Hot Stuff this week: Hospitality sector sees robust growth in key metrics

The hospitality sector in India continued to post strong quarterly numbers. Shrugging off the lull of pandemic times, and end of international travel restrictions, pent-up demand for leisure travel and resumption of work from office bode well for the sector. Hotel room demand across key cities remained robust, primarily driven by conferences, incentives, meetings and other business-related travel.

Let us dive deeper on how revival in broad parameters mentioned above have impacted the overall hospitality sector. Below are a few numbers to understand the trends in hospitality sector:

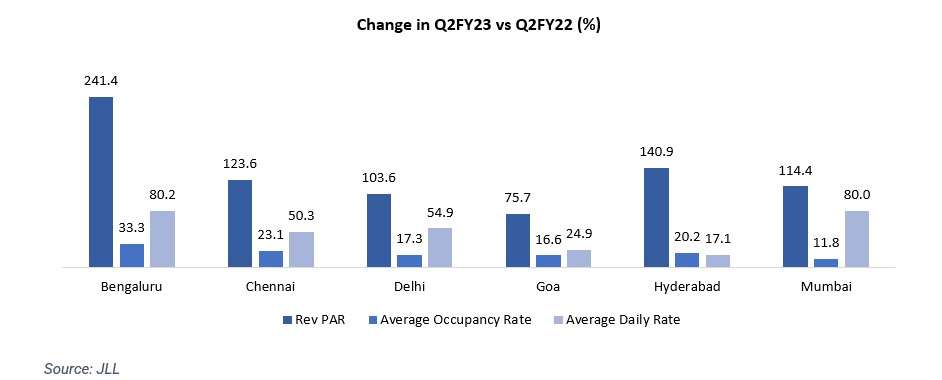

Revenue per available room is a key metrics to gauge the growth in hospitality industry and have shown robust recovery across cities. Overall occupancy levels were above 70 percent. The sector also witnessed strong growth in average daily rate.

Here are key developments that have happened in the hospitality sector:

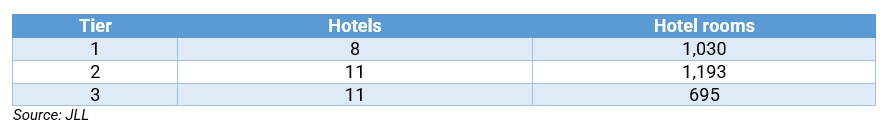

Increase in share of international hotel chains: The table below reflects growth of international hotel chains in India.

International chains have been aggressively expanding in India since 2002. This expansion of international hotel chains is driven by asset light model where they only manage hotels. Whereas Indian hotel chains are more focused on owning and operating. International hotel companies are dominators in luxury hotel space. However local hotel players have started adopting franchise and management contract models as a growth model that is giving them a strong competitive advantage over international hotel chains.

Demand is set to outpace supply: Leaving behind pandemic blues, hoteliers are now more focused on expansion in 2022. Based on research done by hospitality consultancy Hotelivate, about 59,000 rooms are set to hit the market in the next fiver years. Out of this 72 percent that is 35,000 rooms are currently under active development. The active development ratio has gone up by 10 percent as compared to pandemic year 2020.

It is estimated that currently there are about 1.5 lakh hotel rooms, in addition there is a projected supply of 35,000 coming (which is being actively developed) in next 5 years, 7,000 rooms are set to hit the market every year, that comes to around 4.5 percent growth in supply. This indicates that demand is certainly set to outpace supply in the upcoming years.

Here is a breakup of Branded Hotel opening in Q2FY23:

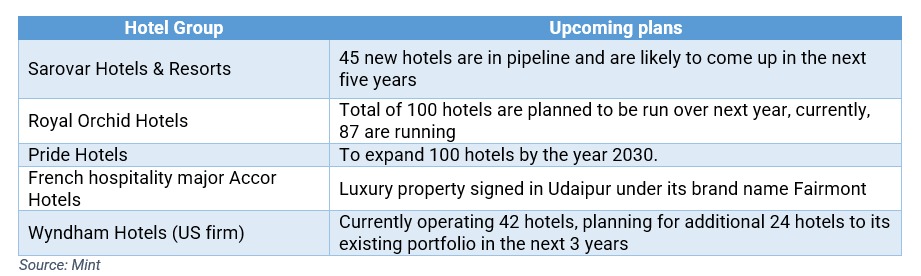

Expansion plans announced by domestic and international hotel chains:

Government Initiatives: The government of India in the past few years have undertaken many initiatives to provide enough impetus on tourism industry. This was done by launching cleanliness drive, providing better air connectivity and overall improvement in hospitality sector. In terms of medical tourism India is the third largest destination in the world.

As a result of governments continued attention to the medical tourism sector, it has grown by 350 percent since 2014. The total revenue from this industry climbed to Rs. 2.1 lakh crore in the year 2019, as compared to Rs. 1.23 lakh crore in 2014.

The government had also announced initiative of e-Visa in 2014 for citizens of 44 countries in order to make the current process smoother for foreign tourists’ arrival in India. This facility has now been expanded to 165 countries.

Hence more and more tourist arrival in India given its rich culture and heritage sites there will be a direct impact on Tier I and Tier II cities hotel industry.

Domestic demand set to rise: Hotels and resorts in India are all set for the upcoming demand from the big fat Indian wedding season. As many as 2.5 million marriages are lined up from 2nd half of November month that stretches all the way to April 2023. With no restriction on count of guests hotels of all formats and sizes are running at their optimal capacity and rates. Most hotel chains are seeing rise in number of weddings that they are likely to host this season, and the numbers are set to surpass the pre covid peak of 2019-2020.

Key take ways: The Indian hospitality sector has been prime contributor to GDP growth of India. Hence, we expect the sector has massive potential for growth in upcoming years. Investors should stagger their investments to make the most of their investment in the long run. However, one should focus more on their risk profile and time horizon and consult a financial advisor before taking any investment decision.

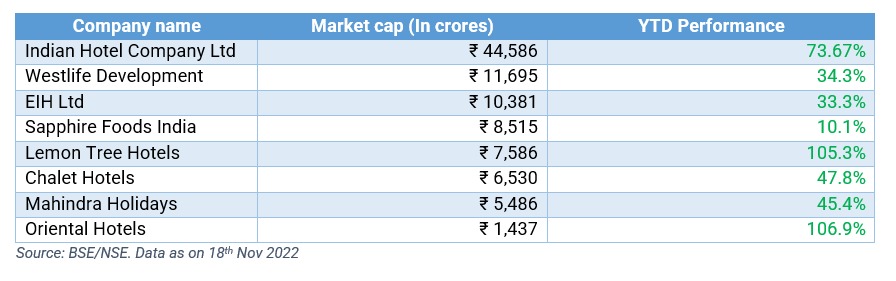

Below is brief summary of performance of hotel stocks:

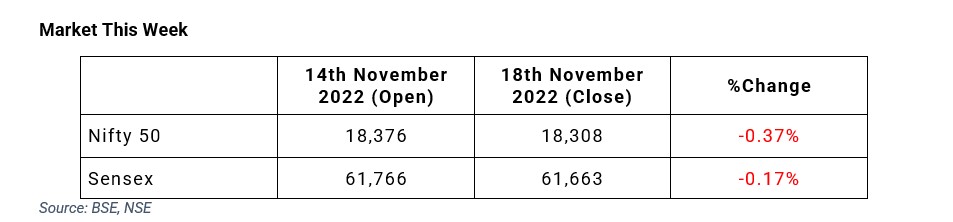

Market This Week

- Markets ended on a negative note.

- Among sectors Nifty PSU Bank and Nifty Bank added 2.3 percent and 0.7 percent. Nifty Media and Nifty Auto were on the backseat with a decline of 5.3 percent and 2 percent.

- At the beginning of this week Nifty 50 witnessed volatility as profit booking continued near 18,400 levels

- Foreign investors bought shares worth Rs. 349 crores while DII’s bought shares worth Rs. 2,275 crores.

- Global markets were in positive mood on expectations that Fed will scale back its aggressive rate hikes as US inflation data eased. However, the optimism was thrashed by better retails sales data from US and aggressive remarks from Federal Reserve authorities.

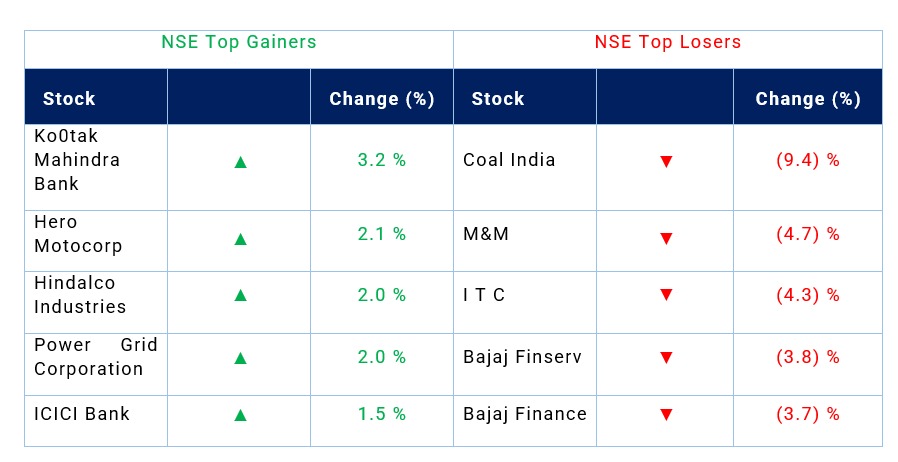

Weekly Leaderboard:

Stocks that made the news this week:

- Large institutional investors who were early investors in Delhivery are sitting on huge profits as company’s pre IPO lock-in period is about to end. Next week key institutional investors like Canada Pension Plan Board, Tiger Global, Nexus Partners, Softbank, Fedex and Times Internet ae some prominent names who are eligible to sell stake.

- PB Fintech stock price rallied during the week as foreign brokerage renewed their expectation. Management guidance of Rs. 1,000 crore by FY27 boosts optimism in a loss making startup environment.

- Nykaa, stocks witnessed two major block deals on Friday as 1.9 percent stake in the company changed hands. Ever since the pre-IPO lock-in period ended stake holders have been offloading from their kitty. Lighthouse India, Noratam S Sekhsaria and Mala Gaonkar have been some prominent HNI investors who sold their stake completely.