Welcome back to Part II of The Bull Market Rally – Why and How? series. 2021 is nearing an end, and in ways completely unexpected after the happening of the recent past. Today, when markets are at all-time high levels, investors are finding new ways to entertain their worries.

The comparison in emotions of investors can be realized through interpreting the market’s inherent behaviour to factor in the growth and prosperity of economy in future. Since it is a known fact that no one can predict market’s future value, let us also refrain from doing so.

In continuation with previous series, what we will do is try to address a few more key events which are helping markets stay elevated at current levels.

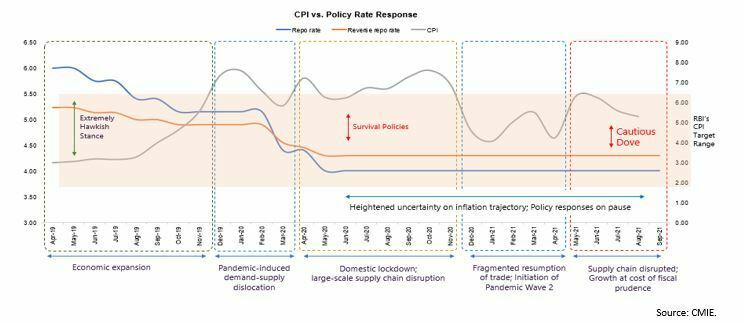

- Easy monetary policy by RBI and other global central banks

Major central banks have pumped adequate liquidity in stock markets. Massive balance sheet expansion programs have been undertaken by the RBI, Federal Reserve, and other central banks. Lower interest rates on traditional instruments and debt securities are pushing retail investors to equity market as there is no other option available with debt securities. Govt.’s Banker has been at its most accommodative, with announcements focused on driving Growth and curbing conservative credit climates.

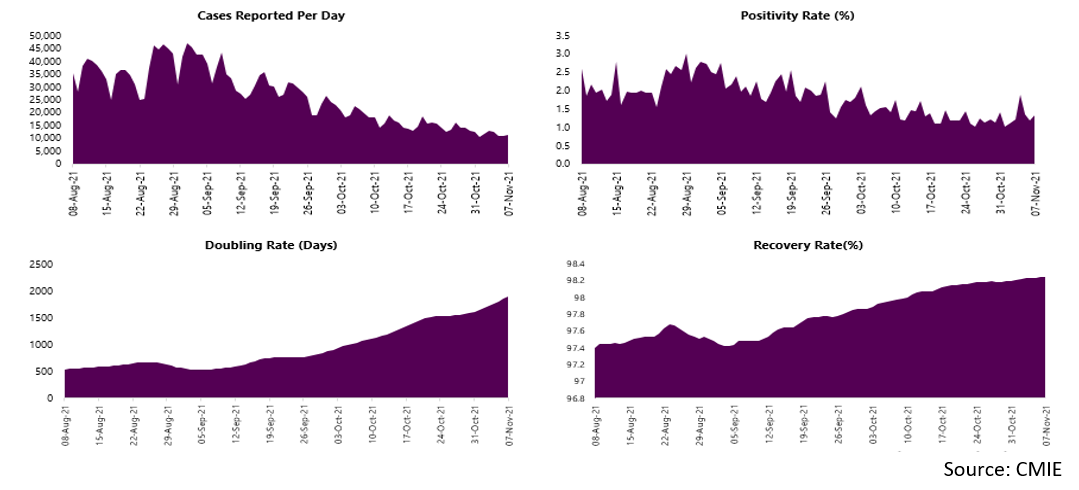

- Shifting Away From Covid-19 Conundrum

India, the world’s vaccine maker, is today in a very healthy-is-wealthy position as compared to its peers. Case reported per day and positivity rate have been on the decline. India is well ahead than its in peers in medicating itself against the virus. India achieved a remarkable milestone in it battle against Covid-19 as cumulative vaccinations in the country have crossed 100 crore mark.

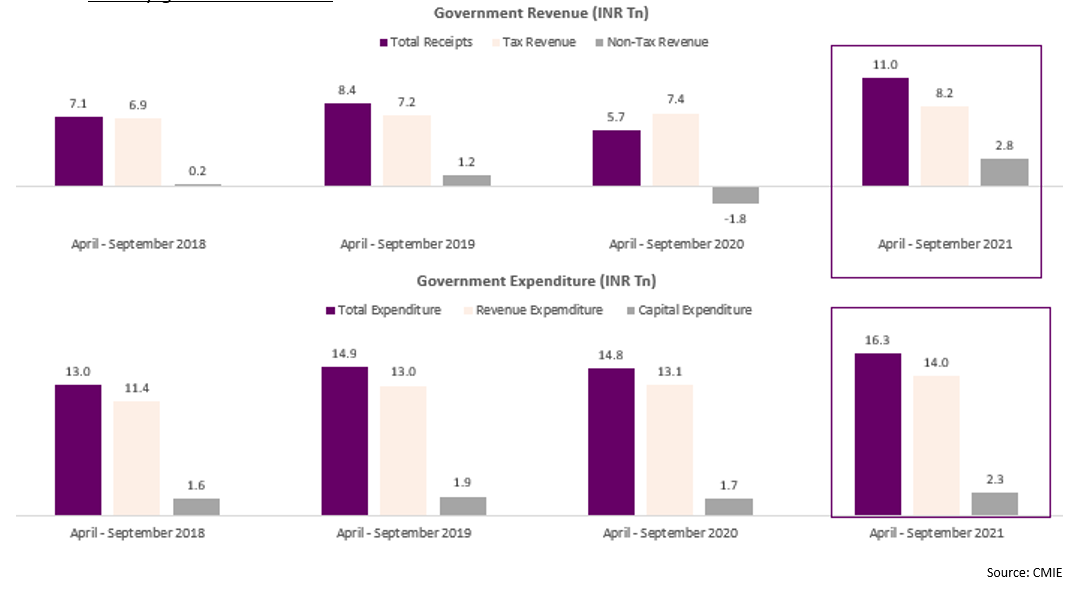

- Healthy government coffers

The government’s total receipts for the first six months of this fiscal stand at INR.11.0 trillion, almost 2x of last year’s level, while registering a growth of 93% absolute growth compared to receipts of the first six months FY20. FY22, thus, could be an exceptional year in which the government manages to over-achieve its fiscal deficit target by a significant margin and end the year with higher-than-targeted spending.

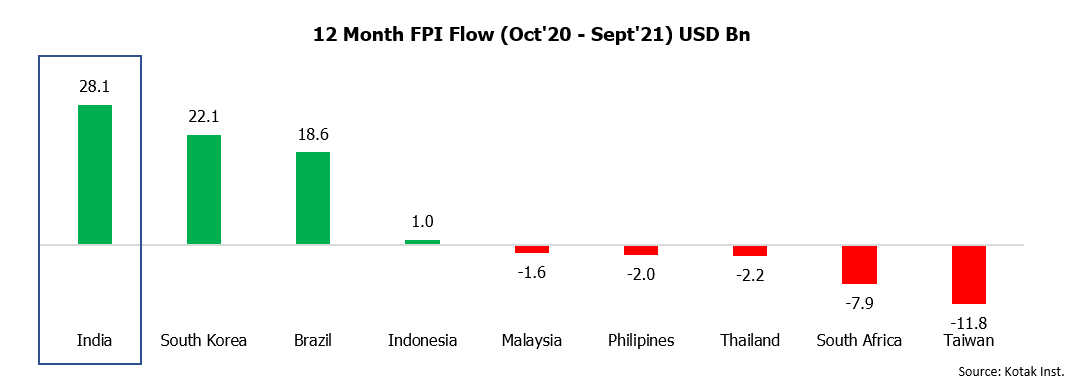

- Foreign investors on a buying frenzy

Massive balance sheet expansion programs have been undertaken by the US Federal Reserve and European Central Bank. Every month the US federal reserve is buying $120 billion worth of bonds. And hence in this search of returns by foreign investors money is being poured into fast growing economies like India, which attracted INR. 2,43,506 crore since March 2020. Also, India has received one of the highest FPI net inflows across emerging market space.

Conclusion:

The current bull market rally is the most logical one. India has been one of the best performing markets in 2021. So, it’s time for some reality check and a check on your investment strategy. Since many investors are sitting on bumper profits and with recent bouts of volatility, a pertinent question arises: Is it time to sell? The answer to this question would depend on your financial goals. If your goal is to participate in wealth creation the strategy should be to invest systematically and manage asset allocation as per your risk profile.