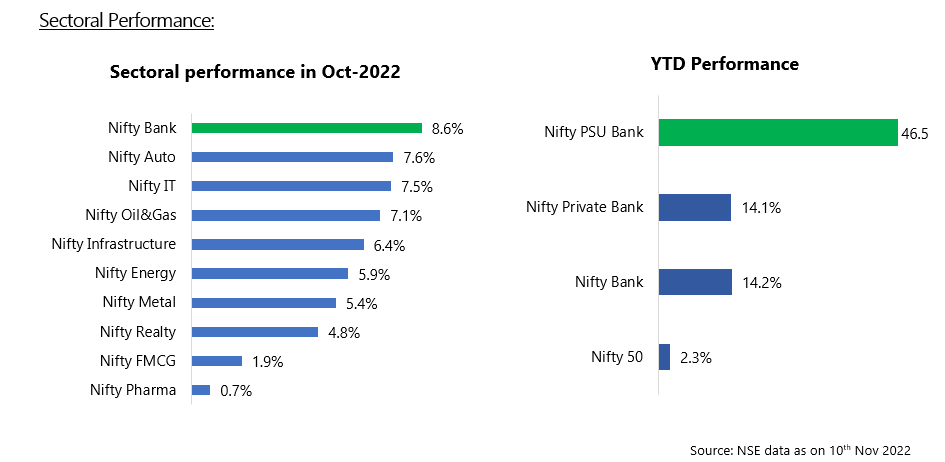

Hot Stuff: Banks remained the top gainers in October 2022

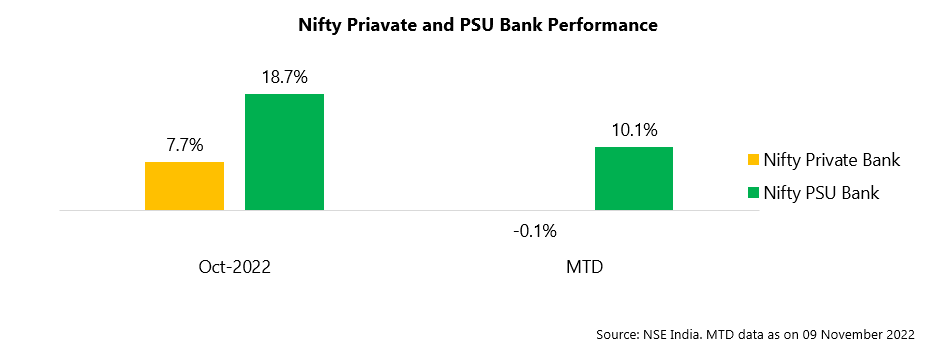

It has continued the same momentum in November to date. The resumption of economic activity has led to improvement in the asset quality of banks. Quicker pass-through of lending rates compared to deposit rates boosted the banks’ overall profitability. Within banking, PSU banks outperformed private banks by wider margins. The Nifty PSU bank index rallied by 10% starting November 2022.

Surprising results posted by heavy index weights contributed to the PSU bank’s rally. State Bank of India, Bank of Maharashtra, Indian Bank, and Union Bank of India are a few names that have rallied from 30% to 55% in the past month. The majority of these stocks are trading near their 52-week high.

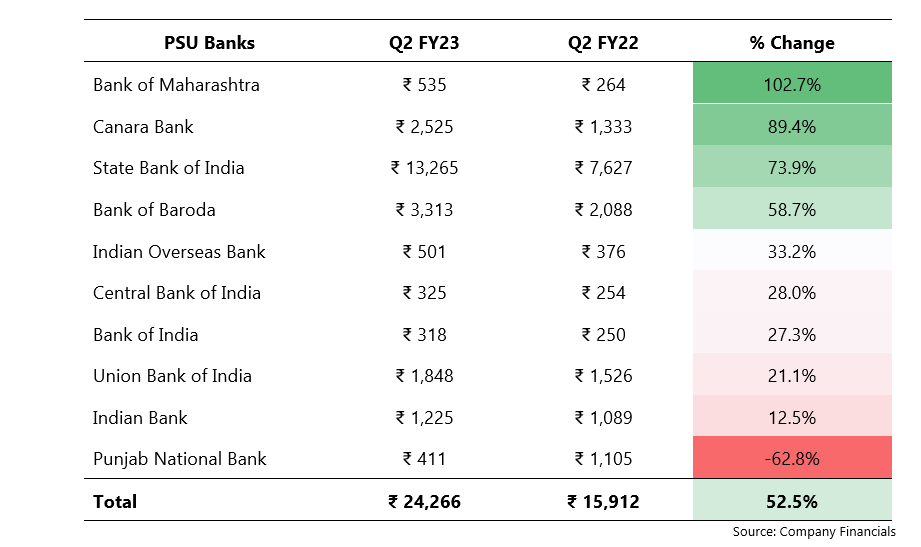

Finance Minister Nirmala Sitharaman, on November 7th, emphasised that the government’s efforts to curb bad loans are yielding results. Most public sector banks have reported more than a 50% jump in total profits in Q2Y23.

PSU Banks story:

PSU bank’s performance was impacted by poor asset quality due to their nature of reckless lending. It has reported ~17% loan growth from FY10 to FY14. Below are a few challenges faced by PSUs:

- Hasty lending

- Economic slowdown

- Asset quality review by RBI that discovered a huge amount of NPAs

Here are a few developments government has taken to improve the performance of the PSU banks:

- Government support:

- In the past few years, banks had to make provisions for bad loans worth over Rs. 10 lakh crores. In the last five years, the government has infused Rs. 3.1 lakh crore to recapitalise the banks. Of these, 35,000 crores were from budgetary allocations, and the remainder, Rs. 2.75 lakh crore, were infused by recapitalisation bonds. Bad loans worth Rs.5.4 lakh crore was written off from PSBs books, of which 37% admitted that they had recovered the claims.

- PSU banks have performed better than private banks relatively as far as corporate slippages are considered. Once considered troublesome, the corporate loan book is pushing its loan growth organically.

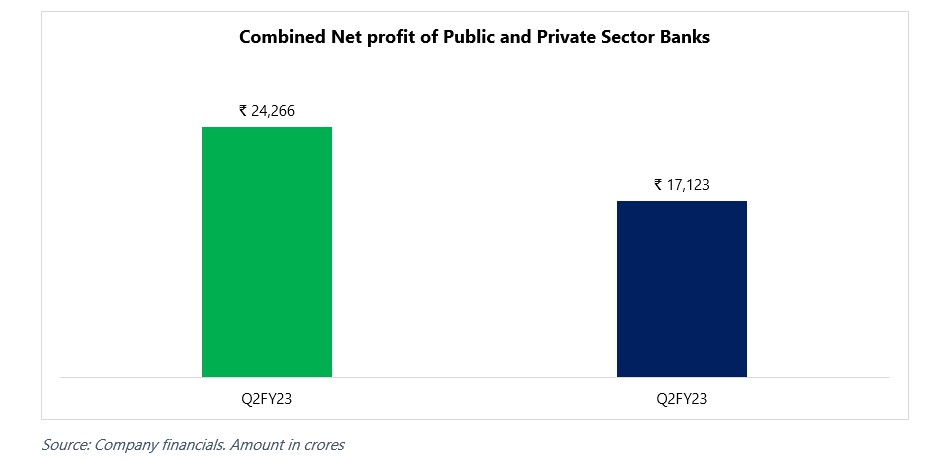

- Better Asset quality, loan demand, and rising profit margins drive strong earnings.

- High public and private Capex and increasing utilisation of working capital requirements pushed up the corporate loan book.

- Credit growth is witnessing strong momentum from decadal lows on solid retail consumer demand.

- Combined net profit of banks up more than 50% vs Q2FY22.

Key takeaways:

Considering the above points, we expect private and public banks to do well. Investors should stagger their investments to make the most of them in the longer run.

Investors should assess their risk profile and time horizon before making an investment decision.

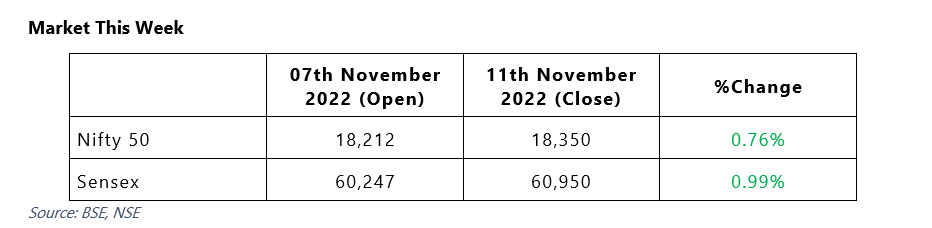

- Markets ended on a negative note.

- US inflation inched lower in October, sparking global market rally as expectations mounted that Federal Reserve will slow down the pace of rate hikes.

- Net inflows by foreign institutional investors have been positive during the week as we arrive at the end of earnings season.

- Investors will now be keen about the release of UK inflation numbers in the upcoming week. UK’s unemployment rate would also be in the news as it was around 3.5 percent in the month of August lowest since 197.

- Numbers for PPI, Jobless Claims and Industrial Production of US are expected in next week, which may impact market sentiments globally.

- Back home there will be several IPO listings on the Dalal Street in the next week.

Stocks that made the news this week:

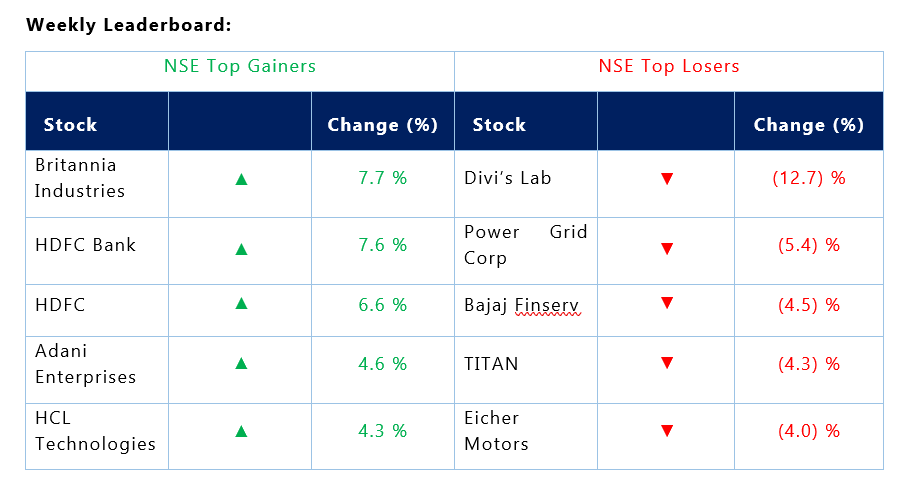

- Britannia Industries which was top gainers for the week reported quarterly results which turned out to be a positive surprise for analysts and investors. Resilient performance was seen by the FMCG maker in the past few quarters. The company also recorded one of the highest revenues ever reported with a growth on 21 percent at Rs. 4,379 crores.

- Eicher Motors registered highest ever quarterly revenue and profits with Q2 profit jumping 76% YoY at Rs 657 crore. The topline and bottom line were majorly in line with analysts’ estimates, but operating performance missed estimates by a slight margin. Motor vehicle major Royal Enfield sold 2.03 lakh motorcycles in September quarter, a robust increase of 64.7% Y-o-Y.

- HDFC And HDFC Bank rallied as global index aggregator MSCI Inc’s modifications to its methodology for considering M&As has removed a major technical overhang on the stocks. HDFC Bank will be considered as an extension of HDFC Ltd post-merger of the two and the foreign headroom requirement will be that of the existing constituents. This would increase the allocation of HDFC Bank sharply in MSCI global index post-merger.

- As estimated by brokerages DCX IPO made stellar debut on the markets. The stock debuted at a premium of 39% at Rs 287 against the issue price of Rs 207. Overall the IPO was subscribed 69.79 times, with the quota for QIBs getting a subscription of 84.32 times, whereas non-institutional investors and retail participants were subscribed 43.97 times and 61.77 times, respectively.