A much-hyped fear of fed tapering is coming closer and is being portrayed like a mythical monster coming towards equity and debt markets across the globe. Before jumping on to conclusions first let’s try and understand what exactly “Tapering” is? And what has happened in the past and how will it impact Indian markets this time.

What is Tapering?

The word tapering is a financial term referred to a reduction in quantitative easing (QE), or else the bond buying programme by the Federal Reserve. Quantitative easing essentially means printing money and then buying bonds or other financial assets from banks. In return banks of other financial assets will make it easier to finance different projects and witness a high loan growth. The fed’s purchases in return will help drive up the prices of bonds by reducing supply, which causes the yields to fall. Lower yield in turn provides fuel to the economic expansion by lowering borrowing costs for companies. Tapering is not an immediate, dramatic event, but is a gradual process and creates minimal market disruption in the long run.

The Story Behind Previous Tapering

During the 2008 financial crisis, slow growth and high unemployment forced the Fed to stimulate the economy through its policy of quantitative easing in the interval from November 2008 to March 2010.

- Fed announced an expansion of the program from $600 billion to $1.25 trillion on March 18th 2009.

- Immediately after the programme was wrapped up, trouble emerged in the form of slower growth, the occurrence of the European debt crisis, and renewed instability in financial markets.

- Fed moved in the second round of QE and involved the purchase of $600 billion worth of short-term bonds. QE2 sparked a rally in the financial markets but did little to spur sustainable economic growth.

- On September 13th 2012 the Fed Reserve launched its third round of quantitative easing and term was so called to be ‘QE infinity’ a plan to purchase $85 billion worth of fixed income securities per month.

- Global markets witnessed a sell off after Fed indicated that it expected to ease its bond buying programme.

- On December 18th 2013 Federal Reserve Open Market Committee finally decided it would scale down its $85 bn month asset purchase programme.

Reaction to Tapering:

- Hike in US bond yields fueled higher borrowing costs around the globe.

- This led to flight of cheap capital from emerging markets and currencies.

- Dollar gained against majority of its most traded peers including India.

How does it apply in today’s context and how will it impact Indian Equities?

This time the signals of tapering have been coming from July meet. Bond yields hardened and stock markets corrected, but it was very shallow and short term in nature. There has been relatively milder reaction form the domestic markets as compared to 2013, S&P BSE 500 declined by 1% on the day of release but recovered the very next day and is currently trading at fresh highs. Indian rupee is unchanged since the minutes were released. Federal Reserve have been playing its cards very carefully and have been giving guidance to financial market participants well in advance. Today’s savvy investors understand the fact that Fed cannot indefinitely continue to pump liquidity when growth is strong, and inflation is above 5 percent.

The biggest impact out of all this on India will be on foreign inflows. FIIs will accelerate the pace of withdrawal of their funds from equities and invest in US treasuries. Also, Indian G secs and rupee could witness volatility.

However, the actual Impact in Indian equities will be negligent.

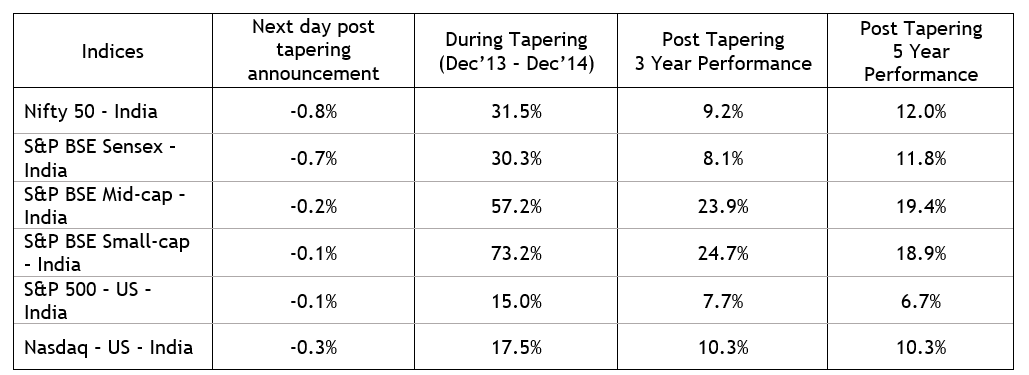

Let’s go back to history and see how does the global and domestic equity markets had responded to taper event of 2013 & 2014 in short term and long term?

Quantitative Tightening Period: 18th December 2013 – 29th December 2014

Returns are CAGR. Past performance is not indicator for any future performance.

During the tapering period, DIIs sold INR.36,150 crores & FIIs bought INR.1,13,155 crores in Indian equity markets.

In our view the lessons for today’s investors are to hold their investments for a longer duration and not to panic when tapering begins. Hence rather than reacting to short term events investor should focus on maintaining the target asset allocation as per their risk profile and time horizon.