2021 is only 2 months away, and the 2019 disease is yet ever-so relevant. Continuing to be a front-page feature, it’s the biggest socio-economic crisis humanity has faced this century.

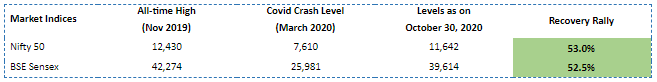

Harbouring a sweet-&-salty relationship, the viral virus infected the markets with a mix of news and noise. Markets went on to wipe out trillions in wealth only to bounce back by 50%+ on the upside since its march lows. With Volatility as its theme (all-time high levels), its not markets which showed erratic behavior, but its participants.

Covid 19 amplified an age-old myth in the markets which was best seen in the record demat-opening run during the lockdown period.

Before we unravel the mystery and find the faults-&-vaults in investor actions, let us paint the rainbow market’s in its true colors.

As can be seen above, the markets were an early Diwali gifts for all new participants who lucked and tucked away 50%+ returns on their 1st investments. This market run on the upside has given birth to new-found myth in “Selling Mutual Funds To Invest In Stocks For Superior Returns”.

Are you the mutual investor wishing you too had the foresight to act and not the hindsight to learn from? If so, let us shine light on new information which can help you trade myths for monies.

Solar System Of Stocks Vs Galaxy Of Mutual Funds

You find yourself comparing gains made by heavyweights such as HDFC Bank and Reliance vs your mutual fund portfolio and find the latter coming up short? If so, the answer is simple as is mechanical. It lies in three key components:

1. Tailored Risk Profile

2. Time-oriented Investment Tenure

3. Time-tested Concept of Diversification

Mutual Funds allow you access to multiple stocks of your choice in a risk-savvy manner to help you capture the upside while limiting downside. As an added bonus, the universality of MFs can cater to investors of all types by it being spread across 3+ different asset classes with each suitable for respective time horizons.

More so your favorite stocks of today may not be hold the position tomorrow which can lead to capital loss. If this were the case, the Nifty would not see regular changes in its composition. But observations below tell us differently:

1. Nifty churns by 40% over a 10-year period implying, 20 current Nifty stocks will move out to making room for equal set of new stocks.

2. 10 years ago, 2/3rd of Nifty was composed of balance sheet heavy stocks like Power, Construction, Metals, Telecom, Real Estate and Oil & Gas. Today, the old-school-cool have moved to retired homes.

3. To cite a few examples:

(a). Of some big names of yester-year in Infosys, Satyam Computers, Digital Globalsoft, and Zee Telefilms – 2 have not even survived as of date.

(b). Other favourites in 2000’s era such as Unitech, BHEL, Suzlon Energy, Lanco Infra and Reliance Communication have eroded 90% of investor wealth.

In fact, even in times of crisis, mutual funds can turn cry-sis into opportunity through its category of “Value/Contra” funds. Even here, exposures are taken in controlled manner to limit risks. Governance by market regulator in SEBI further promotes funds to act in interest of its investors.

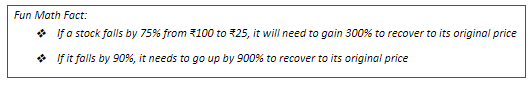

In conclusion, Direct equity is not for the faint-hearted as the loss of pain always trump the joy in gains. Math follows this emotion too as can be seen below:

Today, when we find ourselves in the midst of another crisis, mutual funds offer the smarter route to help your money grow. To draw parallel from a famous fable, “Its Slow & Steady Who Wins The race”

So what are you waiting for? Buy A Mutual fund which suits your style in less than 5 clicks on the Fisdom App!

Seasoned Professionals & Active Management

2020 markets presented a multitude of opportunities, testing investors at every turn. However, for Mutual Funds, it was just another event-filled year for their vintage, and management experience at the helm were its greatest asset.

Having been subject to multiple crises over years-&-decades, fund managers’ have witnessed big falls, and bigger euphorias, to stand firmly by investment processes and not given in to temptations.

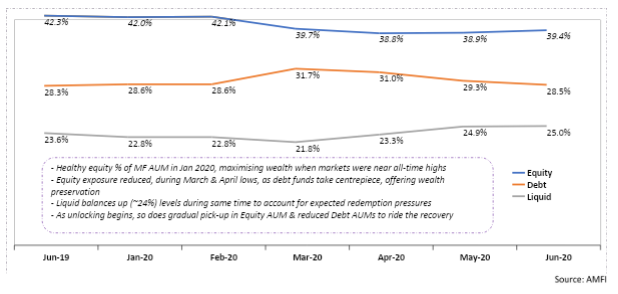

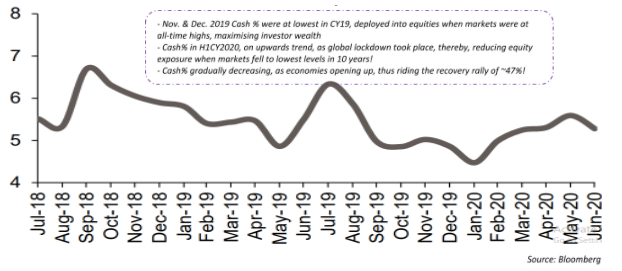

Putting in actions their echoes of asset allocation and emotion-agnostic principle-based investing helped MFs earn their motto of “Mutual Funds Sahi Hai”. The same was observed during peak Covid period, which helped MFs (equity) give stellar returns in the short-term while not compromising on quality/quantity on long-term metrics.

The graph below highlights how and why MFs rely on the tenacity of their timeless fund mangers:

1. Dynamic Construction In Asset Allocation

2. Chance-ful Cash Deployment

Investor Takeaway

As the note shows, indulgence in mutual funds is indulgence in stocks, in a financially savvy manner with broad-based appeal. However, still feel that buying mutual funds is you sacrificing opportunities?

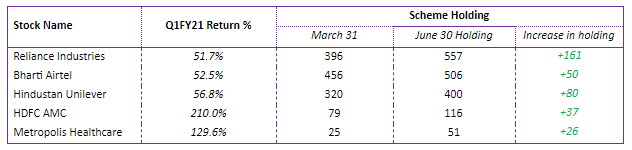

Well, the table below shows the stocks MFs bought when everything appeared green. Difference is, a few stocks were riding the bandwagon while others hitched their ride to it. Could you tell which is which? MFs could.

The table below shows which stocks MFs bought during peak covid days. The data below will satiate your quest for bargain-hunting in an intelligent manner:

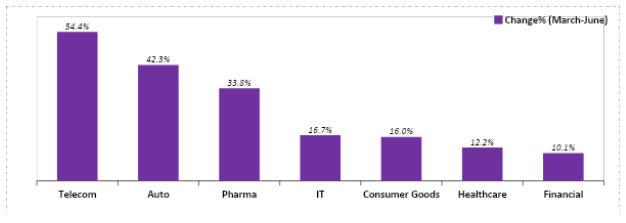

As can be seen MFs tightened their grip on the markets by purchasing stocks and sectors, showcasing near and long-term potential, at once-in-a-lifetime prices. Oh, the sector story followed suit too as can be seen below:

With this new insight, lets put down the perceptions and pick-up the receptions. Besides, we as investors will not to be over-exposed to a stock on the account of belief and defiantly not on the account of data.

The next time you think of opting for Stocks over MFs, read yourselves this line below:

If you want to curate a ₹10 lakh portfolio with ₹5,000 monthly SIP in a single stock for 5 years, your stock exposure will amount to ₹3 lakh, or ~25% of your portfolio!

So be smart and act in accordance with your risks. And if ever in doubt, do write to us ay Fisdom. We eagerly await to hear from you.