Current mindset of investors is that most of them chase returns and invest accordingly to make good returns. What needs to be understood is that returns are a by-product of a right investment strategy and managing your portfolio efficiently to get the best out of it.

From a long-term investor perspective, one needs to review his/her portfolio performance periodically. It is significant to understand whether the portfolio is in line with your desired goals or not. Given the importance of this exercise investors often don’t consider this of relevance or find it tricky to handle various aspects relating to measuring the performance of funds in their portfolios. As a result, many investors make mistakes by either tweaking their portfolio in a hurry based on some random news event or remain invested for years in hope of an improved performance from funds performing poorly.

Then there is a unique set of investors who get into habit of tracking fund NAVs every day and hence find it extremely difficult to handle the impact of market volatility and their portfolios. Although reviewing portfolio is significant for meeting your financial goals, the key is to measure portfolio performance and understand the reason for non-performance. As an investor you need to differentiate good performing funds and non-performing funds. Remember, during a downfall, even the best of the asset managers can’t keep your portfolio in green in short-term.

If downfall in a funds NAV is lesser than that of its benchmark or category, means the fund has outperformed both. Just a reminder reviewing fund performance in an arbitrary manner can force you to make decisions that could have a negative impact on your portfolio in the long run. Hence, there should be a right process to do so and below are some of the guidelines that can help you review your portfolio rationally:

- Stick To Your Goals: One must analyse portfolio performance keeping in mind your financial goals. If the portfolio is on track with your asset allocation and there is enough clarity on time horizon for each of the financial goals, there is no need to panic.

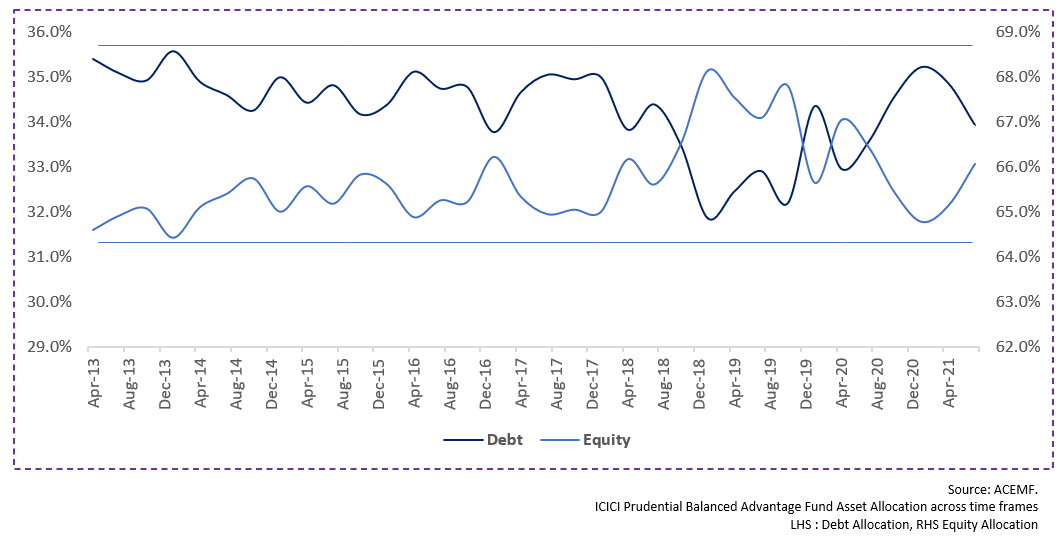

- Rebalancing: While the stock market tends to be volatile from in the short run, different market caps i.e., large caps, mid-caps and small caps also perform differently at different times. As the ebb and flow goes in favour of a particular asset class, the performance of that asset class improves dramatically. Therefore, making changes in the portfolio every now and then based on short term performance of a particular asset class or segment can backfire in the long run. The key is to focus on your asset allocation per your risk-taking ability and willingness.

Asset Allocation: Equity 70%: Debt: 30%

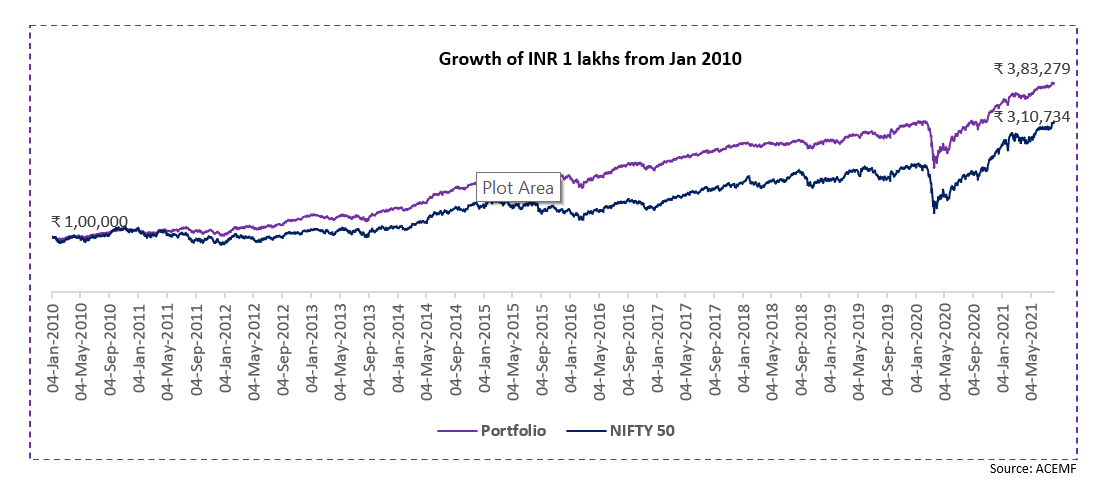

Balanced Portfolio vs Nifty50 Performance

A balanced portfolio performed way better than Nifty 50 indices. And hence managing your portfolio per asset allocation helps enhance performance over the course of investment horizon

The key to managing your portfolio is to have a strategy that you adhere to in a disciplined fashion. Achieving your long-term goals requires balance of risk and reward. Choosing the right mix of investments and then periodically rebalancing and monitoring your choices can make a big difference in your outcome.