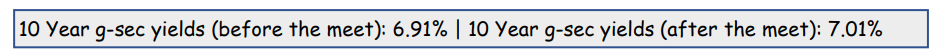

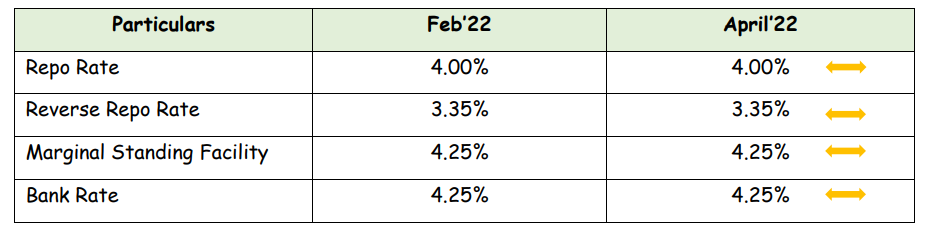

- All rates held steady; stance maintained as accommodative while focusing on withdrawal

of accommodation to ensure inflation remains within the target going forward while

supporting growth. All members unanimously voted for the same.

- RBI has introduced a standing deposit facility or SDF at 3.75%. A standing deposit facility

allows the RBI to absorb liquidity from commercial banks without giving government

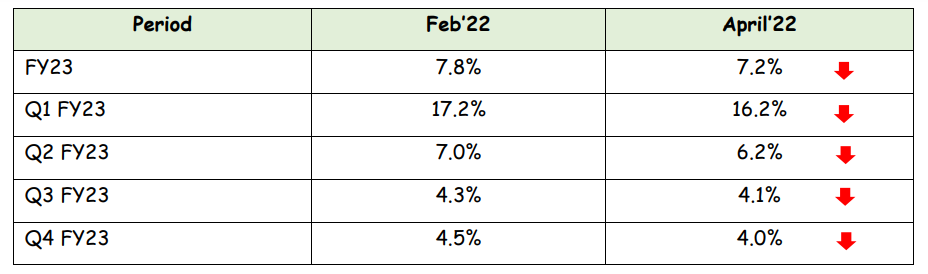

securities in return to the banks. - GDP Projections for FY23 have been trimmed down to 7.2%.

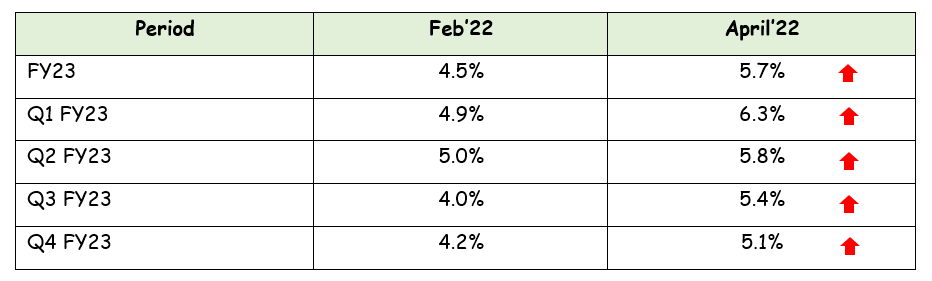

- CPI Projections for FY23 have been revised upwards by ~100 bps. RBI expects global

supply chain disruptions, the surge in the price of key industrial inputs, and input cost

pressures to persist for longer than expected earlier.

In line with the fisdom research expectations, RBI has started with the normalization by

introducing SDF at 3.75%. The market was prepared for this move as the RBI has been conducting

VRRR auctions to suck out excess liquidity at rates that firmed up closer to the policy repo rate.

The interest rate for around 80 percent of the total liquidity absorbed during Q4 FY22 has

firmed up close to the policy repo rate.

We expect the move to hold an accommodative stance while focusing on the withdrawal of

accommodation to ensure inflation remains within the target, indicating that there will be a case

for calibrated tightening. Two repo rate hikes look very likely in FY23.

Risk to policy decisions

• Policy actions taken by other global central banks mainly fed.

• Higher commodity prices mainly crude oil

• Downside risk to economic activity from any new variant.

• Higher inflation than expected

What should debt investors do?

In light of developments on policy rates, and sovereign and corporate bond yields, fixed income

investors can invest in funds with an effective maturity of 3 to 5 years following a roll-down

strategy.

A mix of PSU, and SDL-backed papers offer strong quality to the mix. For investors with a shorter

investment horizon, a tactical allocation to corporate bonds with lower credit ratings up to AA

and shorter duration should pump returns from the debt component.