Have you ever tried planting a seed? You would notice that the more you touch, move or turn the seed before it germinates, higher are the chances that it will not grow well – in extreme cases, will not even sprout.

Like the process of growing a plant, even investing in equities is about nurturing, watching but not touching the seed/investment for a very long time. Your job should be restricted to offering it the right conditions, right nutrition and letting it grow the way it wants to – this is perhaps the best way to have a beautiful plant and investment corpus over a period.

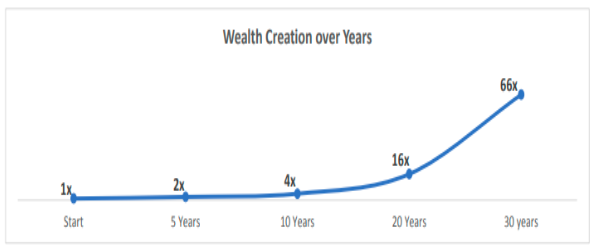

Below is an illustration of how wealth compounds over different periods. The assumption here is that equities grow at 15% annually. Now, do not focus on the 15% – honestly, it is simply an arbitrary choice of number – what is more interesting is the nature of compounding. If you notice, as more time elapses, the line indicating wealth creation grows in a steeper fashion – over a period, if you let investments in equity compound, you’ll notice it compounding in an exponential fashion rather than linear like most traditional investment products.

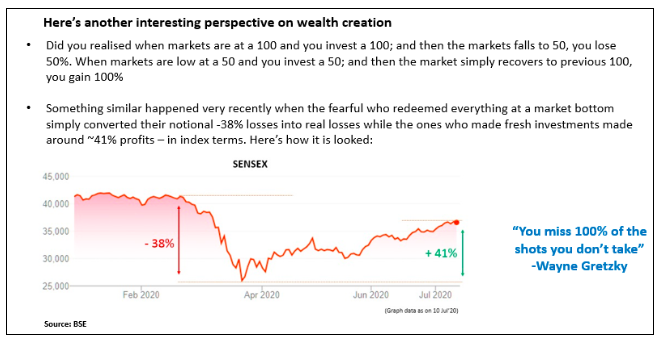

But, times like now make it difficult to take a step back and look at the bigger picture. The shorter-term volatility is unnerving enough to distract, and understandably so. Obviously, the growth of your portfolio would not be looking as smooth as the chart above, but the idea is that zig-zags look sharp when they’re zoomed into – when multiple zig-zags are cramped into the same frame to cover a longer period, it tends to reflect the larger trend while smoothening baby volatility.