The avoidance of taxes is the only intellectual pursuit that carries any reward.

— John Maynard Keynes

Quite often, we rush to make the least thought-through tax saving investment (the easiest like insurance plan & PPF being the most popular) with a short-term view to save on taxes.

Have you ever wondered if the same investment could also help you build wealth and take you closer to your financial goals? Probably not.

Here’s a cheat-sheet to help you choose the best tax-saving option to utilize your section 80C’s INR 1.5 Lakh tax-deductible limit.

Options available under the section 80C basket:

[table id=37 /]

Trivia:

Sagar had started a SIP of INR 12,500/month (INR 1.5L annually) in an ELSS mutual fund – ICICI Prudential Long Term Equity Mutual Fund ten years back.

Over this period, he saved almost INR 4.5 lakhs in yearly taxes while his investment has grown to INR 32 Lakhs! A total gain of INR 21.5 Lakhs in ten years!

What happened there? It’s the power of equity, compounding and a wise tax-saving investment that made all the difference.

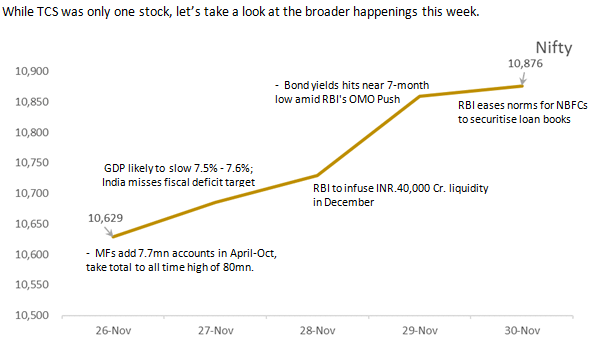

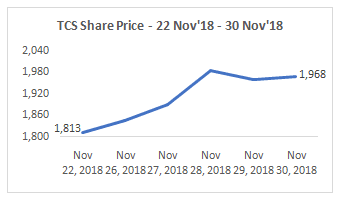

Equity as an asset class is by far the most dominant when it comes to building wealth. A classic display of the power of equity was the performance of TCS shares in the past week.

Shares of TCS gained the most this week. Since it got a clean-chit in the controversial racial-discrimination lawsuit filed in the U.S. Digital funds have been the biggest winners along with TCS.

[table id=38 /]