Some industry veterans are naming LIC IPO as India’s Aramco moment, similar to Gulf oil behemoth Saudi Aramco’s $29.4 billion listing in 2019, one of the world’s largest! Just how big is LIC from the Indian context? Let’s dive deep into the picture and understand the impact and changes it could bring to the Indian stock market or any other industry?

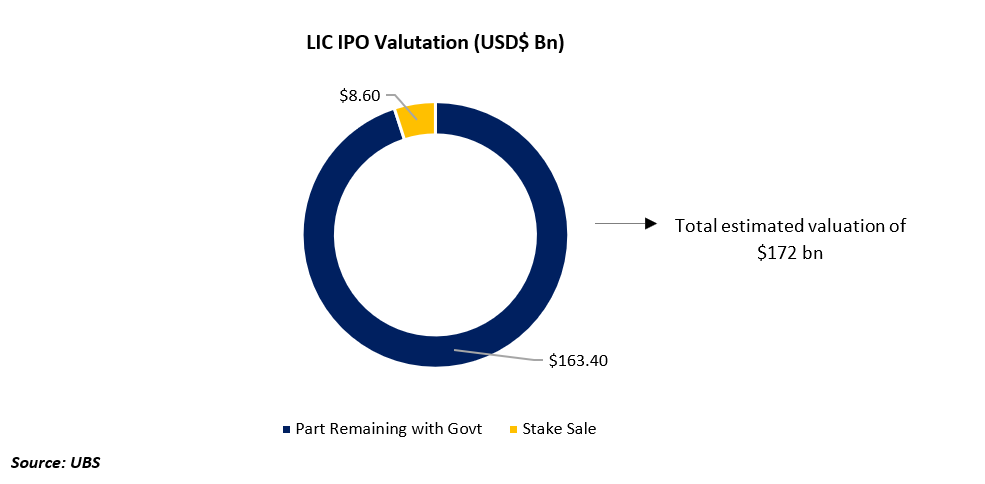

Size of LIC Valuation

At this estimated valuation, LIC would be the third-largest stock in India by market cap, ensuring an entry into the Nifty 50 basket.

The year 2021 saw a record capital raising of $34 bn in the Indian stock market. It raised almost 50% through the IPOs at $16 bn. And the government is expecting – 25% of total capital introduced in 2021, which comes at ~$8.5 bn.

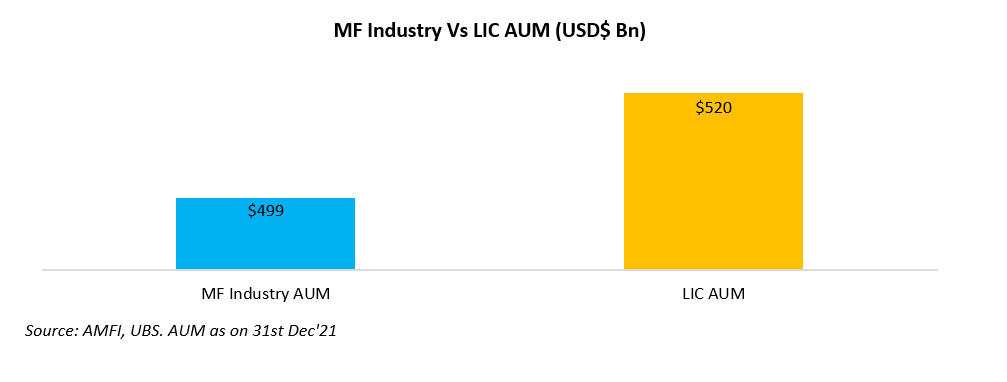

Size of AUM

LIC has a higher total AUM share than the MF industry and is among the largest institutional investors in terms of equity AUM. With this, LIC has about a 4% stake in Indian equities.

Another crucial data suggests that LIC has a disproportionately higher share in SOEs or State-Owned Enterprises. As the name suggests, state-owned enterprises are bodies formed by the government to perform business activities. LIC has maintained a stake in the range of 8-9% in SoEs over the last 5-6 years.

Other than SoE stock ownership, LIC is a crucial entity for the government in many ways. LIC is also the owner of 19% of all government-issued bonds, making it a more significant player than the Reserve Bank of India in India’s bond market. Post listing LIC will have the highest share in the listed equity universe of the Indian government. It is significant regarding the government’s fiscal deficit and future divestments.

With a gist of the size of the LIC IPO and its importance to the Indian economy, the question arises of how investors can participate in this IPO sensibly.

Around half the issue will be reserved for non-institutional investors and retail. As per SEBI listing guidelines, the government will have to mandatorily dilute its LIC stake to allow public shareholding of 10% within two years and 25% within five years, ensuring constant supply.

However, given several headwinds through global markets, this might not be the best time to bring an IPO. The success of an IPO will depend on investor sentiments.

Mutual funds can be one of the ideal ways to participate in LIC IPO, as it owns 60 percent market share instead of individual players with 10 percent or 11 percent market share.

Mutual funds are keeping aside cash components to invest in LIC IPO. Some industry executives believe that a few large-cap and Flexi cap funds might park their fresh flows expected to get in the days to come until the IPO. A few funds may also opt to liquidate some of the positions in already listed insurance players and redirect or replace them with a new, more prominent player.

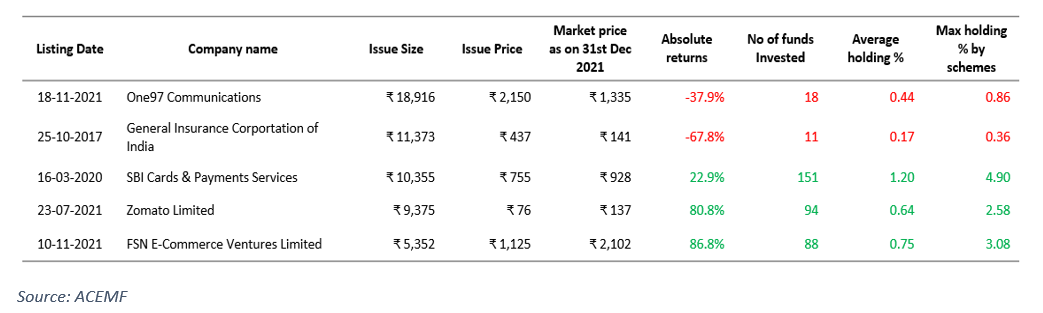

Below is an example for of how mutual funds have smartly assess the IPOs before investing into it:

Therefore, an investor does not need to worry as the mutual funds or fund managers are already taking an active call on the same and managing the allocation as and when required.