2021 – the premier year of the new decade, is generating investor wealth at paces unseen before at returns unrealized before. Befittingly, flagship index BSE Sensex has honored market’s only code “Each time history (read as: crisis) repeats itself, the price goes up”. Kissing the eve of the pandemic, the prices have gone up in serious fashion, as BSE Sensex makes new markings amongst the goliaths on the global stage.

As we stand today, India’s oldest index BSE Sensex has crossed the $3 trillion market-cap mark, becoming the eight largest index in the world. Recording the fastest $500 billion jump in index value, India now stands above Germany in the terms of cumulative value of listed equities.

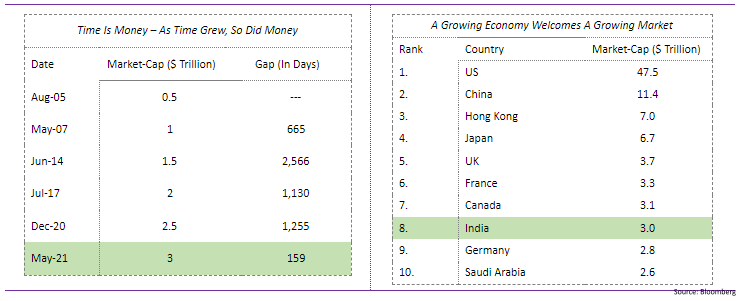

The graphs below highlight BSE Sensex’s journey across milestones and amongst peers:

This journey to $3 trillion milestone has been one of many ups and downs, wearing emotions aplenty. Across the variate troubles of different kinds, the indices have always emerged triumphant. The result of this pattern has seen optimists adorn the winner’s crown, while other flavored participants have been left to fend the loser’s curse.

The embodiment of markets to always scale up in the long-run was also visible in the year of the once-in-a century pandemic. The BSE Sensex takes first place in delivering the highest 1 year returns vis-à-vis peers as of date. In addition to this, the BSE Sensex has delivered an average 13.1% CAGR across its run between the trillion tapestries.

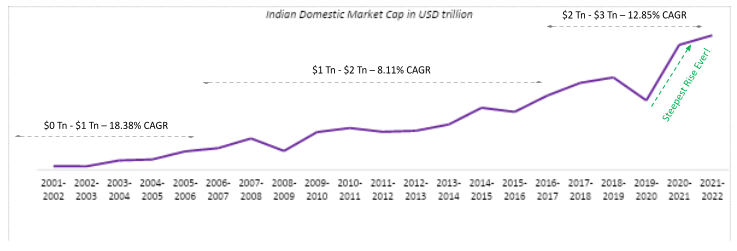

The graph below highlights how BSE Sensex’s paddle over this millennium:

Today, BSE Sensex is recognized as a tool for transferring investor wealth from the impatient to the patient. Charting the index’s behavior on an annual basis is proof of this as it highlights average returns of 20% vs hiccups of -21%.

When concocting data since inception, Sensex has delivered positive annual returns 31/40 times, growing wealth growth by ~91x! The ebb and flow have some great learnings for those seeking the earnings. They are:

- The money is in the waiting

- Every trough is followed by a peak

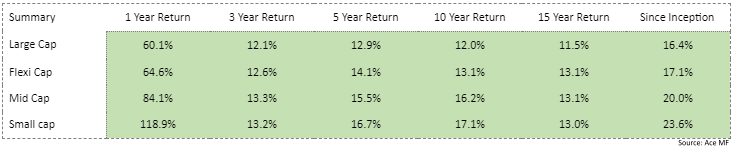

A big beneficiary of aforementioned principles has been the everyday person’s investing avenue of mutual funds. Unlike the index, mutual funds have ~100% track record of delivering positive returns across the short and long horizons.

The table below puts this fact into figures:

The coming decade is expected to see India parade the party from the front as it preps to become the fastest growing economy. The journey is set to be anything but normal. But like last year’s taught us, “abnormal markets make for abnormal returns”. The markets have not had their last twenty years easy, as its heralded swords with speed bumps in Dot-come bubble, SARS, Global financial crash, Demonetization, GST and more. As new troubles will brew, headlines will be the first to report that “This Time It’s Different”, and then miss out on the betterment in the marker’s health and wealth.

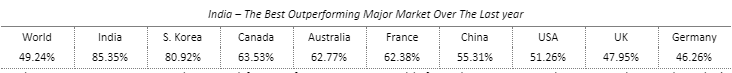

To those wondering where the markets will go from here, the graph below highlights just how far India has to go before it ‘runs out of gas’.

The graph below highlights India vs the Big Boys on the grandest stage of them all:

The opportunity is plenty but subtle, disguised as lucrative knock on those doors who are willing to hear it. Missing out on this is missing out on Indian market’s ambitious target of the quadruple trillion.

For those, who wish to know how they can make the best of this new leg of growth, do write to us at fisdom.

As always, we excitedly await to hear from you.

Till then, Happy Weekend