Diwali is one of the biggest festivals celebrated with great enjoyment and enthusiasm across the nation. On this occasion, people celebrate the return of Lord Rama after a victorious battle against the Lanka ruler Ravana. This Diwali is a little different as it here with a bang! With cases falling, people are out to shop with a vengeance.

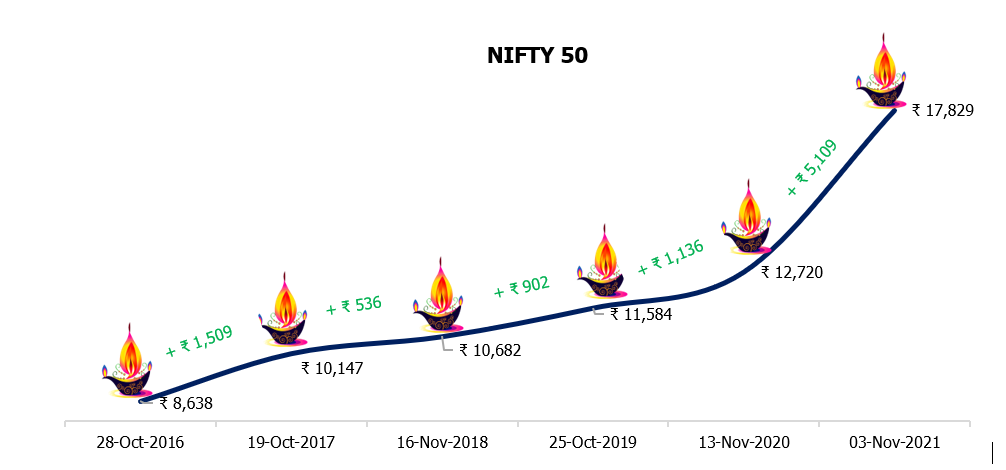

Here’s a look at how Nifty has performed in the last 5 Diwali’s:

The majority of us end up purchasing things impulsively and may never even use those. E-commerce platforms like Amazon India and Flipkart have got $2.7 billion in the first four days of the festive season starting on October 2, 2021, as per estimates quoted by Redseer Consulting. Flipkart, the e-commerce major, has echoed that the total premium smartphone sold during this year’s sale doubled compared to last year. They also indicated that 55% were new sellers added, with almost 10% of overall sellers on its platform witnessing three-fold growth in sales this year.

A significant reason for impulsive buying is raining discounts, cashback offers, and other offers. And we all agree that it is not easy to resist indulgence in shopping amid easy access to credit cards, buy now and pay later schemes, and plenty of liquidity in various forms as interest rates remain historic lows.

Another critical factor here is to note that many of us look forward to during the festival season is the Diwali bonus. We plan many things around this windfall that get credited to your account once a year. Although it’s a bonus for all the hard work you have done during the year, you spend this money cognizant fashion. When you splurge on things, it can lead to overspending, which inevitably leads to a debt trap.

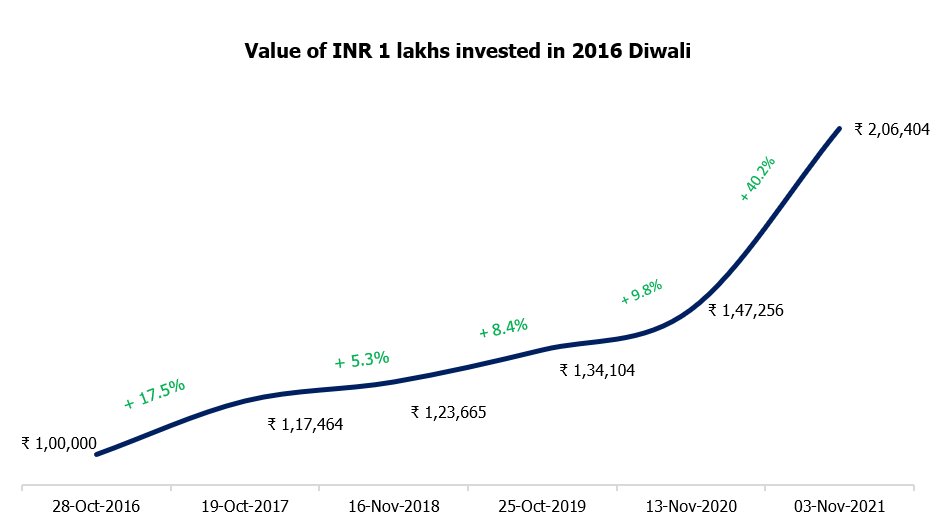

Below is the table reflecting how much you could have earned if you invested INR 1 lakhs in 2016 Diwali.

Investment of INR 1 lakhs in 2016 has become 2x in between last 5 Diwalis, and if an investor had invested at any Diwali in the last five years, he would have never faced losses; however, not a case always but the probability of getting negative returns in 5 years is almost zero.

Here are a few things which you can follow to make this Diwali even more smart:

- Plan your spending’s: To begin with make a pamper plan for yourself. List down all the spends that you want to have for the year. Try to split the spending across various periods. In this manner you can have the satisfaction of pampering yourself throughout the year. For every spending you do above the budgeted value, invest the same amount for one of your goals.

- Be careful with ‘Buy now, pay later’ schemes: ‘Buy now, pay later’ is kind of personal loan given by companies especially fintech’s. Majority of ‘Buy now, pay later’ schemes proved an interest free period of 14-15 days to make the repayment on purchased products however the EMI option in these cases comes with an interest expense. Some major e-commerce platforms charges late fees which can go up to INR 600 in case you do not pay your dues on time.

Retailers and e-commerce companies also offer zero cost EMIs on purchasing electronics and multiple other products. The no cost EMI might seem to be a good deal as it helps to manage your cash flows, but they may not always be cost efficient. There may be a additional processing fee which might actually increase your total cost of product.

- Avoid investing in trending investment products: Cryptos or NFTs are one of the trending products and investors tend to get attracted to such products looking at their historical returns. Investors need to understand that these products are unregulated, and they do not really know how these products work. While NFTs and collectible can be hard to value, and gains seen recently may not mean that this will sustain in the future.

- Use SIP for Festive season expenses: Mutual funds can be one of the most sought asset class as they help to rebuild wealth in a disciplined manner. You can easily create a kitty out of your SIPs for discretionary spending during Diwali.

Thank You.