We will be celebrating 75 years of Independence this 15th of August. In the last 75 years, with continuous innovation and technological advancements, new products and avenues of investments across equities, fixed income, and other alternative investment strategies have changed the investment landscape significantly.

Achieving financial Independence is one of the most aspirational goals that they may have. Yet as Indians, we see our parents and grandparents struggling to reach this goal, living with minimal incomes or working for far longer than expected.

Therefore, financial Independence is of utmost importance for all of us, and the very famous FIRE lifestyle comes into the picture. FIRE stands for ‘Financial Independence, Retire Early’, aiming to achieve enough wealth to retire early.

Financial Independence essentially means that an individual need not work for money. In other words, financial Independence is when you no longer are dependent on an employer to provide you with a paycheck.

Simple math tells us that achieving financial Independence requires having enough assets saved to cover living expenses till perpetuity.

The logic behind FIRE strategy

Many people adopting a FIRE style often use the ‘4% rule. Understanding the math behind the 4% rule is essential for those who want to achieve financial independence. It gives us a reasonable idea of what you need to work towards as you get closer to your retirement.

The 4% rule essentially means multiplying your annual expenses 25 times and withdrawing 4% of that corpus during your retirement while adjusting the same for inflation. However, the general rule that must followed is that the lower the withdrawal rate, the better it is for you since you also need to ensure that this corpus goes on for several years.

The above may not apply to every individual investor. However, there is one thing that is common for everyone in this world, and that is retirement. To achieve your financial freedom or retire early, you can adopt the following approaches:

Invest First, Spend Later: In today’s world of BUY now and pay later, we have forgotten this basic rule of investing first and spending later. A prudent approach would be to set aside an investment corpus and budget the remaining expenses.

Emergency corpus: Once you pay attention to accumulating an emergency fund, you can use a liquid fund/overnight something that is accessible at any given time. Invest in such a manner that you earn decent returns versus a savings bank account without compromising on the liquidity part. Liquid funds invest in instruments with a maturity of fewer than 90 days.

Be Disciplined: In investing world there is a famous saying that “The best time to invest in markets was 10 years ago; the next best time to invest is now, which clearly means that one needs to start investing early. Suppose your retirement corpus (one method to find this is through the FIRE strategy mentioned above) requirement and time horizon are clear in your mind. In that case, financial planning becomes extremely easy, too, in a disciplined manner.

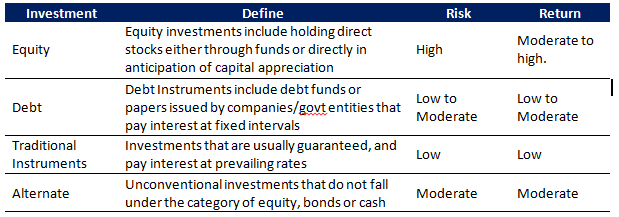

Asset Allocation: Asset allocation implies distributing or apportioning investments across asset classes such as gold, equity, real estate, cash or cash equivalents, and debt along with a new-found asset like crypto. The primary objective of asset allocation is to minimise volatility and maximize returns. Below is a general comparison of asset classes along with their risk and definitions:

Ignore More React Less: As investors get swayed by the market volatility and hit the panic button whenever the markets are down the best approach here is to ignore when others are reacting and react when others are missing investment opportunities. Taking investment decisions as a reaction to news can hamper your returns.

Since each asset class performs differently at any given time, it is imp time; investors must allocate as per their risk appetite and investment horizon and maintain asset allocation until. While the above approaches may not mitigate all financial problems, they at least will provide a guide for an individual investor on the right path to achieve financial independence soon enough.

Till the Happy Independence Day and Happy Investing!