753 |

59,307 |

2.7% |

- Markets ended the week on a positive note.

- During the week, it crossed the 83-mark, striking a fresh record low.

- Healthy corporate earnings and fresh foreign inflows offset negative cues from global markets.

- Foreign institutional investors bought equity shares worth Rs. 1,324 crores, whereas DIIs bought Rs. 3,569 crores of equity shares during the week.

- The festive season helped credit card spending reach a record high of Rs. 1.22 trillion. On a month-on-month basis, the spending rose by 9 per cent, whereas on a year-on-year basis, the spending rose by 53 per cent.

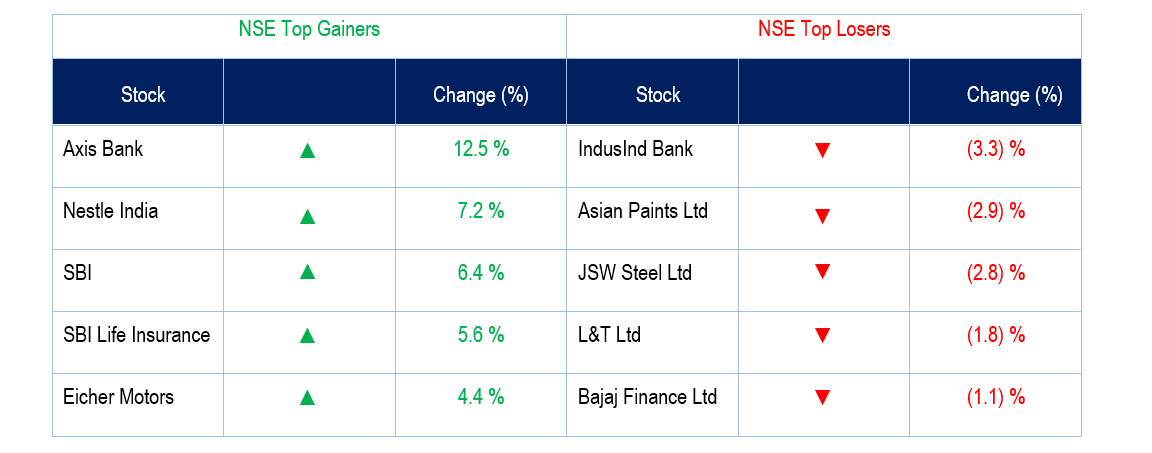

Weekly Leaderboard:

Stocks that made the news this week:

- Reliance Industries, on a consolidated basis, reported a profit of Rs.13,656 crores for the September quarter. The company plans to demerge the financial services firm into Reliance Strategic Investments Limited and revive it into Jio Financial Services Ltd. That is to be listed on stock markets.

- Axis Bank posted a 70 per cent year-on-year growth in net profits for the quarter that ended September 2022. The bank beat all estimates, and the profit grew by 29 per cent.

- Another bank, IndusInd Bank, posted a 57 per cent y-o-y rise in net profits for September 2022. The gross NPA declined to 2.11 per cent for Q2FY23 vs 2.35 per cent in Q1FY23. Global brokerage Macquarie has maintained its stance of outperform call for the stock as asset quality strengthens. Credit Suisse, JP Morgan, and Morgan Stanley maintain overweight calls on the stock.

- Asian Paints to set up a vinyl acetate-ethylene emulsion manufacturing facility in India. Capex of around Rs. 2100 crore will be set up by the company for three years, and the installed capacity of the said plant will be Rs 1 lakh ton p.a.