Technical Overview – Nifty 50

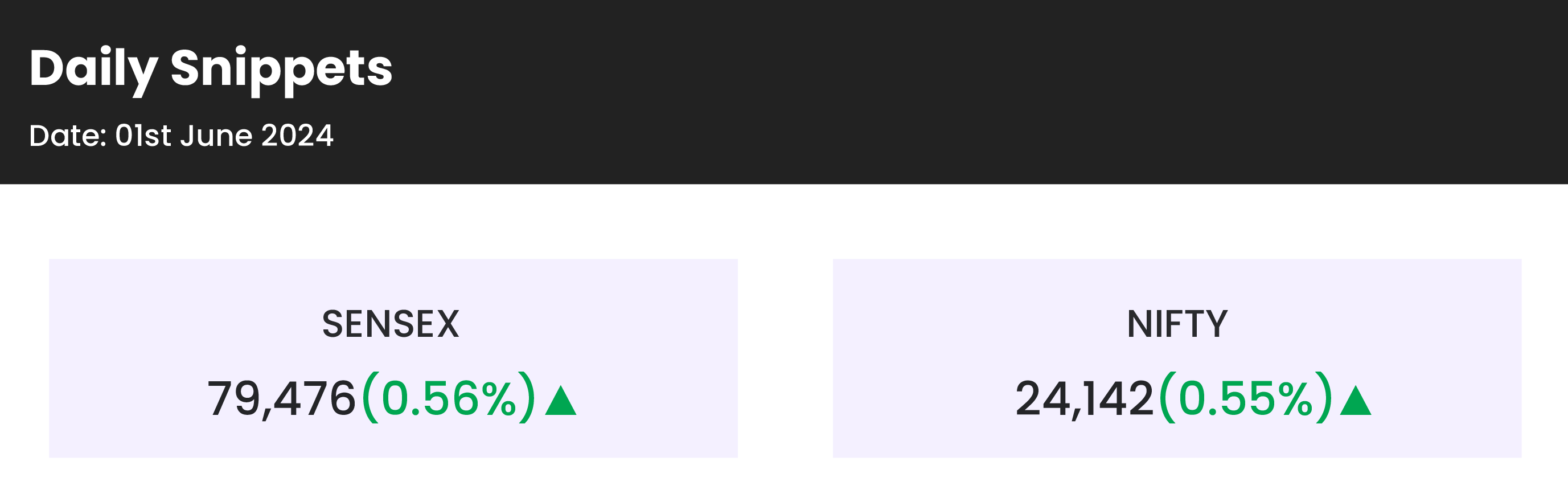

The index showed bullish momentum after profit booking in the previous session. The index gained little more than half a percent for the day. The index closed again at the upper band of the rising channel. The index took support at the previous session low and closed near the day high forming a bullish candle.

The horizontal resistance breach was highlighted by the RSI (14) momentum indicator, which closed near the 70 level. The fact that the MACD is rising and above its polarity indicates that the positive trend should continue. The fact that the index is above each major DEMA adds extra support to the general bullishness.

Benchmark index OI data suggests a base formation at the 24,000 level, with Put writing close to 79 lakhs contract, and may face resistance at 24,500, with call writing close to 67 lakhs contract.

For the upcoming sessions, the support and resistance levels are 24,200 and 24,400 and 23,800 and 23,650, respectively.

Technical Overview – Bank Nifty

The banking index closed nearly where it started yesterday, having a really boring day. The index has formed a DOJI candlestick every day. The benchmark index outperformed the banking index.

The lag in the upward momentum can be explained by the barrier at the RSI (14) momentum indicator’s downward-sloping trend line. The upward trend should continue because the MACD is rising and above its polarity. Mean reversion moves could happen because the index is above each significant DEMA, but this does not change the positive picture overall.

The resistance and support levels for the upcoming sessions are 52,750–53,000 for resistance and 52,150–51,900 for support.

Indian markets:

- On June 28, Indian equity indices extended their rally to new record highs, with the Nifty surpassing 24,100 and the Sensex reaching 79,600, driven by Reliance Industries and other major stocks.

- However, selling pressure at higher levels erased all the day’s gains, causing the indices to end in the red.

- After a gap-up opening at fresh record highs, the market stayed positive during the first half. However, in the second half, it fluctuated between gains and losses, ultimately closing near the day’s low.

- Sector-wise, healthcare, metal, PSU Bank, oil & gas, and realty indices rose by 0.5-1 percent, while the bank index fell by 1 percent and the capital goods index declined by 0.4 percent.

- The BSE midcap and smallcap indices each added 0.5 percent.

Global Markets:

- European stocks started the new trading week higher.

- Regional investors are absorbing the results of France’s snap parliamentary election.

- The first round of the election saw a significant increase in votes for the anti-immigrant National Rally party.

- European markets are reacting to this sharp upswing in support for the National Rally.

Stocks in Spotlight

- On July 1, Zomato’s stock rose by 1.57 percent, nearing its 52-week high of Rs 207 amid heavy trading volumes. This increase followed reports that Zomato plans to enter derivatives trading and join the NSE Nifty 50 index.

- Alembic Pharmaceuticals gained around five percent on July 1 after announcing tentative approval from the USFDA for its Abbreviated New Drug Application (ANDA) for Bosutinib Tablets, 100 mg and 500 mg. The approved ANDA is therapeutically equivalent to the reference listed drug, Bosulif Tablets, 100 mg and 500 mg, by PF Prism C.V. (PF Prism).

- On July 1, Garden Reach Shipbuilders & Engineers surged over 10 percent to an all-time high of Rs 2,309 per share after announcing a contract to construct an advanced ocean-going tug for the government of Bangladesh. This year, Garden Reach shares have risen over 163 percent, compared to a 10 percent increase in the benchmark Nifty 50 index.

News from the IPO world🌐

- Emcure Pharma announces price band for Rs 1,952-crore IPO at Rs 960-1,008/share

- Vraj Iron and Steel IPO subscribed nearly 40 times so far on last day.

- Insurer Niva Bupa plans $360 million IPO.

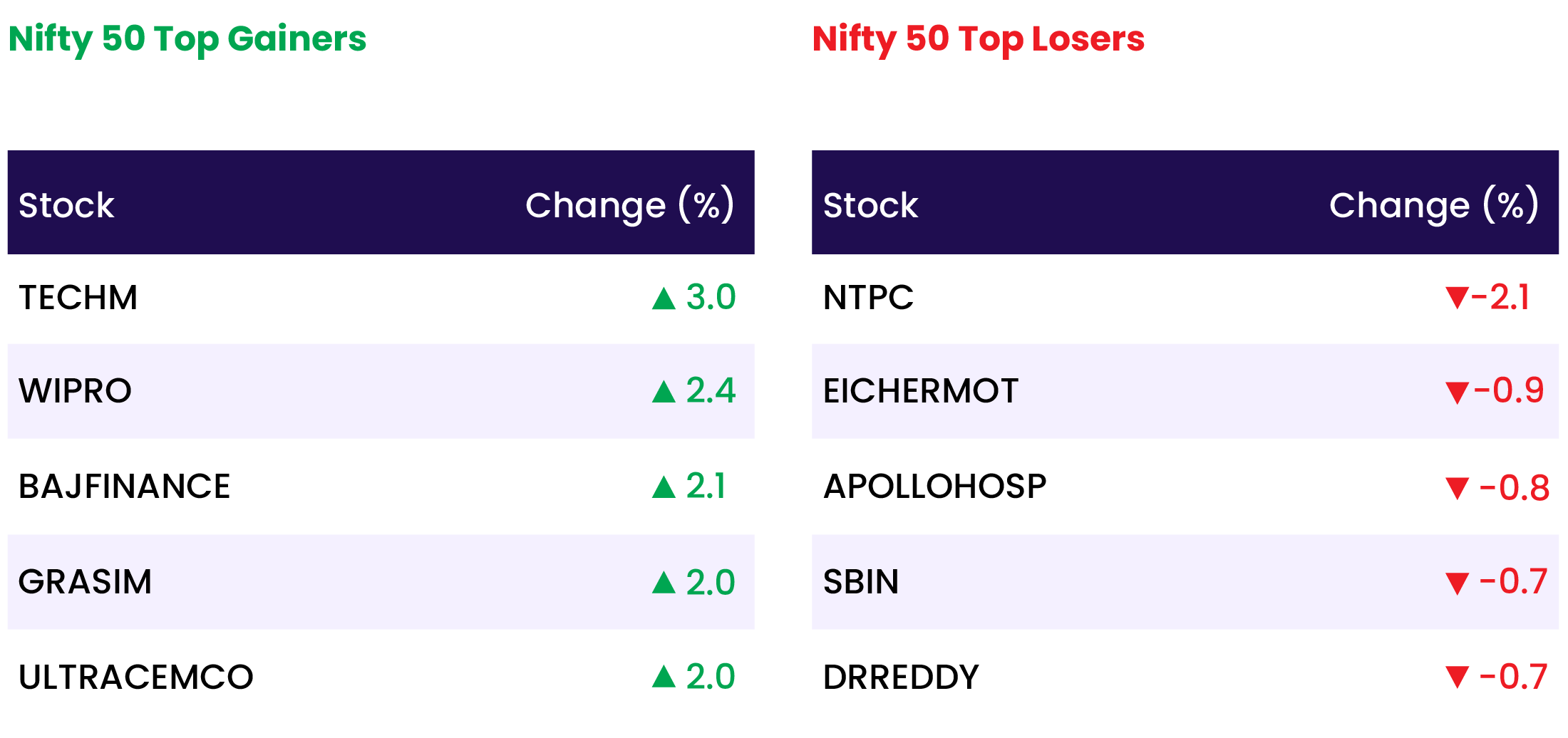

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 2.4 |

| NIFTY IT | 2.0 |

| NIFTY FINANCIAL SERVICES | 0.9 |

| NIFTY MIDSMALL HEALTHCARE | 0.8 |

| NIFTY CONSUMER DURABLES | 0.8 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2656 |

| Decline | 1346 |

| Unchanged | 144 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,119 | (0.1) % | 3.7 % |

| 10 Year Gsec India | 7.0 | 0.1 % | 1.2 % |

| WTI Crude (USD/bbl) | 82 | 0.2 % | 16.3 % |

| Gold (INR/10g) | 71,265 | (0.1) % | 6.3 % |

| USD/INR | 83.37 | 0.0 % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer