Technical Overview – Nifty 50

The index closed nearly flat and formed a DOJI candlestick. The index recovered from the 24,360 low after opening lower with a gap. The index found support at the 10-DEMA for the third time; here, CNXMIDCAP gained over a percent, while CNXSMALLCAP gained just over half a percent.

The momentum indicator, RSI (14) shows a bearish divergence on a weekly period at all-time highs. The index is trading above the main EMA, as indicated by the weekly period. In the future weeks, we might anticipate a mean reversion of the index to the 10 and 20 EMAs. It is still prudent to buy on dips if there is a mean reversion.

Based on benchmark index OI data, a base formation may take place at the 24,300 level, where put writing is almost 36 lakhs. At 24,700, call writing is almost close to 40 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.91.

The view remains buy on dips. The support levels for the upcoming sessions are at 24,350 and 24,150 and resistance at 24,650 and 24,750, respectively.

Technical Overview – Bank Nifty

The banking index had a slow start to the week; by closing, it was essentially unchanged and stayed in the consolidation zone. The index formed another DOJI candlestick, demonstrating that neither bulls nor bears were interested. Following a 15% short-term rise, the index is currently stuck in the 51,750–52.850 range.

On a daily timescale, the momentum indicator RSI (14) has hidden positive divergence, indicating that the momentum increase is probably going to continue. Although the enthusiasm of bulls to bake the index seemed to be decreasing, the index was supported by the 20-DEMA during the previous session. The MACD shows a negative crossover over the daily chart, suggesting a lag in the upward trend.

Based on benchmark index OI data, a base formation may take place at the 52,000 level, where put writing is close to 15 lakhs. At 52,500, call writing is almost close to 18 lakhs, which might act as a resistance. The PCR value of the benchmark index is 0.64.

In the event of a decline, the opinion is still to buy on dips and to pyramid over 52,800 levels. The resistance and support levels for the upcoming sessions are 52,650, 52,850 for resistance, and 52,000, 51,750 for support.

Indian markets:

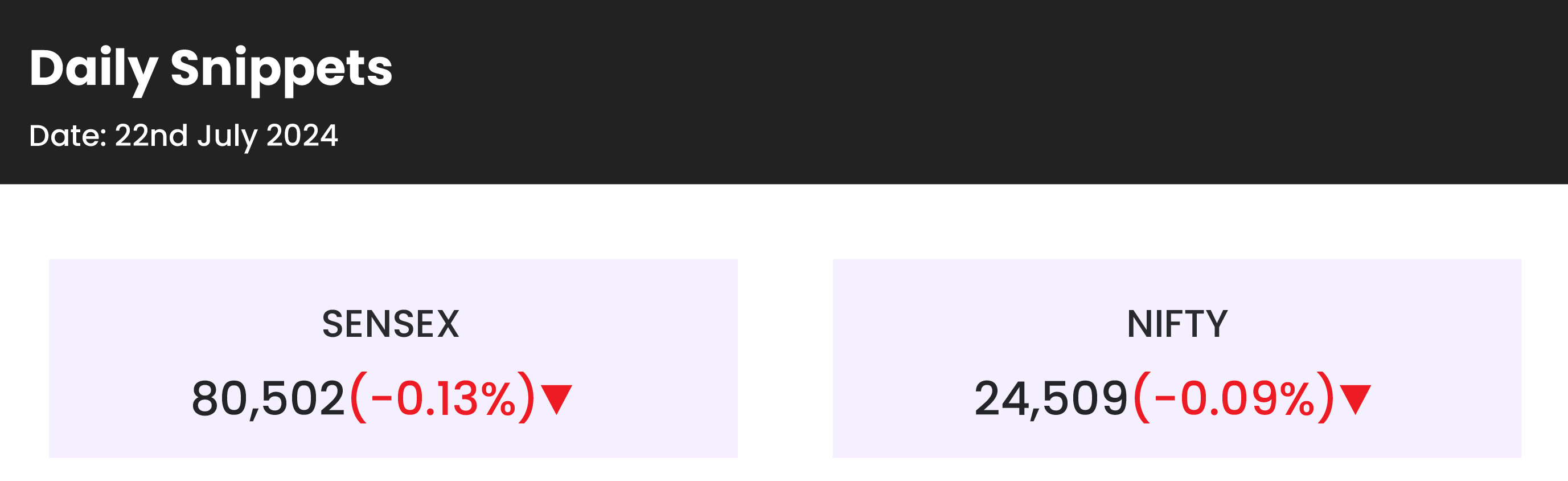

- The Indian benchmark indices closed lower for the second consecutive session on July 22, as traders remained cautious ahead of the Union Budget announcements.

- Weak global cues led to a lower opening for the Indian indices, which slipped below 24,400 early on. Although there was some recovery in the initial hours, the indices remained in the red throughout the session.

- Sectorally, the auto, capital goods, healthcare, metal, and power indices each gained 1 percent, while the media, bank, IT, realty, and FMCG sectors saw selling pressure.

- The BSE midcap index rose by 1.3 percent, and the smallcap index increased by 0.8 percent.

Global Markets:

- Asia-Pacific markets fell on Monday following news that U.S. President Joe Biden had dropped out of the presidential race and endorsed Vice President Kamala Harris as the Democratic nominee.

- China’s central bank unexpectedly cut rates, lowering the short-term 7-day reverse repurchase rate to 1.7% from 1.8%.

- Hong Kong’s Hang Seng index was down 1.22% in its final hour of trade after the PBOC’s announcement, while mainland China’s CSI 300 lost 0.68%.

- The Taiwan Weighted Index led regional losses, tumbling 2.68%, dragged down by industrial and tech stocks.

- Japan’s Nikkei 225 fell 1.16%, while the Topix also dropped 1.16%, marking the first time in three weeks the Nikkei dipped below the 40,000 mark.

- South Korea’s Kospi dropped 1.14% to 2,763.51, while the small-cap Kosdaq saw a larger loss of 2.26%

- Australia’s S&P/ASX 200 dropped 0.5%.

Stocks in Spotlight

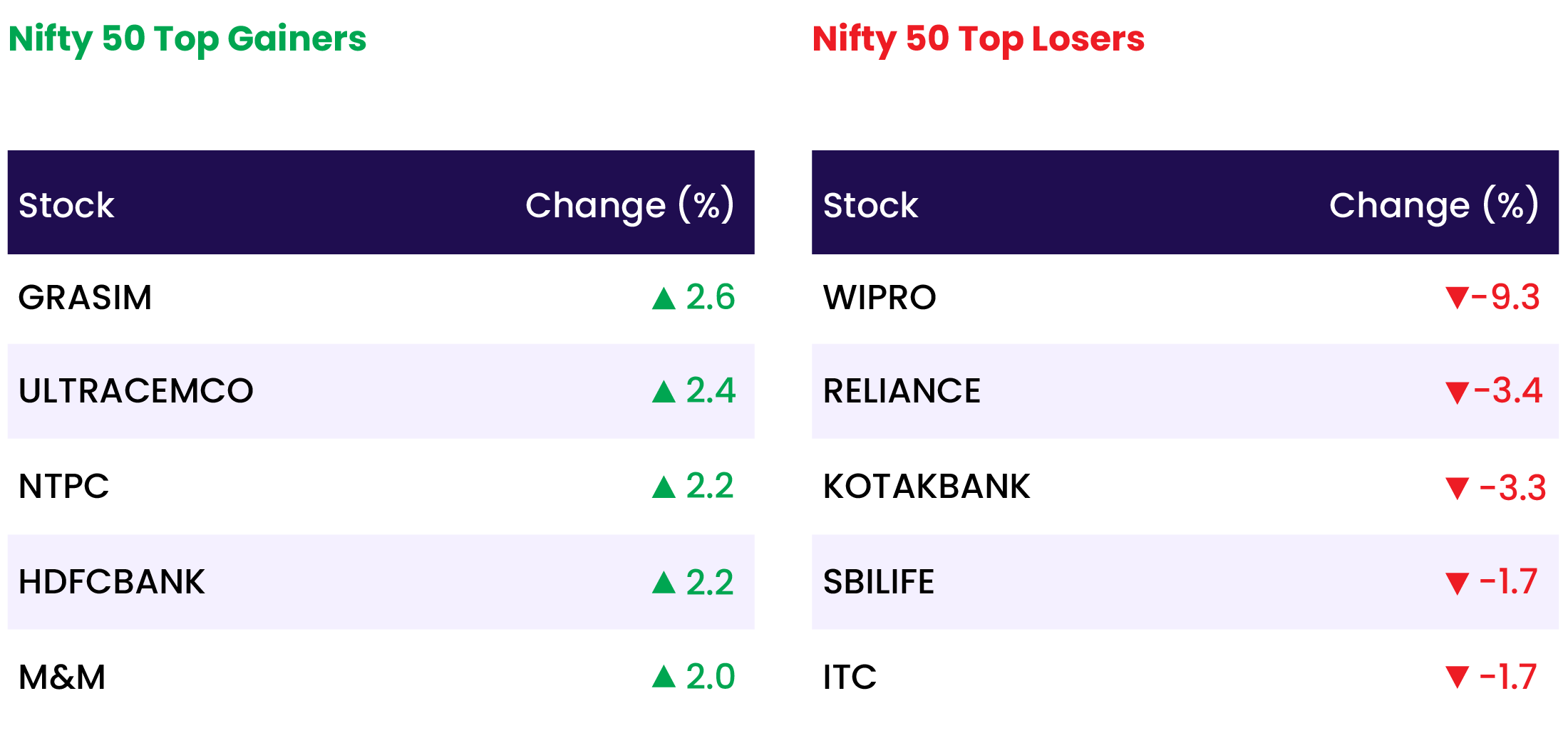

- Wipro Shares fell as much as 9.3 percent after the company reported a weak Q1 FY25 performance, with a 1 percent quarter-on-quarter (QoQ) decline in consolidated revenue.

- Fertilizer stocks these surged as much as 13 percent ahead of the Union Budget 2024, which is set to be presented by Finance Minister Nirmala Sitharaman on July 23. The spike came as investors speculated on the potential subsidy allocation for the sector in the upcoming budget. The interim budget had estimated the fertilizer subsidy requirement for FY25 at Rs 1.64 lakh crore, down from Rs 1.89 lakh crore for FY24.

- Indian Hotels Company Limited stock jumped over 7 percent after the company reported strong April-June quarter (Q1 FY25) results. In Q1 FY25, the company’s revenue increased by 5.7 percent year-on-year to Rs 1,550 crore, while net profit surged 10 percent year-on-year to Rs 260 crore.

- Kotak Mahindra Bank Investors booked profits in Kotak Mahindra Bank, causing its stock to drop over 3 percent despite the lender reporting strong Q1 FY25 results. Brokerages offered mixed opinions on the stock, citing uncertainty over the timeline for lifting the Reserve Bank of India’s (RBI) digital banking ban, which impacts the margin and loan growth outlook.

News from the IPO world🌐

- Stallion India Fluorochemicals gets Sebi’s approval to float IPO

- Sanstar IPO gains momentum on Day 2

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY AUTO | 1.2 |

| NIFTY HEALTHCARE INDEX | 1.1 |

| NIFTY PHARMA | 1.1 |

| NIFTY MIDSMALL HEALTHCARE | 1.1 |

| NIFTY METAL | 1.0 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2190 |

| Decline | 1822 |

| Unchanged | 140 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 40,287 | (0.9) % | 7.9 % |

| 10 Year Gsec India | 7.0 | (0.0) % | 0.9 % |

| WTI Crude (USD/bbl) | 80 | (3.2) % | 13.9 % |

| Gold (INR/10g) | 72,843 | (0.0) % | 7.6 % |

| USD/INR | 83.63 | 0.1 % | 0.7 % |