“Mutual Fund investments are subject to Market Risks, read all scheme related documents carefully before investing”

In watching TV, reading paper, or hearing a radio – the above phrase has become the poster-boy phrase for our mutual fund industry.

Mutual funds today rope in higher count of diverse investors, economically & geographically, as is evident in growing AUM and city coverages. Hence, in the interests of investors, MF body regulators in SEBI, and AMFI, design and re-design policies in-line with evolving financial acumen across state borders.

The variety of risk is determined per mutual fund’s category (asset class) and sub-category. This variety is then assigned a label per the risk-o-meter.

What Is The Mutual Fund Risk-O-Meter?

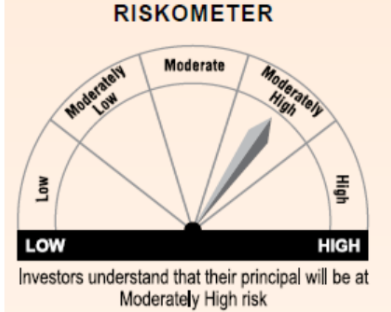

The Risk-O-Meter is a tool designed to help investors gauge the level of risk in a mutual fund via a meter. Ranging from low to high, the scale helps in uniform labeling of a fund to help investors assess true level of portfolio risks.

Below is a pictographic representation of the current Risk-O-Meter:

A key limitation in current risk rating system is subjectivity in labeling practice, highlighted by the decision-making abilities resting with AMCs per their scheme objectives.

Another limitation lay in sans-scoring of various key parameters to give fund an overall risk score, but rather scores being assigned on a more holistic basis.

Such limitations prompted the need for the risk profiler to be given a new face.

In-line with the philosophy, SEBI has introduced a new Risk-O-Meter with effect from January 1, 2021.

What Does The New Risk-O-Meter Encompass?

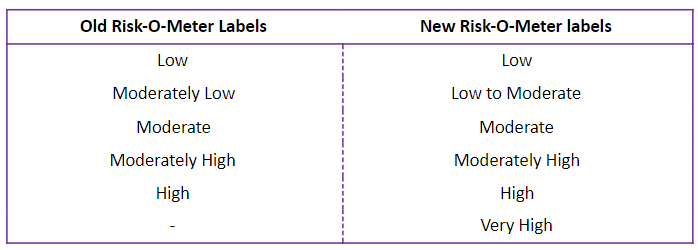

The new meter is designed to better factor in range of risks associated with respective asset classes, when assigning risk label. The biggest difference is broadening of labels on the higher risk hierarchy, thus clearly defining boundaries between riskier instruments.

What Are The Benefits Of The New Risk-O-Meter?

- Dynamic Risk Setting

Mutual funds to disclose risk level of schemes on March 31 of every year, along with number of times the risk level has changed over the year. Further, every fund house will evaluate risk-o-meter on monthly basis, making risk-reading more dynamic.

- Parameter/Component Scoring

The new Risk-O-Meter introduces practice of scoring key parameters (determined by asset class), with final output being 1 weighted average of component scores. The risk level corresponding to final number will print the risk level for said fund.

The parameter scoring is to be undertaken for every portfolio security to reduce subjectivity in reading to the minimal.

For equity funds, 3 risk parameters will print market fund risk. They are as follows:

- Market Capitalization

- Volatility

- Impact Cost

For Debt Funds, 3 risk parameters will print market fund risk. They are as follows:

- Credit Risk

- Interest Rate Risk

- Liquidity Risk

For schemes that invest in more than one asset class, the risk score of respective asset classes will be calculated and then, added up.

Investor Takeaway

In introducing scoring of broad parameters with investor-friendly output via rating scale, the regulators have made current risk control system more robust. Fund peer reading can now become more scientific, as investors can map fund performance to risk taken vis-à-vis peers.

AMC’s may be deterred to wear higher risk metrics, due to new visibility on the latter. This will keep investors disincentivized to switching to relatively safer funds.

As 2021 continues to pass, it will be interesting to see how funds balance the risk-return profile of funds to maximize upside while minimizing downside.

All-in-All, the modified risk-o-meter will help investors in making more informed decisions by aligning personal risk appetite with that of a fund.

We continue to recommend investors to solicit advice from investment professionals before putting their monies into a particular fund.

Please click here – SEBI Risk-O-Meter Revamp Circular – for more information.