Investors around the world are experiencing the fact that the pandemic rally which started in 2020 onwards is now coming towards its fag end. On a year-to-day basis, Nifty50 has corrected by 7.5 percent, broader markets have plummeted even more Nifty Midcap 100 is down by 8.0% and the Nifty Small cap 100 shrugged nearly 22.7% on a YTD basis. This correction in indices has affected the returns of equity-dedicated mutual funds. Even the rising bond yields have impacted the returns of debt portfolios.

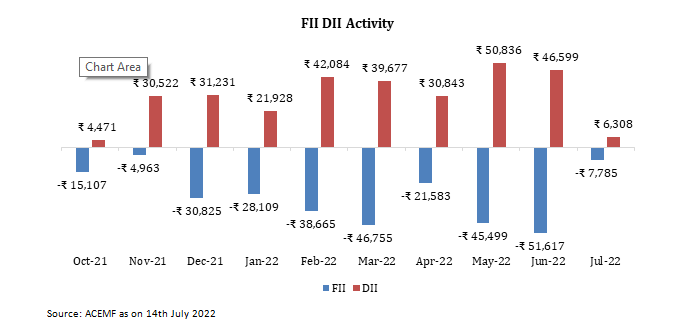

Now before jumping on to the question should, you review your mutual fund portfolio? it’s quite interesting to understand why the markets have underperformed. The underperformance can be attributed to many factors and one of them is FII selling. FIIs have been net sellers for the past nine months in a row. Moreover, despite DIIs being net buyers in the same period, the markets could not cope with the amount of selling done by the FIIs. The selling has intensified as rising inflation took center stage while the geopolitical tensions between Russia and Ukraine remain rigid.

On top of it, the US stared at 40-year high inflation, leading the Federal Reserve to turn hawkish and aggressively increase the interest which was at zero. Another prominent reason can be, valuation of India against other emerging economies was higher than the peers and became the reason for sell-offs by FII in Oct 2021 on account of profit-booking and re-balancing. The Reserve Bank of India has hiked the repo rate and in the recent bi-monthly meet, gave up its accommodative stance. Equity and bond markets are severely hit by rising interest rates.

While investing in mutual funds, it is important to understand that you need to review your investment periodically.

Things you can consider while reviewing a mutual fund portfolio:

Asset Allocation: Having a proper asset allocation is the most sensible way to manage your investments. There are various ways in which you can understand your optimal asset allocation. To arrive at an asset allocation, you first need to understand your risk appetite.

Portfolio Diversification: Investors may divide their investments between core and satellite portfolios. The core portfolio should be strictly dedicated to your financial goals and the satellite portfolio should be wealth creation or alpha generation.

Fund Performance: Reviewing your mutual fund portfolio quarterly is prudent. To do so, one can compare the performance of mutual funds against the benchmark index and category average across time frames to gauge whether the fund has performed against its index and category.

Having a long-term view: When the markets are jittery and the funds in your portfolio are not doing well it is easy to take an exit and book losses. However, do remember that markets are cyclical, so what goes down comes up eventually. Therefore, consider selective trimming of individual holdings that have not performed well or have performed beyond your expectations and replace them with holdings that still hold the promise of long-term value.

Conclusion:

The primary goal of a review is to achieve target asset allocation at every point of time. Different asset classes perform differently. Therefore, your portfolio must be monitored and rebalanced periodically to achieve the risk-return reward in line with your financial goals.

Till then Happy Investing!