Retirement is often pronounced as the end-all goal of working-cum-investing, marking the beginning of a new phase in one’s life. On a lighter note, retirement is characterized in 1 of 2 ways:

- Waking up in the morning with nothing to do, and having retired before doing it

- That period when you stop lying about your age and lying ‘round the house

Retirement is the 1 common goal we all aspire to enjoy care-free irrespective of working age, and socio-economic differences.

However, while India enjoys one of the healthiest work-friendly demographic distribution vis-à-vis other countries, it suffers from lack of planning for post-work life. This behavior has found new found attention across media outlets too, as is evidenced below:

- The Economic Times – You Will Never Get A Loan To Fund Your Retirement

- The Week – More Than Half Of Indians Have No Financial Plan For Retirement

- Outlook Money – Barely 1 In 5 Indians Consider Inflation While Planning For Retirement

- International Adviser – Indians Prioritise The Present Over Retirement Planning

- Café Mutual – Retirement: Least Important Goal For Indians

In the interest of saving your time (read as: use saved time to plan for retirement!), let us summarize the observations made across the links mentioned below:

- In India, private sector does not contain a robust pension policy with little-to-none government social security programme. This makes having retirement planning all the more necessary

- ~50%+ survey participants do not have any financial plan for post-work life, while allocating ~60% of income to current expenses

- Retirement takes a back seat in financial priority with child and spousal security and even fitness ranking ahead

- ~50% are not aware of total financial plan required in and after retirement age

- Barely 1 in 5 Indians considers the impact of inflation on returns while planning for their retirement

Your tomorrow (retirement) is going to defined by how you plan-&-act today. Lack of planning for post-work life will have you constantly dependent on a stream of regular income with no room for interruption, which in essence, is top contender for financial sin.

Unfortunately, the covid-19 lockdown transformed above observation into practice as working population resorted to loans and (more importantly) loan moratoriums to stay sans-scarce on a monetary front. A RBI study revealed how ~50% of total retail customers depended on moratorium facilities to curb pandemic hits.

In light of this information, remember that in today’s world, the only financial goal for which there is no loan facility is retirement.

As you get more worried and inclined about planning to save for retirement, SBI AMC brings forth their Retirement Fund NFO to soothe your stress by doing it for you.

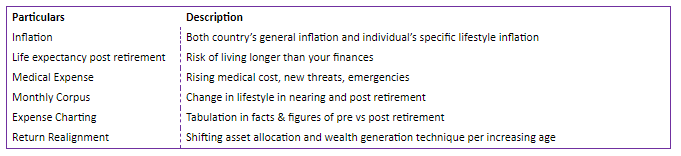

In a simple and systematic manner, the retirement fund factors in many pre-&-post retirement expenses so you are best prepared to circumvent unexpected episodes. A few of them are:

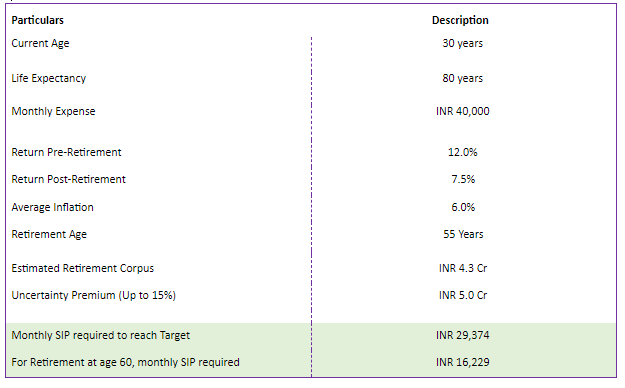

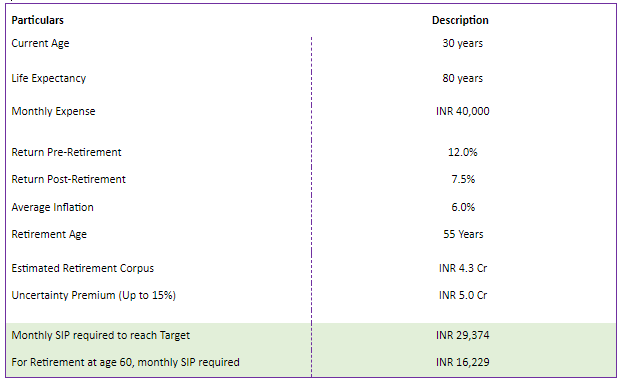

The Retirement NFO takes care of another key challenge in factoring in total amount needed post retirement in a financially savvy manner. An illustration of the same is shown below:

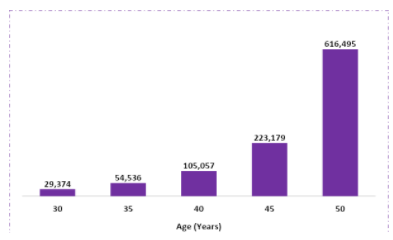

Another essential element in saving for retirement is to act early. Many were caught off-guard last year in the wake of the pandemic cause of poor planning. The chart below highlights how delaying retirement planning significantly increases cost with delay interval of 5 years:

As is observed, delay of 5 years (Between Age 30 & 35) can increase your SIP amount by Rs. 24,982. The difference increases as lag increases.

Already excited to go hunting for a mutual fund to take care of your retirement need? SBI AMC introduces their Retirement Benefit Fund so you can wait to enjoy your retirement life but not wait to plan for it.

SBI Retirement Benefit Fund

SBI Retirement Benefit Fund is an open-ended, retirement solution-oriented scheme. Per SEBI, the investment amount is locked in

for 5 years or until retirement (i.e. completion of 65 years), whichever is earlier. Also, No investor above the age of 65 years will be allowed to subscribe to the scheme.

The NFO will offer 4 different plans for investors across life stages as shown below:

The NFO comes with many investor friendly features. A few are:

- Asset Allocation:

This can be undertaken in 1 of 2 ways:

- Auto Transfer:

Investment plan is chosen based on the investor’s age per table shown above. As the investor advances in age, the invested assets get automatically transferred to the next low risk investment plan corresponding to the investor’s age. No exit load is applicable in case of this switching of assets between plans. However, tax will be applicable as per prevailing taxation laws.

- My Choice:

Initial investment plan chosen by investor will continue irrespective of advancement in age. Incremental investment will also be added to initial plan. Further, any number of switches are allowed between the four plans of the scheme.

- Insurance Benefits With SIP:

SIP registered under this with a tenure of 3 years plus, has insurance benefits wherein in case of an unfortunate event the nominee stands to get the benefits as mentioned below:

- Year 1: 20 times the monthly SIP installment

- Year 2: 50 times the monthly SIP installment

- Year 3: 100 times the monthly SIP installment

- Year 4 onwards: 100 times the monthly SIP

- Cash Flow Management With SWP

Investors can opt for this facility and withdraw their investments systematically on a Quarterly basis (applicable quarters are end of December, March, June, September). Withdrawals will be made/ effected on the 25th of every month of that particular quarter and would be treated as redemptions.

(The above features are subject to terms & conditions. Kindly enquire about the same with your financial advisor)

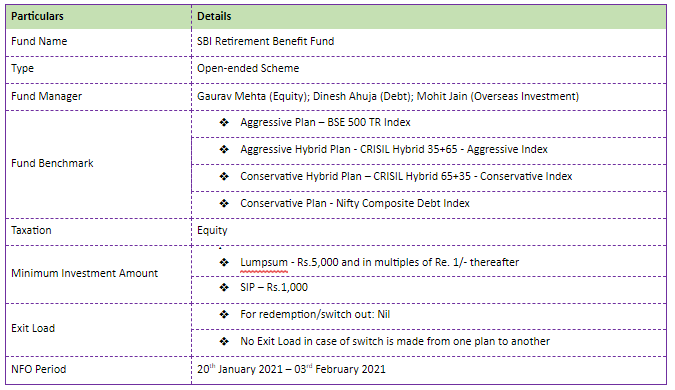

Key Details