This note is with reference to the decision taken by Franklin Templeton AMC to wind up six of its MF schemes.

The AMC had gone through multiple legal proceeding in the past few months w.r.t the fund wind up post the consent of its investors.

The latest developments on the issue present 2 voting options available to unitholders. They are as follows:

- Voting “Yes” to the Resolution means opting for an orderly wind-up of schemes while potentially realizing fair value of its assets

- Voting “No” to the Resolution means opting for the schemes to be re-opened, potentially leading to distress sale of assets and loss of value

The exact dates for voting have yet to be known but it’s widely expected to take place later this month.

AMC has highlighted that the voting “No” may lead to lead to fire-sale of many securities held by these 6 schemes.

It may reduce the price of these securities which may the turn into drop in NAV prices of respective funds that have exposure to these securities.

Follow below link to get the fund-wise circulars:

https://www.franklintempletonindia.com/investor/downloads/updates

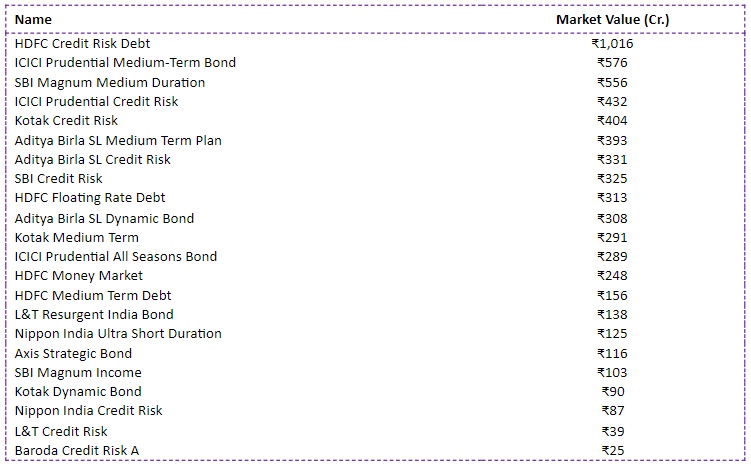

The question is – which debt MFs have how much exposure to the securities held by the 6 schemes of Franklin Templeton MF?

Key Takeaways:

A. If you are having any of the scheme mentioned above then suggest you either exit today or hold it for few more months post the decision.

B. If you are not having any of the above-mentioned scheme, then suggest you stay away from them till further notice.