Hot Stuff: Adani pledges a stake worth $13 billion in newly acquired ACC, Ambuja cement

| Adani Group companies’ share prices have been rallying for quite some time, making Mr Gautam Adani the world’s second richest person. Companies from ports to gas distribution and coal mining have jumped partially due to soaring energy prices. And very recently, Adani Group completed the acquisition of Ambuja Cements and ACC Ltd. by acquiring Holcim’s stake in both companies. As per a regulatory filing on Tuesday this week, Adani Group has pledged their entire stake in ACC and Ambuja Cement for about $12.5bn to foreign banks to finance the $6.5 bn acquisition of two cement producers from Holcim. The deal will make the combined entity the second largest cement producer in the country, only next to Ultratech Cement, leaving behind other big players like Shree Cement and Dalmia Bharat. |

What could be the reason for pledging the shares of ACC & Ambuja?

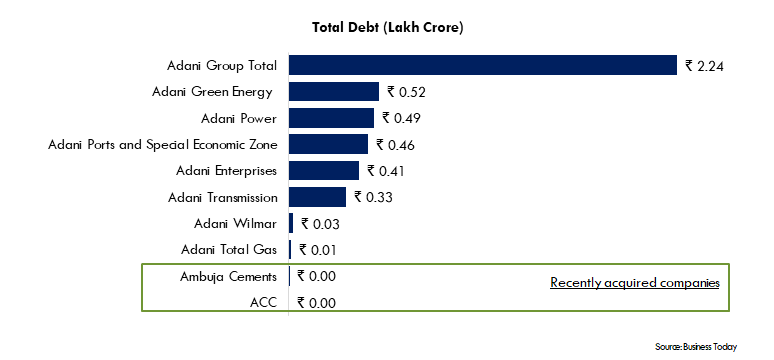

The key reason, in our opinion, could be the huge debt raised by the Adani group in recent years through different financing routes. Let’s have a look at the existing debt of the group companies:

Is rising debt a worry for Adani Group?

I. Out of Rs. 2.2 lakh crore debt, long-term debt obligations of Rs. 1.64 lakh crore, and short-term debt of Rs. 21,000 crores are backed by government contract receivables. Along with this, the group has total cash and cash equivalents of ~Rs. 27,000 crore makes external long-term debt obligations to Rs. 1.37 lakh crore. Newly acquired companies in the cement segment are virtually debt free however entire stake of these two companies has been pledged to fund the deal.

Also, while responding to the concerns raised by the Creditsights on the higher debt, the group highlighted that the net debt to EBITDA ratio came down to around 3.2x versus 7.6x nine years ago, indicating lower debt at the aggregate level for the operating companies.

II. The group has always been transparent in disclosing its CAPEX plans. We have listed a few key announcements made by the group in CY2022.

- Adani signs MoU with Ballard Power for exploring the manufacturing of hydrogen fuel cells

- Financial closure of Navi Mumbai Airport has been completed by Adani group.

- It plans to invest $20bn in generating clean energy over ten years

- It raises $250mn debt for the airport sector CAPEX

- Group to build a one million ton per annum (MTPA) copper plant in Gujrat, and for that, it raises Rs.6,071 crore

- It plans to acquire Macquarie Asia infrastructure fund’s toll road portfolio in Andhra Pradesh and Gujrat for Rs.3,110 crore.

- Inks pact with Israel Innovation Authority to jointly take up the technology innovations

Case in point: Adani group’s decision to expand its airport business was successful as the business is now the second highest revenue generator for them.

Even for ACC & Ambuja, the group planning to double its capacity in the next five years and become the most efficient company by 2030.

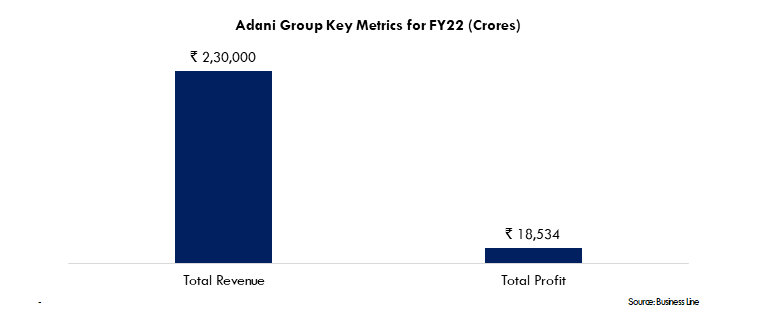

III. In currency denominations, nearly 30% of the total debt is denominated in foreign currency. The absolute level of debt by Indian banks to Adani has more or less remained stable in the past five years. Below is the summary of Adani Group companies’ revenue and profitability:

The market capitalisation of Adani Group companies, including ACC and Ambuja, is approximately Rs. 23 lakh crores making it the most valuable business group replacing TATA Conglomerate.

Below is the performance of various Adani Group companies in the CY2022 till 23rd September 2022:

|

Stock name |

Industry |

Abs YTD Change |

| Adani Power | Power |

281.5% |

| Adani Wilmar | FMCG |

202.8% |

| Adani Transmission | Power |

124.4% |

| Adani Enterprises | Holding Company |

113.3% |

| Adani Total Gas | Utility |

102.8% |

| Adani Green Energy | Renewable Energy |

71.7% |

| Ambuja Cements | Cements |

39.7% |

| Adani Ports and Special Economic Zone |

Maritime Infra |

23.9% |

| ACC | Cements |

10.4% |

While debt levels have gone up gradually, the Group has also shown more assets coming in and becoming operational. Investors have also done the same & prioritised the company’s aspiration and CAPEX plans over the mounting debt, which can be reflected in group companies’ remarkable rise in share prices. It is interesting to see how the Adani group will keep pace with their expansionary plans & generate more ROI to pay off the debts that they have raised.

Markets this week

|

19th September 2022 (Open) |

23rd September 2022 (Close) |

%Change |

|

| Nifty 50 |

17,541 |

17,327 | -1.2% |

|

Sensex |

58,747 | 58,099 |

-1.1% |

- Markets ended the week on a negative note.

- Indian Rupee touched a record low of 81.24 by crossing the 81 mark against the USD for the first time.

- Along with US Federal Reserve which hike the interest rates by 75 bps this week Britain, Sweden, Switzerland, and Norway were among the key economies that hiked interest rates.

- With the US interest rates set to rise at a faster pace for longer than expected tenure, the US Dollar has hit a two-decade high and extended its double-digit gains against several currencies for the year.

- Gold, which is considered a safe haven but does not pay any interest has come under pressure particularly in this quarter as yields have risen to make it less attractive.

|

BSE Top Gainers |

BSE Top Losers |

||||

|

Stock |

Change (%) |

Stock |

Change (%) |

||

| Page Industries Ltd | ▲ |

8.7 % |

Power Grid Corporation | ▼ |

(14.0) % |

| Marico Ltd | ▲ |

6.6 % |

Shree Cement Ltd | ▼ |

(9.1) % |

| Sun Pharmaceuticals Indus |

▲ |

6.0 % |

Godrej Properties Ltd | ▼ |

(7.8) % |

| Hindustan Unilever Ltd | ▲ |

6.0 % |

Shriram Transport Finance | ▼ |

(6.5) % |

| ITC Ltd |

▲ |

4.5 % |

GAIL (India) Ltd |

▼ |

(6.3) % |

Stocks that made the news this week:

- Can Fin Homes decline by 19 percent after the company announced that it CEO Girish Kousgi has resigned from the company sighting personal reasons. Jefferies has retained their buy rating for the stock whereas domestic brokerage ICICI Direct cited the overall impact as negative.

- M&M Financial Services dropped by 14 percent post RBI directed the company to stop recovery operations immediately through third-party agents. Morgan Stanley and CLSA have maintained their positive outlook.

- DishTV gained during the week post-resignation of Jawahar Goel.

- Shree Renuka Sugars rallied as the company got relief on the working capital front and gained better credit rating.

- Welpsun Corp, the metal company advanced 13 percent during the week amid acquisitions and order wins.