“Abnormal times make for abnormal markets” is a phrase we can use in describing the latest developments in Indian equities. This is particularly evident in the crowning of BSE benchmark index as the eighth largest index of the world….amid a new variant of a much familiar-to-all Covid-19 virus.

However, the current market volatility has fueled worries about it being “investor-friendly”. Many patrons have requested addressal of these mostly “loud” woes, and share a permanent solution to today and tomorrow’s temporary problems.

Diving head-first, we assure you that you need not worry about the count or intensity of crashes, as every crash is followed naturally by a rise. The markets are no different and in fact often used as a fitting example to explain this phenomenon.

As reference, if you study the last ~5,300 trading days, you’ll notice that Indian bourses have borne the brunt of many a crisis/disruption (global and domestic) in Dot-come bubble, SARS, Global financial crash, Demonetization, GST and Covid-19. In spite of all the bumps, markets have observed a minimum of 3% fall only 5% of the time. This helps instill belief in market’s resilience over the long-run while parallelly advocating investors to remain tone-deaf to frequency-agnostic turbulences.

A key observation in studying market trajectory since inception showed that falls were blessings in disguise for those putting in fresh monies when fear was tickling all investing senses. The approach here resonates Mr. Buffett’s widely applauded, but rarely practiced wisdom in being greedy when others are fearful.

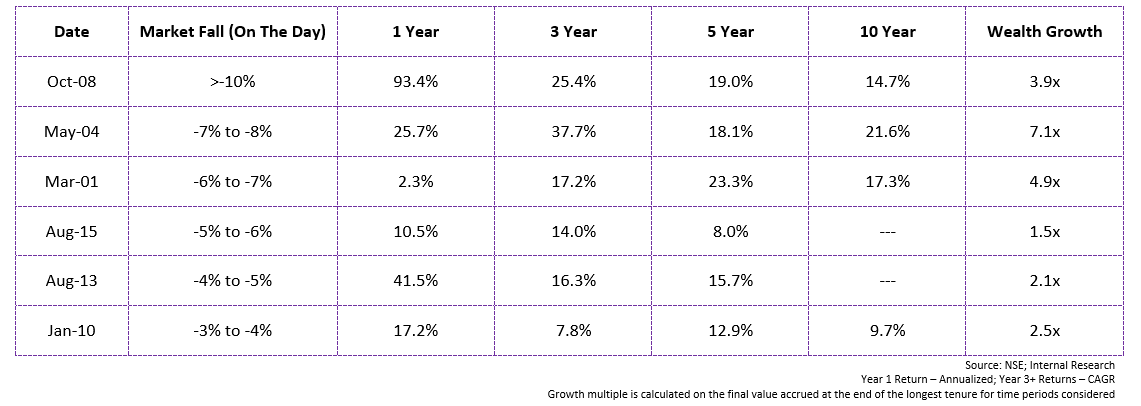

The table below highlights the returns realized by investors (across tenures) who capitalized on the breaking of markets by investing more on said days:

The table above brings forth two key observations:

The table above brings forth two key observations:

- Wealth is created in the long-run irrespective of the quantum of market fall (table shows 3% fall and more) on the daily as is reflected by the wealth multiple. The only losers are those who stayed away due to participative fears.

- Investing is a timeless activity (table covers time-variate starting points), offering pockets of return amplifiers, which are more-often than-not disguised as market falls. This observation summarizes Mr. Munger’s words in Success coming to those who are very patient most of the time, and aggressive when it’s the right

On a longer time-frame it is evident that markets, for the better, carry an upwards rising trend.

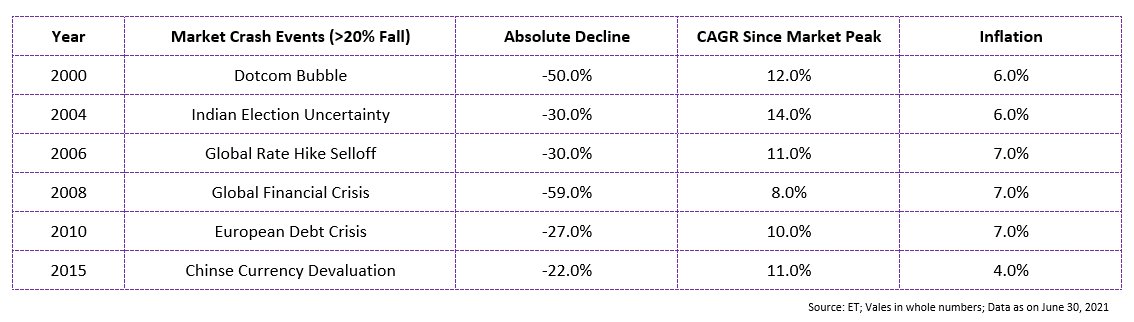

To add further merit to an investor’s most common mistake and market’s most common learning, here is how your investments would have fared had you put in money at the eve of some of market’s biggest falls:

Like in times of prior crisis, and as is this time as well, markets out-shone the virus in the across horizons even after having being deemed “infected”.

There is a funny saying which is phrased as, “Each time history repeats itself, the price goes up”. Many questioned the learnings this phrase stood to serve, or rather did, till covid and aforementioned table happened. After looking into all the facts and figures, this phrase captures all of market’s offerings and participant’s hesitancies, only to help the latter re-learn the golden rule in staying invested. And if you have the vantage, then you can see the advantage!

As vaccination drive takes centerstage globally, Covid will soon become a feature in the history books and markets will gear up to fight newer tensions. As an example, an investor who invested on the eve of this millennium and did nothing in the interim, would today realize an XIRR of 11%, or wealth growth of 9x! Mr. Buffett was right indeed when he referred to markets as a “device of transferring money from the impatient to the patient.”

In conclusion, feel free to view markets through any lens, across any time period, and see for yourself who comes out as the winner. As a pro-tip, if you want it to be you, then begin investing.