The difference between successful investors and others lies in asking “How to invest?” and “How to invest right?”. In a place where there are more inferences than information, we all know for certain that no asset class performs all the time, but one asset class performs all the time. So, logic dictates that you should have exposure to all asset classes. How you ask? Through Diversification.

When talking of investing, there is no denying the benefits diversification brings to the table. However, English being a funny language opens doors for misconceptions about how to read into this widely merited concept.

In essence, diversification is spreading your investments across different types of funds to limit risks arising from any particular constituent. The key word used here is Different. More often than not, it is confused and substituted with More.

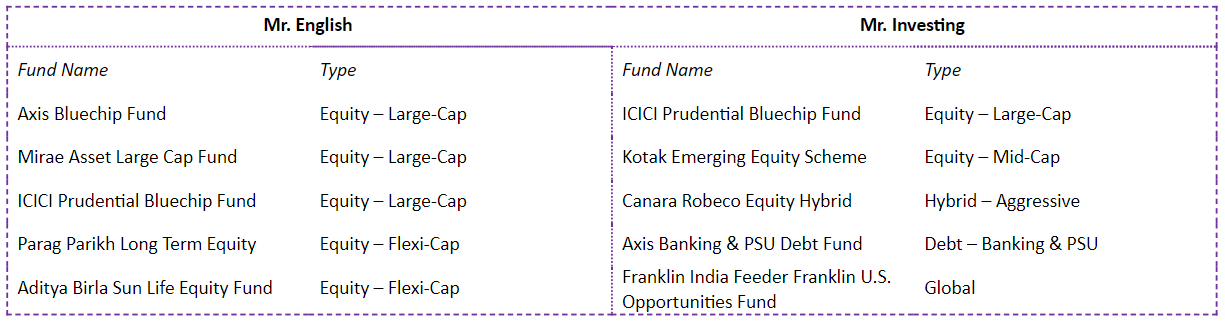

As a test, table below highlights 2 portfolios, each with 5 constituents. Let us see which more diversified:

Mr. English’s portfolio is a classic case for a portfolio being conceived as diversified but in reality is far from it. Three out of five funds in portfolio belong to same category, thus limiting his investing universe and becoming subject to heavy composition overlap.

Mr. Investing’s portfolio represents successful diversification, as investments are spread across multiple counts in geography, asset class, and categories.

The above table highlights how it is not the count of funds, but their nature/type which helps portfolio avail the benefits of diversification. A few other ways in which the principle of diversification can be compromised is as follows:

- When top holdings wear excessive contributing weights in a portfolio

Ex: Top three funds in a ten fund portfolio make up 75% of the portfolio

- When portfolio holdings cannot enjoy correlation benefits

Ex: Poor correlation will have funds behave in similar manner across situations, thus eliminating purpose of spread investments

- When fund count is very high, thus limiting constituent funds’ risk-return potential

In a twenty fund portfolio of equal weights, a 100% run-up in one fund will contribute only 5% to total return for said period

Diversification is a tricky necessity for successful investing, one which in principle is easy, but in practice is an equal opposite. Can a concept as applauded as diversification faulter to “too much of a good thing becoming a bad thing”? Maybe. Maybe not.

The results will always wary on a case-to-case basis, with the advocates of this principle echoing, “Don’t hate the game, hate the player.”

Now, perplexingly, the opposite of diversification would equal to you “putting all your eggs in one basket”. Changing perspectives, the same can also be read as the investor diversifying his holdings across one fund.

A practice of this nature comes with its own set of faults, but we leave that discussion for another day (write to us if you wish to see our next blog on concentrated approach and the faults in its stars!)

Let’s get back to addressing the challenges in getting diversification right and how investors can mould their approach to minimize the opportunity costs of fund selections in their portfolios. We do this by lime-lighting the three key datapoints

The Return Reckoner

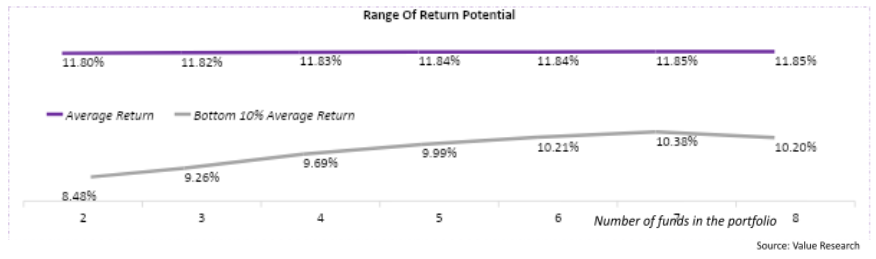

Investing is global an activity as it’s a harmonious one, as all who approach it do it with the sole intention of growing wealth. Hence, in order to address impact of diversification on a portfolio’s return potential we conducted stress-tests across portfolios with different number of holdings. The graph below presents our findings:

Portfolios with higher fund counts have delivered an alpha of only 0.05% over funds with lower counts. With probability of going wrong with fund selection being higher in portfolio with more funds, the risks-reward ratio is skewed. And they aren’t in the investor’s favor.

The Virus In Volatility

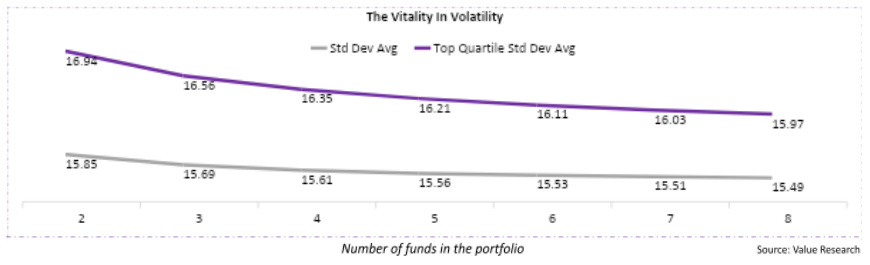

A key reason for adding more funds is to arrest the ability of a fund to shake the portfolio’s figures, thus injecting stability In portfolio’s path of growth. The markets of yesteryear are a sane example of when things go insane! With volatility still as relevant today, let us see how portfolios with more vs lesser funds navigated their way through this unavoidable market element:

In giving credits where due, the inclusion of more funds does lower the susceptibility of portfolio to external elements. The eye for finer details shows it does by a very small margin of ~36 bps.

More so, the benefit of higher fund count to comfort portfolio shocks tapers significantly after the addition of the fifth fund to the portfolio. Thus, again stressing on diversification not equating to more exposure to more funds.

The Stock Story

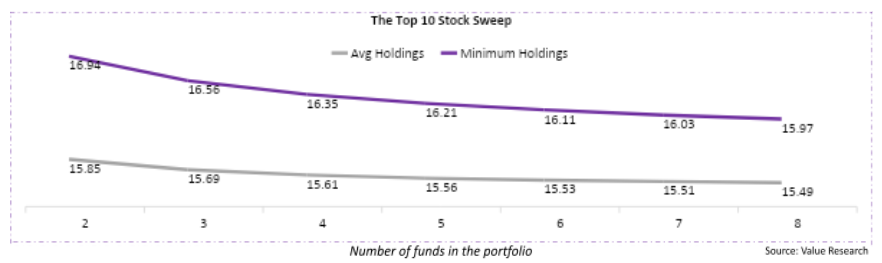

A benefit of adding more stocks to portfolio should mean investors getting wider exposure to the basket of Indian equities. In fact, mutual Funds cover the top ~1,500 companies, accounting for ~30% of total investable Indian market universe. But, this is most often not the case. The graph below presents our findings:

The addition of new funds sees top 10 concentration reducing by only 3% indicating limited addition of new stock exposure for investor.

Another challenge lies in assigning every stock a meaningful weight, so it can justify its quality via effective quantity. However, even a portfolio of only eight funds fails to deliver on this end, by having 170 of the 217 total stocks wear less than 0.5% of portfolio AUM.

So the risk of having extra funds does not print a favorable return pattern for the investors.

Investor Takeaway

The longevity in diversification being recognized as “chicken that lays the gold eggs” in investing parlance, highlights the need for every investor to practice this principle the right manner.

The skill in applying diversification is the difference between successful and novice investors. The skill in applying diversification rightly is the difference between a very successful and successful investor.

Worried about your portfolio being over or under diversified? Well write to us and let’s getting chatting and charting the right road-map for you, so you maximise your upside and minimize your downside

Eagerly waiting to hear from you

Till next time, wish you a happy weekend