Every asset class has its “season,” and an investor whose portfolio is dynamically aligned with shifting into the asset class is poised to win the most. All asset classes have their designated role ranging from generating alpha to acting as hedges, thus helping the portfolio achieve diversification benefits.

The Multi-Asset fund category, as defined by SEBI, is to have >10% allocation into the three asset classes. It gives the funds the ability to adopt intelligent and tactful asset allocation per market situation to deliver maximum upside potential while arresting downside risks.

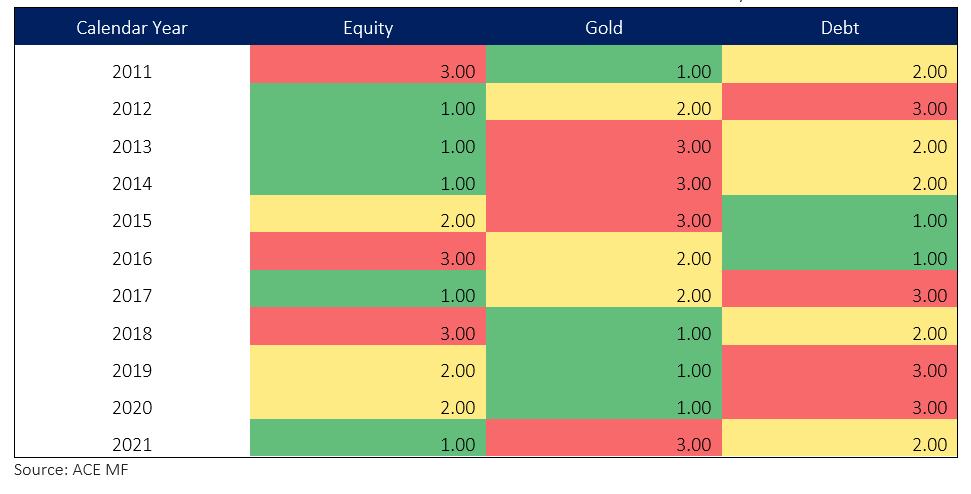

The chart below shows how individual asset classes have ranked across different calendar years.

As seen above, different asset classes perform in other market conditions. One key component to not having asset classes cannibalize the contributions of component classes is to study their co-relation. The lowest possible correlation is suitable for achieving the best possible asset allocations and effective hedging in trying times like today.

As you have understood the importance of asset allocation, let’s try and understand how does an investor should manage it?

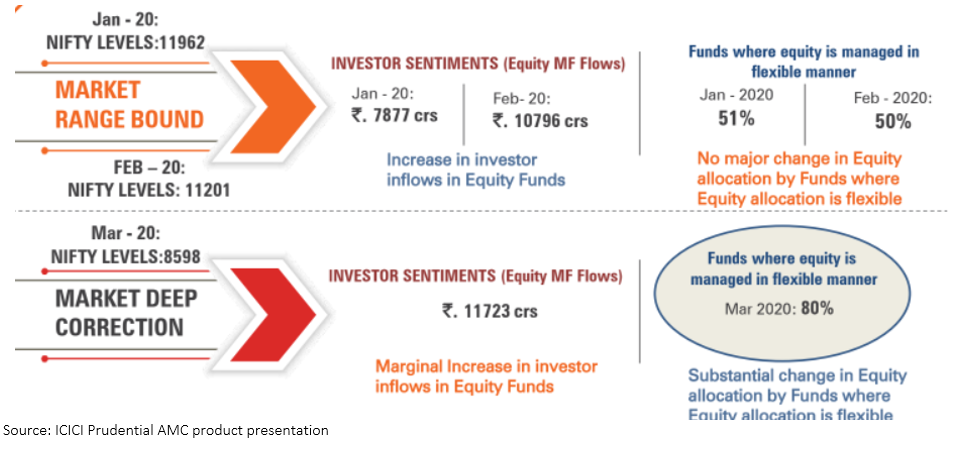

Investor behavior Vs. Institutionally Managed

As seen above, a fund with equity is managed flexibly to drive the allocation successfully across the different market cycles. And hence individual investors should not try to manage the asset allocation actively on their own. Instead, they should opt for multi-asset funds to manage their money efficiently.

Investor Takeaway

Psychologically the human mind is designed to be risk-averse. The pinch of losing almost always trumps the ecstasy of winning.

Multi-asset is an umbrella risk investment, for it acts as a limiter in practice and as Balm to anguish!

You can’t control market volatility, but you can limit its effects on your portfolio. Think of Multi-asset as an antibody for inflated risks. The note has brought forward the inherent risks every asset class carries… Individually. Clubbed together paints a different picture, which is risk-efficient from the get-go.

Whether in books or speeches, proper asset allocation merits a special mention when discussing investing. And Multi-Asset is an outcome of those theories.

Are you already excited to go hunting for your favorite multi-Asset fund? As always, feel free to write to us to share your question with the research desk.

Till next time, wish you a Happy Weekend.