—————————————————————————————————————————————–

Story Outline

- CCI approved the proposed merger of ZEE, and Sony pictures

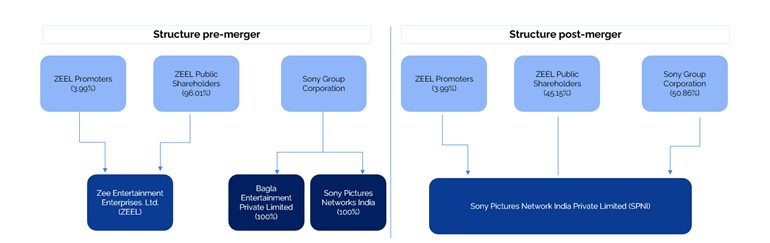

- SPNI (Sony) shareholders will hold a 50.86 per cent stake in the merged entity.

- Punit Goenka, the CEO of ZEE, will lead the merged entity.

- Both companies have a complimentary forte, and synergies are lucrative.

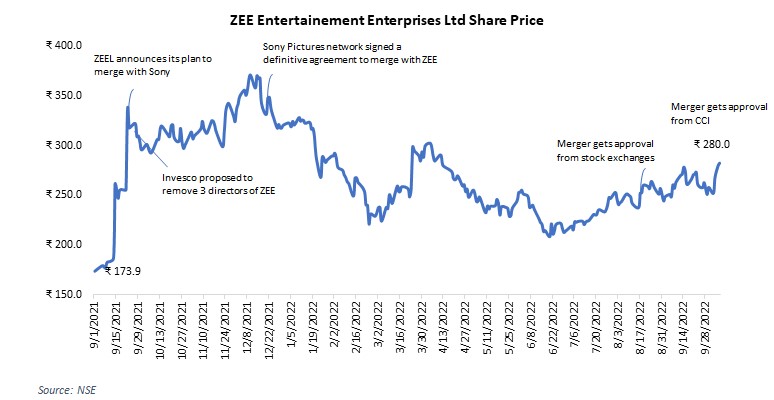

Zee Entertainment Enterprises’ share price rallied by ~10 per cent during the week after the Competition Commission of India approved the proposed merger with Sony. With this, there will be only one final check from shareholders to approve the merger in the shareholder meeting scheduled on October 14th.

Below is the stock performance of ZEE so far post the merger announcement:

What circumstances led to the merger?

Zee Entertainment is inter-alia engaged in TV content development, broadcasting regional and international entertainment on satellite television channels, movies, music, and digital business. The Company is among India’s most extensive entertainment networks.

Sony is engaged in creating, owning, operating, programming, providing, transmitting, distributing, and promoting linear and non-linear, non-news program services, including sports program services, delivered by any means primarily to viewers in India and the Indian diaspora globally. They are also involved in the production, exhibition, broadcast, rebroadcast, transmission, re-transmission or other exploitation of non-news audio-visual content, including sports content, in any format or language spoken in India (including English) for exploitation of such program services.

Until 2017, the Sony Network had the broadcast rights to the country’s marquee cricket tournament Indian Premier League. From FY15 to FY18, Sony’s revenue almost doubled from ~Rs. 3,300 crores to ~Rs. 6,300 crores and the net profit jumped by six times. But as Star & Disney India took over the IPL broadcasting rights in September 2017, Sony’s revenues stagnated while impacting the net profit negatively.

ZEE had struggled with its continuous decline in promoter stake. It has declined from 43.05 per cent in December 2015 to 3.99 per cent.

The Deal Synergies

With combined revenues of both entities at $1.79 bn, the merged entity would be the second largest entertainment network after Disney & Star India, with an approximate revenue of $1.8 bn. Another critical factor is that the merged entity will have 75 channels and a strong presence in sports, entertainment and regional markets.

Below is a summary of synergies for both companies:

| Genre | Zee Entertainment | Sony Pictures Networks India | Total |

| Hindi GEC |

6 |

5 |

11 |

| Hindi Movies |

9 |

4 |

13 |

|

Sports |

– |

10 |

10 |

| Regional |

25 |

2 |

27 |

|

English |

9 | 4 |

13 |

| Kids |

– |

1 |

1 |

| Total number of channels |

49 |

26 |

75 |

| Overall all India market share |

17% |

10% |

– |

| OTT Platforms |

ZEE5 |

SonyLIV |

– |

- The merged entity allows both players to fill in white spaces in their respective segments.

- Sony has a negligible presence in regional channels, whereas ZEE has impressive organic growth in the Bengali, Marathi, or South Indian language space. Similarly, ZEE Entertainment Enterprises has zero presence in the sports segment, especially in the cricket segment. The combination will help ZEE-Sony to emerge as a dominant player in Hindi, GEC, Hindi Movie English entertainment and Marathi genres.

- Within the film content space, the merger will help synergies quite neatly. ZEE has aggressively invested in films in its OTT, TV and music business. At the same time, Sony has not been aggressive in producing regional language films but has a robust suite of international movies that can be distributed in India.

Below is the structure of the organisation pre and post-merger.

Way Forward:

As per Punit Goenka, MD & CEO of ZEE Entertainment Enterprises, the merger will bring in 6-8% synergies in cost reduction. With the $1.57 bn cash coming into the company, this could mean the further scope of M&A opportunities within the digital space and help in premium bidding for content like sports.

The merged entity is set to capture a significant foothold and receive strong ad spending from industries as it would have a much broader reach. The merged entity would also have a competent and experienced board that knows the business well. We think that the deal is a win-win situation for shareholders, minority shareholders, and promoters.

Markets This Week

|

03rd October 2022 (Open) |

07th October 2022 (Close) |

%Change |

|

|

Nifty 50 |

17,102 | 17,315 |

1.24% |

| Sensex |

57,404 |

58,191 |

1.37% |

- Markets ended the week on a positive note.

- During the week the INR touched a fresh low of 82.42.

- On the BSE, the Metal index rose 5.7 percent, BSE Capital Goods index is up 3.6 percent & Realty index gained 3.4 percent. On the other hand, FMCG index declined by 1 percent.

- Foreign institutional investors sold equity shares worth Rs. 36.55 crores whereas DIIs bought Rs. 1,024 crore worth of equity shares.

- The World Bank forecasted a growth rate of 6.5% for the Indian economy for the fiscal year 2022-23, a drop of one percent from its previous projections in June 2022, noting deterioration in global environment.

Weekly Leaderboard

Stocks that made the news for the week of 03rd Oct 2022

- Most businesses of Titan Ltd witnessed double-digit growth with overall sales growing 18% year on year (YoY). The company continued to strengthen its retail network by adding 105 stores (net) for the quarter. Flagship jewelry business division of the company grew 18% YoY. The base of Q2 FY22 had elements of pent-up demand and spillover purchases of a Covid-19 pandemic disruption in Q1 FY22.

- Coal India’s production went up to 299.0mn tonne until September FY23. This was much higher vs 249.8mn tonne for the same period in FY22. The company has been shoring up supplies to 332.2mn tonne and the growth in total offtake over April-September FY23 was 8%.

- Eicher Motors slipped during the week amid profit booking after the company reported volume growth of 17.1 percent m-o-m. Despite heavy fall the stock has outperformed the BSE Sensex by a huge margin on an year to day basis.

- ONGC has been rising in the past few sessions as gas prices are on the rise. As per analysts every $1 rise in gas prices is expected to lift ONGC’s standalone EBITDA (earnings before interest, tax, depreciation and amortization) by 4 per cent, respectively.