The Indian stock markets are back to a losing streak on December 17th after a day’s break. Concerns over global cues post the big event of Fed policy, Bank of England raising interest rates, and decisive action in primary markets are putting pressure on the secondary markets. The absence of any positive triggers has left FIIs on a selling spree along with inflation worries in crucial developed economies. In this scenario where investors are looking for alternatives to reduce volatility in their portfolios Dynamic Asset allocation category can be a great choice.

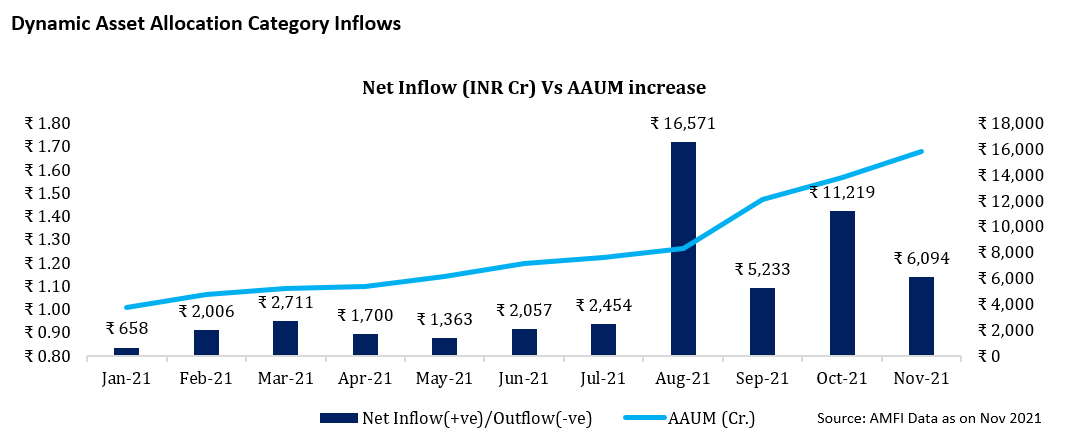

Dynamic asset allocation also known as Balanced advantage funds (BAF) funds have caught investors’ attention in the past year. So far in the calendar year 2021, the category has managed to accumulate INR ~52,000 crores worth of inflows, and the category AUM as of Nov 2021 has been up by ~68 percent since Jan 2021. Another gauge for this category’s attractiveness can be seen in response to NFOs launched within this segment. SBI Balanced Advantage, which was launched in Aug 2021, has mobilized INR 14,500 crore to become the third-largest fund in the category before even starting its operations. The fund has received the highest AUM within equity-oriented space in the history of the Indian mutual fund industry.

By SEBI definition, dynamic asset allocation funds do not have any restrictions on minimum allocation to equity or debt. These funds truly follow the ‘go-anywhere strategy and theoretically a mixture of Flexi cap funds on the equity side and dynamic bond fund on the debt side.

Here’s what makes Dynamic asset allocation funds the best choice for market volatility and uncertainty around the future course of action.

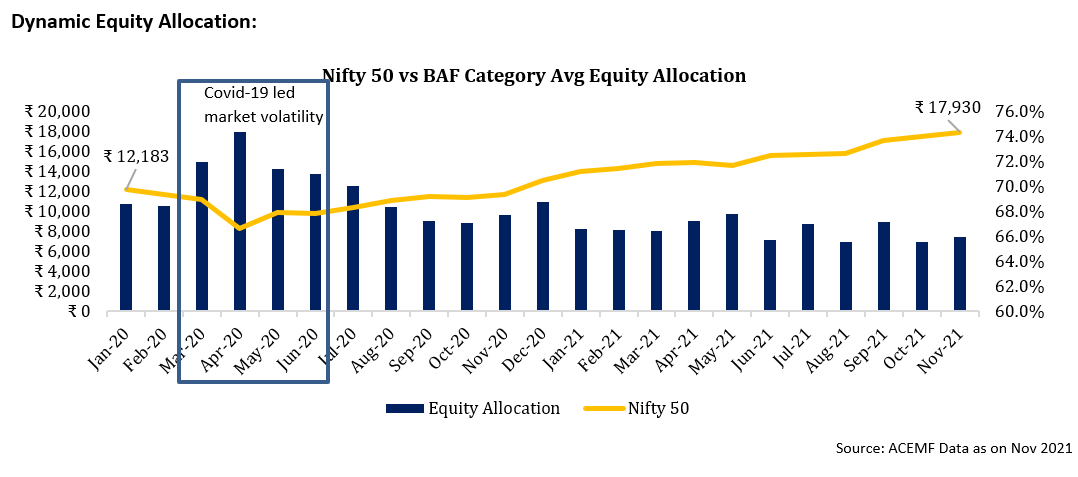

An interesting thing to notice in the above chart is barring a few instances where there have been drastic asset allocation changes. The equity allocation has been maintained within a specific range. It gives investors a clear perspective on the funds’ allocation during a bull run rally and a bear rally. Funds with consistent higher equity allocation will continue to outperform during the upmarket and vice versa.

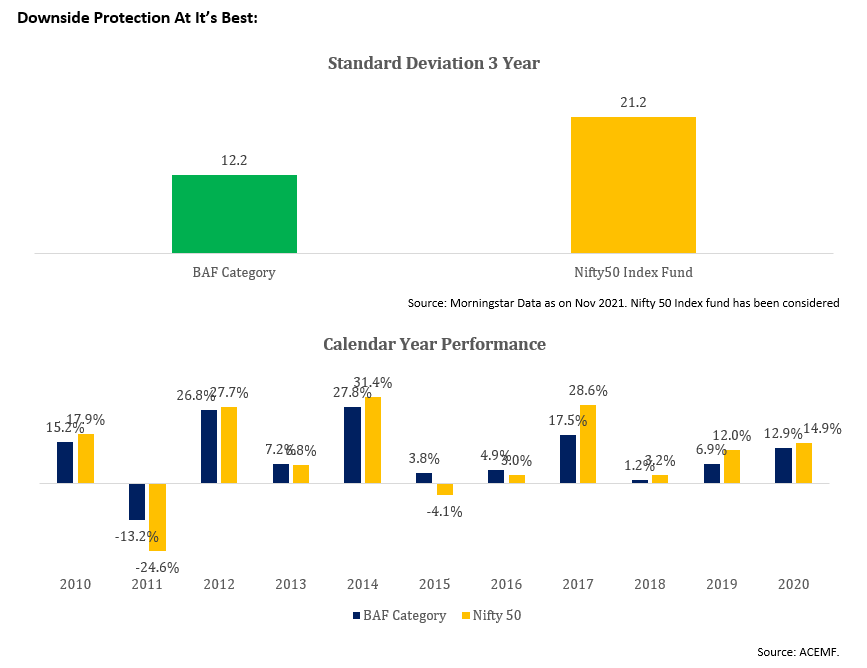

Although returns are a critical aspect when investing, investors also need to be concerned about volatility. Financial markets worldwide will remain volatile, not just because of Covid-19 but several other factors exist. Along with this, the BAF category maintains about 65% (using derivatives) allocation towards equities; equity taxation will be applicable.

Investor Takeaways:

Given the dynamic nature of equity markets, investing in one asset class and selling when the time is right might not be an easy task for retail investors. Hence this is where the dynamic asset allocation category steps in. A dynamic asset allocation fund is best suited for investors who don’t want to interfere with their investment too much or are new to markets and have limited know-how for capital markets in general. Even if you are a savvy investor, you can allocate some proportion to dynamic asset allocation to balance other risky investments.

Happy investing!