As the third wave of the Covid 19 pandemic, the emergence of the Omicron variant, sweeps the country, the Finance Minister has to present a budget in a completely unpredictable environment.

While the latest data reflects inflation rose by 5.59 percent in December 2021, against that, the growth in industrial output has slipped 1.4 percent in November, the lowest in nine months. However, a silver lining is that the ongoing pandemic wave has not been seen as severe as the previous ones, allowing the government to continue its focus on pushing growth and boosting investment. Even the tax revenues so far this year have been robust and are expected to surpass the Budget estimates of FY22.

Investors will try and gauge things that would and would not impact the stock markets and their portfolios within this unpredictable environment. The relationship between markets and Budget is more an appearance than an image. Markets treat Budget as just another event; at least market returns depict the same. Markets are built to scale up/down on current occurrences till a new event comes its way.

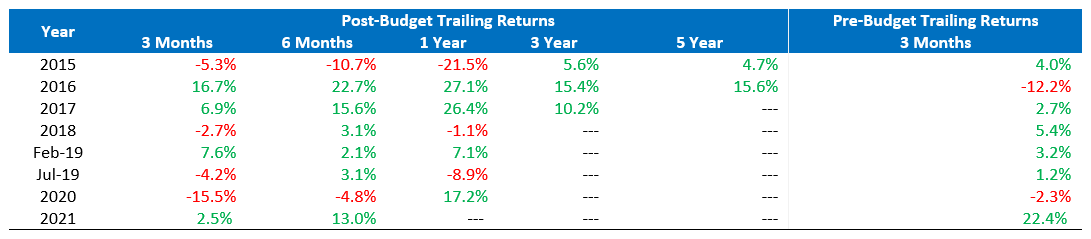

The table below looks at how market’s reaction over the last five years in pre & post-budget scenarios to thoroughly assess the “apparent” impact of Budget on markets:

As observed, the effect of the budget on market movements subsides over longer holding periods. Similarly, the government’s objectives and budgets propel economic growth across parameters. Hence, as the country grows, so do the markets.

For instance, the run-up to the 2016 budget saw market participants worried, with many opting to take an exit route as markets contracted by 10%+ in 3 months leading up to the budget.

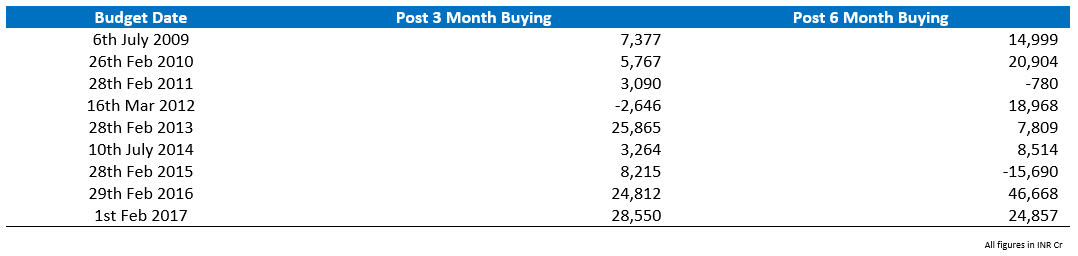

FII inflows can establish the link between markets & the budget.

In observing the budget’s nature of welcoming health-&-wealth into the country, FIIs have not shied away from buying into Indian markets. The table below highlights the same.

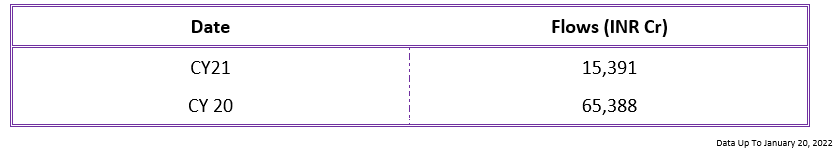

Like in the past, FIIs have maintained their buying spree this time around, too, despite being a pandemic year.

India ended CY 2020 being the only emerging country to witness positive FII flows.

The trend got carried on in 2021, as FIIs remain bullish on the country irrespective of various events and budgets.

The beauty of budget lies in its having visible short-term illness but long-term wellness on markets and its participants. This time around, the short-term effect of the budget is paired with uncertainty around inflation and rising interest rates across the globe and a move towards normalization hence inducing volatility over the past few months.

Have a look at the nifty performance over the long term:

In the long run, markets have maintained their return slope to be upward sloping. This curve is inclusive of the budget and more. Hence, as we walk into Budget FY23, we uphold our golden advice of staying invested and not acting out of hesitation.

What should investors do?

The Budget is certainly the most important event in an economy as it lays out path towards wellness of economic and market participants. We suggest investors to remain informed about the budget, however, do not take any action without understanding the actual implications. Here’s is an analysis how different portfolio performed in the last 3 budgets.

In the end, reiterating the old wisdom: Stick to asset allocation, do not churn your portfolio basis short term impacts of the budget rejig your portfolio per risk profile and goals.

Till then, Happy Investing!