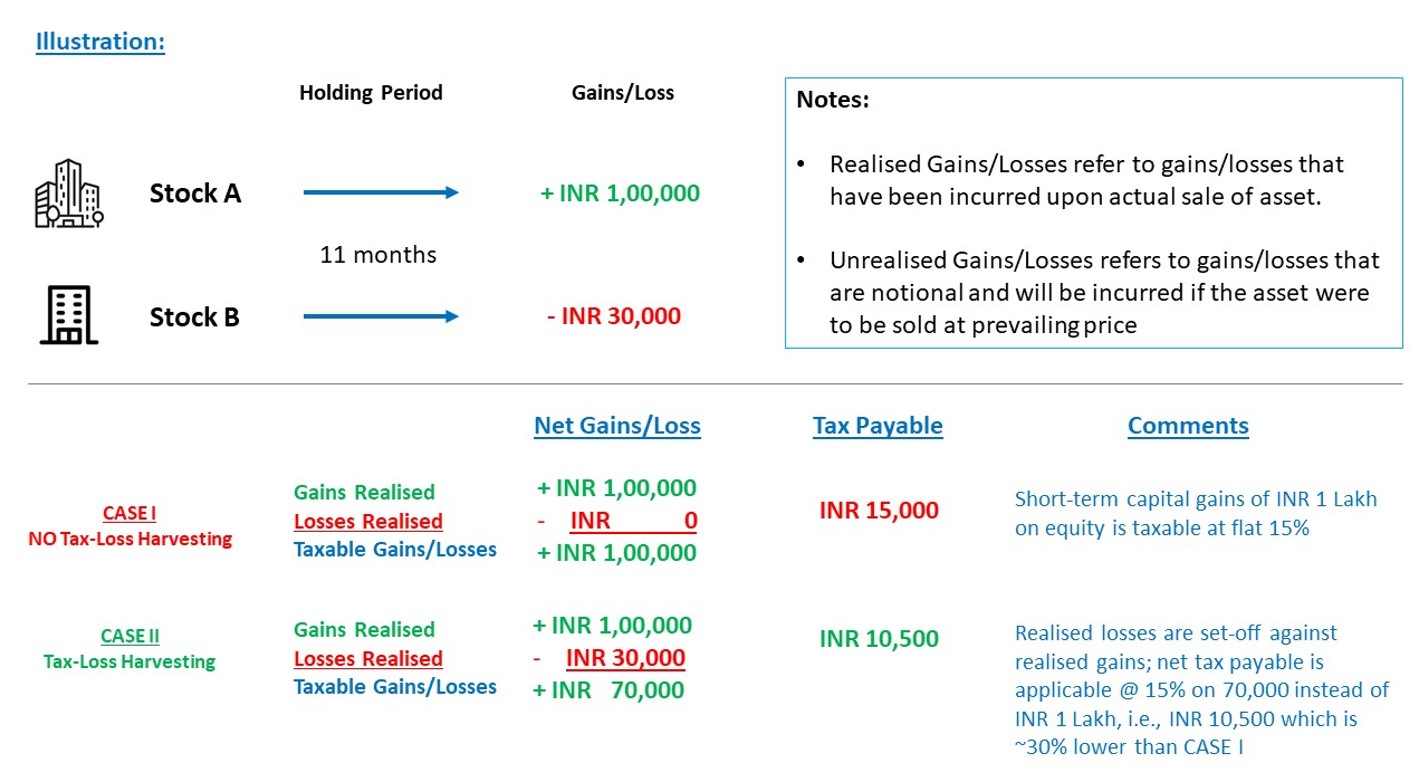

Imagine you have some investments that didn’t do well and lost your money. Tax-loss harvesting is like using those losses to your advantage. You sell those not-so-good investments to balance out any gains you made from other investments. This doesn’t erase your losses but helps protect the money you’ve earned from being taxed too much.

| In easy words, when we mention losses and profits, we mean gains and losses from things like stocks, Mutual Funds, Gold, and Real Estate. And as per the Income Tax Act, any money you earn or lose from these things is referred to as "capital gains" or "capital losses. |

Here is an illustration that will help understand tax-loss harvesting better.

What is the actionable for an investor?

Here are the steps simplified:

- Identify Loss-Making Assets:

Look at your investments and find the ones that have lost value since you bought them.

- Sell Before Year-End:

Sell those assets before the end of the financial year to turn those losses into real losses on your records. Make sure to consider the timing of these transactions.

- Rebuy if You Want:

If you still believe in those investments and want to keep them, you can use the money from selling to buy them back. Remember that the price might have changed a bit due to market fluctuations.

- Rebalance Your Portfolio:

You can take this opportunity to adjust your overall investment mix if needed. This can help ensure your portfolio aligns with your goals and risk tolerance.

- Use Losses to Offset Gains:

| Situation | Action |

| Losses < Gains | Book the losses and set off against the gains |

| Losses > Gains | Carry forward the leftover losses for up to eight years (assuming the losses are non-speculative) Speculative loss can be carried forward for only four years. |

Which type of capital losses can be set off against what type of capital gains?

| Type of Capital Loss | Can be Set Off Against |

| Short-term Capital Loss | Short-term Capital Gains and Long-term Capital Gains |

| Long-term Capital Loss | Long-term Capital Gains |

What tax rates are applicable on capital gains from different capital assets?

| Type | Period | Taxation | ||

| Short Term | Long Term | Short Term | Long Term | |

| Stocks & Equity Mutual Funds | < 1 Year | > 1 Year | 15% | 10% if total gains exceed Rs. 1 lakh |

| Unlisted Equity | < 2 Year | > 2 Year | Taxable per-slab rates | 20% post indexation |

| Mutual Funds_ Debt Oriented | – | – | Taxable per-slab rates | Taxable per-slab rates |

| Listed Debenture/ Non-Convertible Debentures (NCDs) | < 1 Year | > 1 Year | Taxable per-slab rates | 10% without indexation |

| Unlisted Debentures/ Non-Convertible Debentures (NCDs) | < 3 Year | > 3 Year | Taxable per-slab rates | 20% without indexation |

| Tax-Free Bonds | < 1 Year | > 1 Year | Taxable per-slab rates | 10% without indexation |

| Sovereign Gold Bond: | ||||

| if held till maturity | – | – | Tax-Free | Tax-Free |

| If redeemed before maturity, i.e., 8 years | < 3 Year | > 3 Year | Taxable per-slab rates | 20% with indexation |

| Real Estate | < 2 Year | > 2 Year | Taxable per-slab rates | 20% with indexation |

Please consult your tax advisor in case of any specific queries.

Please note that the above taxation is applicable to individuals.