Working on an investment strategy in line with your beliefs may hold you in good stead with your conscience and help you sleep better at night, but is it a profitable idea?

So far, it has been a unanimous “yes” from all investors, not just from the folks following Islam, but also from investors who are conscious about the industries they support. Yes, Shariah-compliance is not just about Islam but has more to do with conscious investing in shares of companies who do not operate in the not-so-ethical business segments like alcohol, gambling, tobacco, weaponry and similar. Additionally, there are restrictions to invest in companies operating on interest accrual models and pork products which skew the philosophy towards Islamic ideologies. But hey, fun fact – a large chunk of the total assets managed by Shariah funds are invested by members of the Jain community.

In brief, the idea is purely about investing with a conscience. But, getting back to the original question, is it profitable? And, what makes this a good investment strategy?

1. Shariah funds have outperformed the market for a long time now

While the Shariah funds are slowly gaining momentum, and have only two AMCs with limited AUM, the fund managers have done an exceptional job in beating not only the fund’s benchmark but also the broader Nifty despite being subject to restrictions, limitations and compliance challenges.

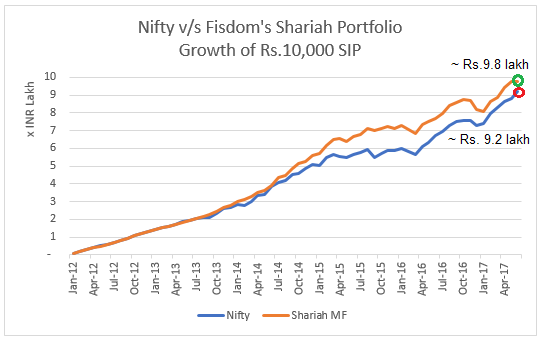

The following chart illustrates the wealth-growth for an investor who would have started an SIP into the Shariah mutual funds (asset-weighted allocation) versus how would his wealth grow if the same amounts were invested into Nifty, which has been clocking new highs lately.

Notably, Nifty’s value has increased at a CAGR ~14.4% from the beginning of 2012 to May, 2017. For the same period, Taurus Ethical fund’s NAV outperformed marginally at a CAGR ~14.8% and Tata Ethical fund’s NAV grew at a CAGR of ~17.7% while comfortably outperforming the index.

2. Diversified asset allocation helps to enhance risk-adjusted returns

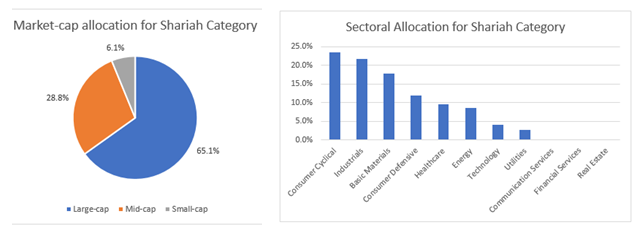

The Shariah category follows a multicap investment strategy which allows the fund to explore opportunities without being subject to market-cap-related restrictions. This mix ensures that volatility is controlled through a higher exposure to large-cap stocks while the mid-cap and small-cap bets allow for a bump in the portfolio’s returns.

The sectoral allocation is well spread across different sectors, thus diversifiying sector-specific risks to a great extent. One key point here is that, despite the positive performance outlook for the financial sector, the category has almost no exposure to it as interest earnings are prohiboted under the Riba clause of the Shariah law. However, a good workaround would be to invest in a sectoral fund for financial services.

3. Shariah funds are tax-efficient

Like all other equity mutual funds, returns generated through Shariah funds are completely tax-free if redeemed after one year. If redeemed within a year, a flat tax rate of 15% would be applicable.

For those who are conscious about how they earn instead of how much they earn, Sahriah funds seem to be the right fit. This category aims at blending values and profitability into a happy mix.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F2UVJAfr||target:%20_blank|” button_position=”button-center”]