Technical Overview – Nifty 50

Another day, yet another benchmark index all-time high. The index had a gap at the beginning of the session and closed near the day low before stabilizing. The index closed above the upper band of the rising channel. Volumes of the index’s component parts appear to be trailing the momentum.

The momentum indicator RSI (14) has closed above the 72 level and continues to rise, confirming the upward trend of the benchmark index. The upward trend should continue because the MACD is rising and above its polarity on a daily basis.

Over the past three sessions, the benchmark index’s equity breadth below the 200-day moving average (200SMA) decreased from 90% to 86%.

Based on benchmark index OI data, a base formation may take place at the 24,300 level, where put writing is almost 30 lakhs contract. At 24,400, or almost 23 lakhs, the call writing contract’s value, resistance might arise. The PCR value of the benchmark index is 1.07.

The support and resistance levels for the next sessions are at 24,200 and 24,050 and 24,400 and 24,500, respectively.

Technical Overview – Bank Nifty

The index opened with a gap over 53,550 levels, setting a new record high. The day’s open and high were the same, while the banking index showed a slight profit booking.

Over a 125-minute timeframe, the momentum indicator RSI (14) is displaying a hidden positive divergence. A horizontal resistance has been breached and closed above by the daily time-frame index. The upward trend should continue because the MACD is rising and above its polarity on a daily basis. The index’s position above each major DEMA lends more credence to the overall bullishness.

For the next sessions, the resistance and support levels are 53,500, 53,700 for resistance and 52,800, 52,450 for support.

Indian markets:

- India’s benchmark Sensex achieved a historic milestone by closing above the 80,000 mark for the first time on July 4, while the Nifty 50 also ended above the 24,300 mark.

- Despite opening higher, both indices retraced most of their gains throughout the day and closed only marginally higher.

- The Indian stock market started impressively and traded with gains throughout the session amid positive global cues.

- However, the key indices pared their gains significantly towards the end of the session, hinting at growing caution against the market’s premium valuation.

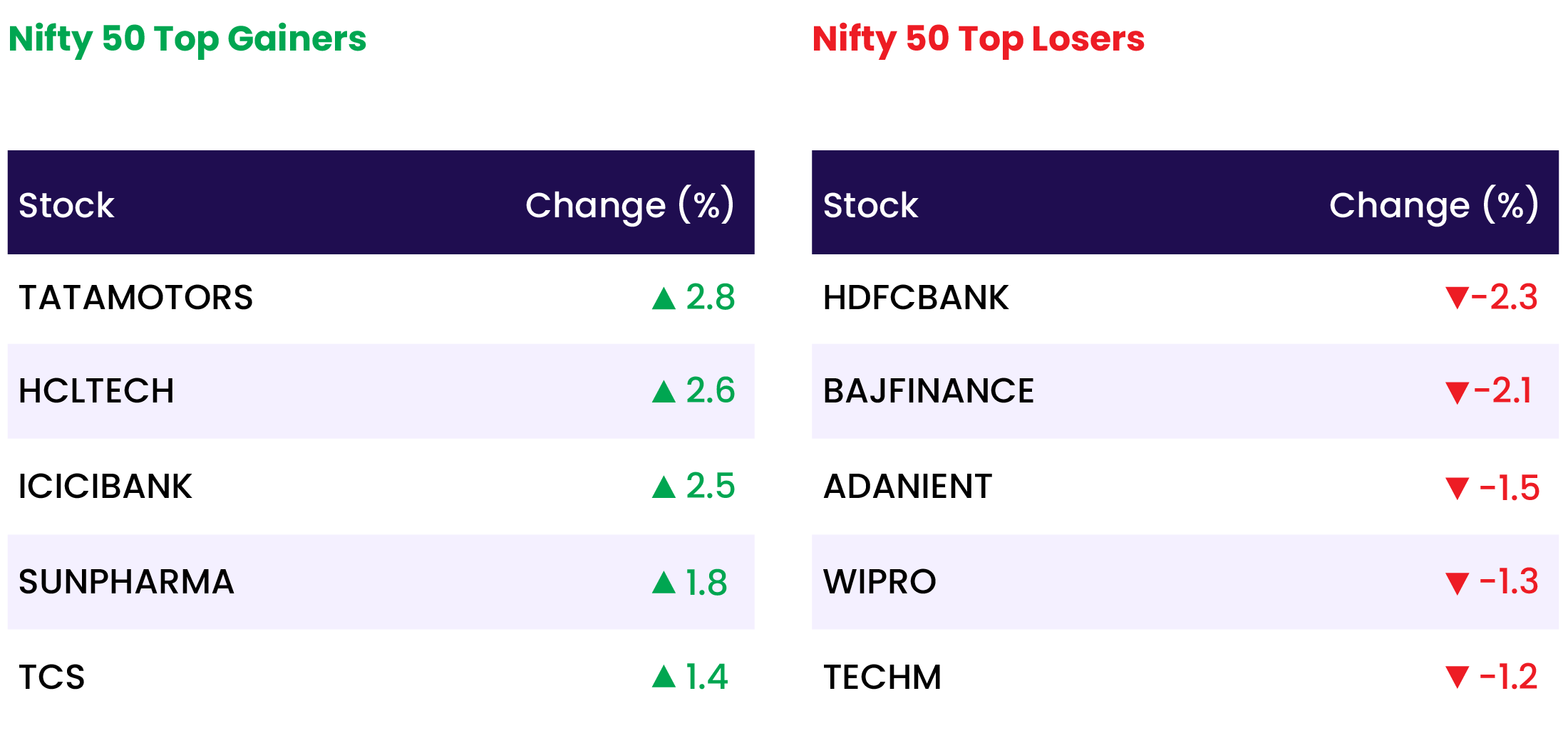

- Among sectoral gainers, Nifty Pharma led with a gain of 1.4 percent, followed by Nifty IT and Nifty Auto, which rose 0.9 percent each. On the other hand, Nifty Media declined by 0.5 percent, while both Nifty Financial Services and Nifty FMCG dropped by 0.2 percent each.

Global Markets:

- Asia-Pacific markets mostly rose on Thursday as Japan’s major indexes and Taiwan’s benchmark hit all-time highs.

- The Topix rose 0.92% to close at 2,898.47, surpassing its previous all-time high of 2,886.50 set in December 1989.

- The Nikkei 225 climbed 0.82% to close at 40,913.65, exceeding its previous record of 40,888.43 set in March this year.

- Hong Kong’s Hang Seng index was up 0.21% in its final hour of trading. Mainland China’s CSI 300 ended the day flat at 3,445.81.

- European stocks were higher for a second straight session Thursday, regaining some momentum as the U.K.’s general election draws focus in the region.

Stocks in Spotlight

- Wockhardt shares surged by 5 percent, extending their uptrend for the 12th straight session. With this sharp rally, the stock hit a fresh 52-week high of Rs 995, delivering exuberant gains of nearly 80 percent over the past month. Optimism for the company stems from its research and development prowess as it nears the launch of two blockbuster antibiotics, poised to change the course of the drugmaker’s earnings trajectory.

- Inox Wind shares skyrocketed over 13 percent after the company announced a Rs 900-crore capital infusion from its promoter, Inox Wind Energy Limited (IWEL). The funds were raised through the sale of Inox Wind equity shares in block deals on stock exchanges, attracting participation from several high-profile investors. In a regulatory filing, Inox Wind stated that IWEL finalized the capital infusion on July 4, marking a significant step towards achieving a debt-free status for IWL. The proceeds from the infusion will be used to reduce Inox Wind’s external term debt, thereby enhancing its financial position and accelerating its growth prospects.

- Shipping stocks | Shares of shipping firms like Cochin Shipyard and Mazagon Dock surged up to 17 percent. These stocks were among the PSUs experiencing a sharp rally lately, as investors anticipate that Budget 2024 announcements will further boost their performance. Veteran investor Raamdeo Agrawal believes that despite the recent upward movement, PSUs are still trading at single-digit PE multiples. The stocks also gained due to strong Q1 earnings expectations. In its June quarter earnings preview note, Antique Stock Broking indicated that the combined sales of eight defense companies, including Mazagon Dock, Cochin Shipyard, Bharat Dynamics, BEML, Hindustan Aeronautics, Bharat Electronics, PTC Industries, and Garden Reach Shipbuilders & Engineers Ltd, may jump 27 percent YoY.

News from the IPO world🌐

- Emcure Pharmaceuticals IPO booked nearly 3x so far on Day 2

- Softbank backed Firstcry, Unicommerce get SEBI approval for IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PHARMA | 1.4 |

| NIFTY HEALTHCARE INDEX | 1.3 |

| NIFTY MIDSMALL HEALTHCARE | 1.3 |

| NIFTY IT | 1.1 |

| NIFTY AUTO | 0.7 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2117 |

| Decline | 1821 |

| Unchanged | 83 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,308 | (0.1) % | 4.2 % |

| 10 Year Gsec India | 7.0 | (0.0) % | 1.2 % |

| WTI Crude (USD/bbl) | 83 | (0.7) % | 17.7 % |

| Gold (INR/10g) | 72,175 | 0.0 % | 7.4 % |

| USD/INR | 83.48 | 0.1 % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer