Hot Stuff: Climate experts worldwide have warned about the possible condition for an El Nino phenomenon in CY2023.

Earlier this year, the IMD reported that La Nina, opposite to El Nino, ensures healthy monsoon conditions and healthy rainfall are about to end. Starting in 2023, the abnormalities of cool weather in the Pacific Ocean will likely dissolve, which could impact the Indian monsoon season negatively. It is still early days to call out an El Nino, and a more accurate forecast will be made available by April. But it is always exemplary to factor in such possible risks early & align the portfolios accordingly.

Before getting into the details, let’s understand what El Nino is & how it will impact the economy & finally, your portfolio.

What is El Nino?

El Nino refers to changes in the direction of winds and the flow of warm water currents that increase the surface temperature of parts of the Pacific Ocean. It affects rainfall in different parts of the world.

- As per experts on an average El Nino conditions occur every 2-7 years, however they do not occur on a regular schedule.

- The effect of which is felt for 9-12 months, but sometimes can last even longer.

- The latest forecast by National Oceanic and Atmospheric Administration, a US regulatory agency for weather predictions, has indicated that the El Nino may start from July onwards.

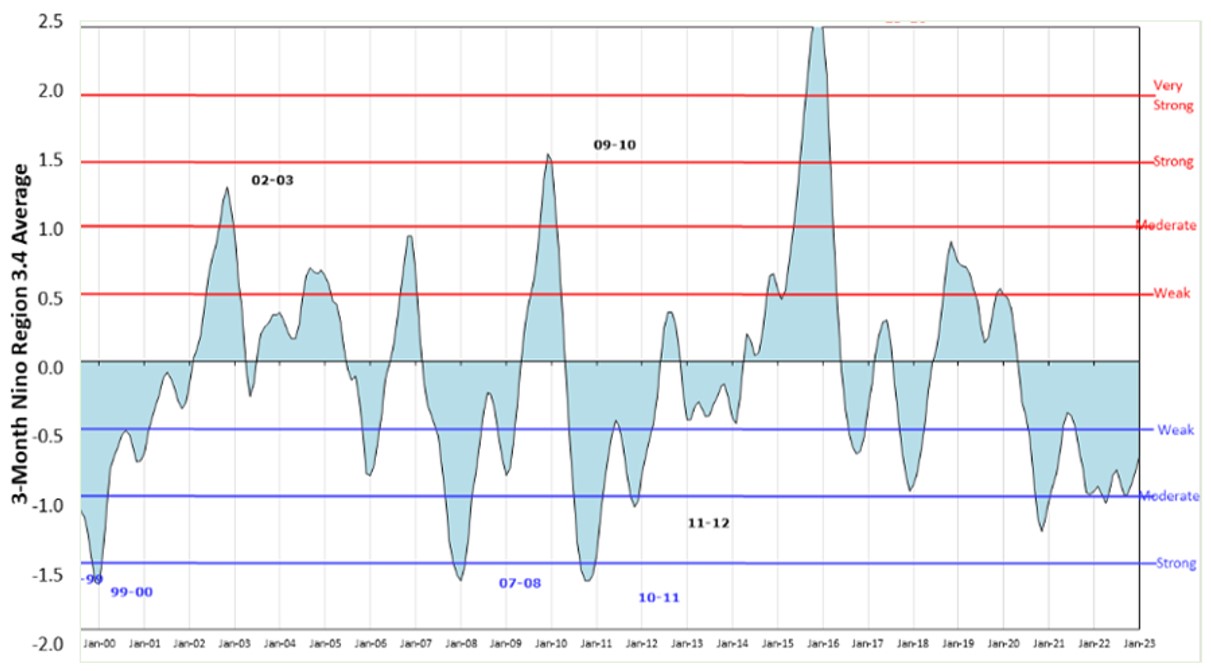

Past occurrence of El Nino & intensities since FY01

| El Nino – 7 | ||

| Weak – 4 | Moderate – 2 | Very Strong – 1 |

| 2004-05 | 2002-03 | 2015-16 |

| 2006-07 | 2009-10 | – |

| 2014-15 | – | – |

| 2018-19 | – | – |

Source: ggweather.com. Data is based on the Oceanic Nino Index de-facto standard that NOAA uses.

Some estimates suggest that most of droughts in India over the past many years have been linked to an El Nino event.

El Nino & its impact:

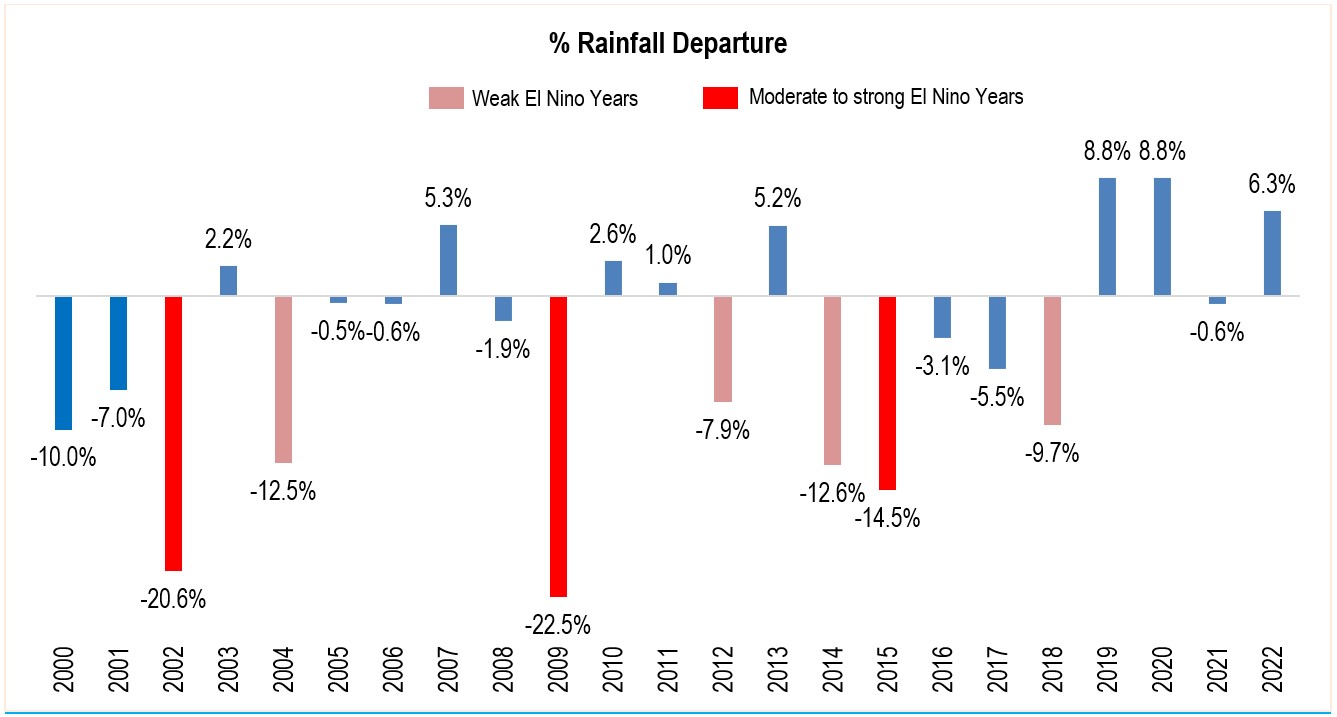

1. Impact on rainfall departure

Source: CMIE

The above data shows that the weak monsoon is clearly attributed to the El Nino event. We have rainfall impacting significantly during moderate to strong El Nino events. Rainfall departure during moderate to strong El Nino events of 2002, 2009 & 2016 was down by 20.6%, 22.5% & 14.5 respectively.

Even though India had a great monsoon in 2022, the expectation of El Nino in 2023 may severely impact the rainfall.

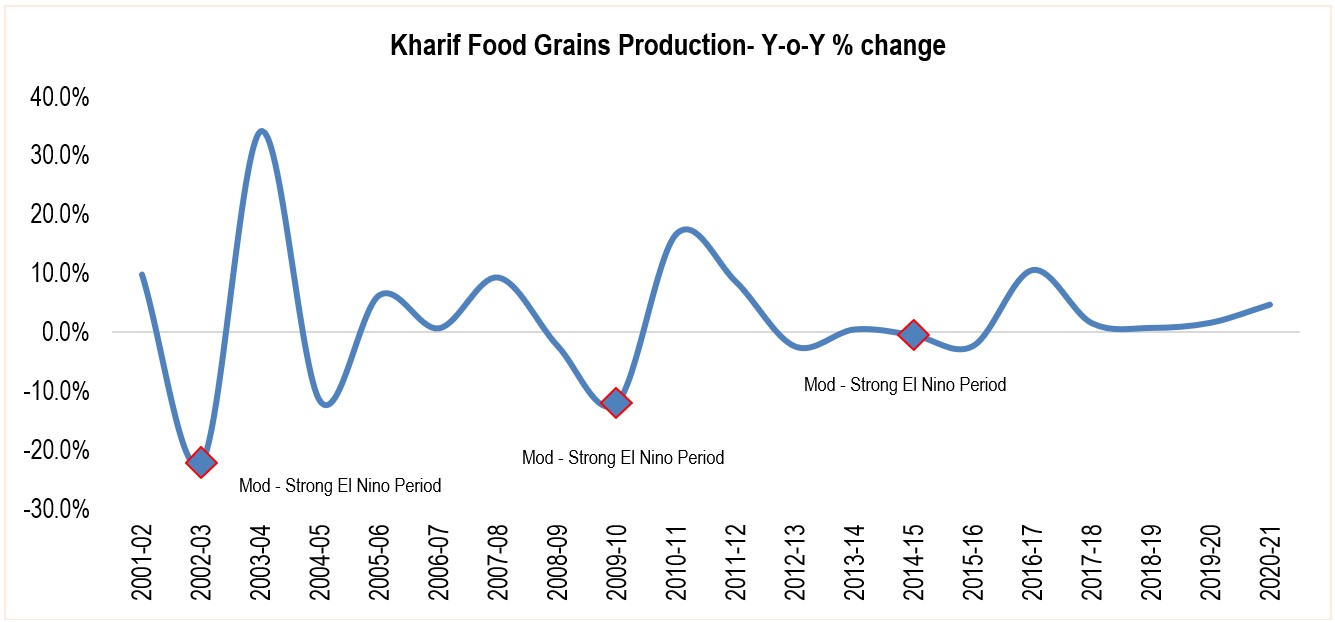

2. Impact on kharif food grains production:

Source: CMIE

Kharif food grain production of several commodities, such as rice, maize, ragi, pulses, soya bean, groundnut, etc., was severely impacted during the moderate to strong El Nino events. We have seen a dip in production in the 10-25% range amid such periods.

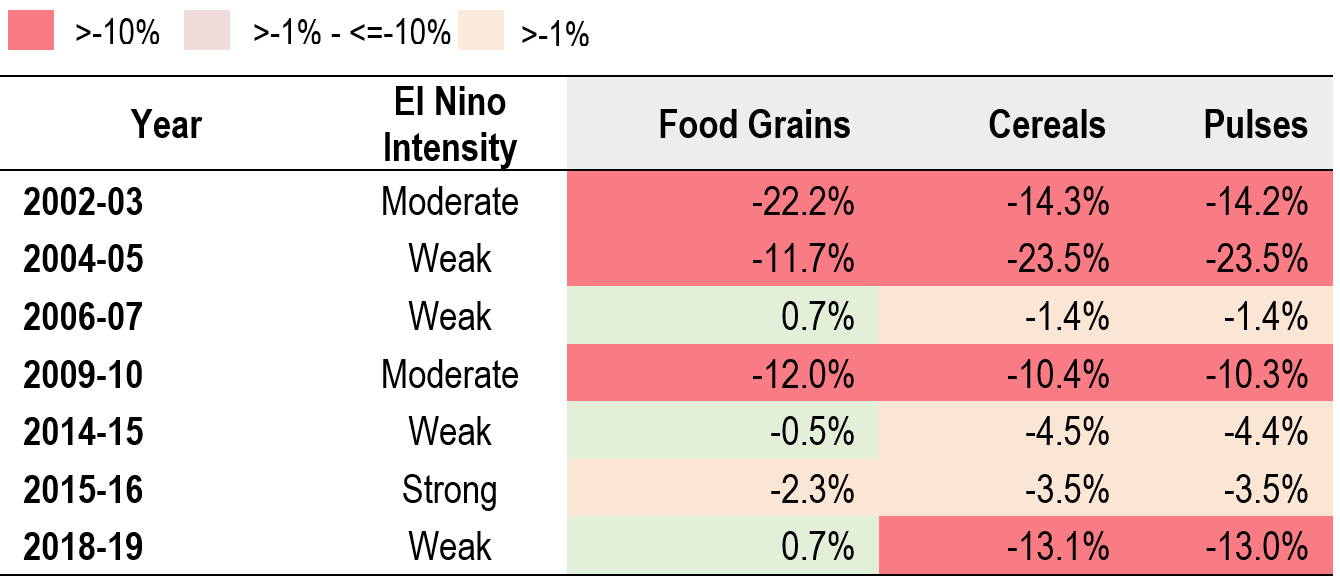

Kharif Production – Category wise Split (Y-o-Y % change)

Source: CMIE

Simply put, severe El Nino event affects the monsoon and things related to monsoon. Ultimately, it funnels down to the bigger problem, “Inflation” & finally the “economic growth”

Current context:

The world is currently experiencing the repercussions of what was referred to as a rare occurrence earlier – hybrid inflation. Hybrid inflation is far more difficult to contain as its ripples reach the farthest corners of the economy.

India is not an exception. Even India’s inflation print exceeds the upper threshold limit of 6%. Headline inflation excluding vegetables has risen well above the upper tolerance band and may remain elevated per RBI’s MPC minutes. Most cereal prices have increased substantially due to the supply chain challenges from Dec ’21 – Dec ’22. We have recently seen a correction in the prices of certain commodities, and it has provided some hope. However, considering an expectation of El Nino in 2023 may hurt the production of cereals & pulses and, ultimately, the prices.

The higher inflation could provide another reason for central banks to tighten the monetary policy, which will have consequences on the overall economy & markets.

Key Takeaways:

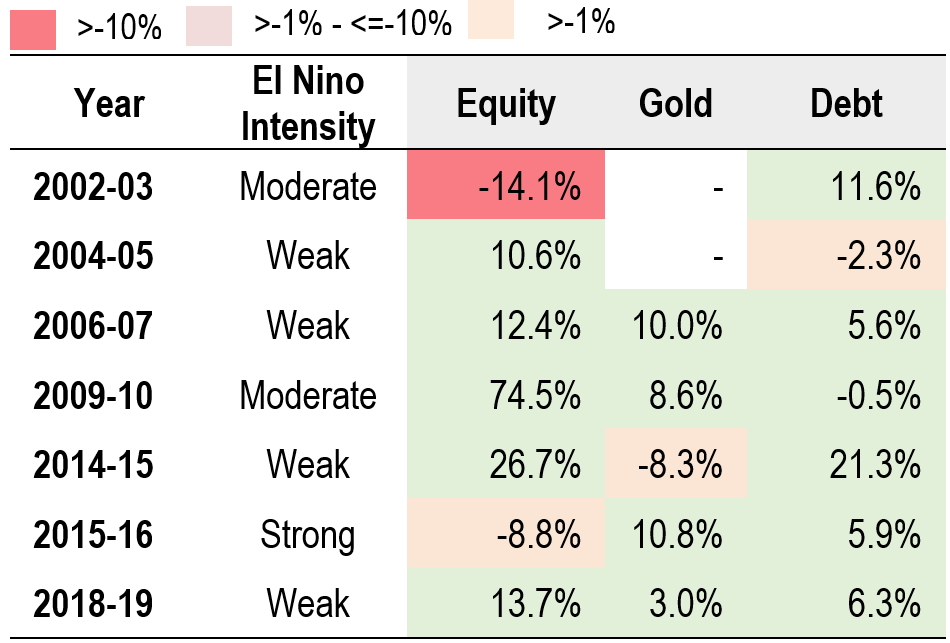

Source: ACE MF. Fisdom Research. For Equity: Nifty 50, For Gold: MCX Gold Spot Price & for Debt: SBI Magnum Gilt mutual fund NAV has been considered.

Historically, markets have reacted negatively to the moderate to strong El Nino events except FY10, where we have seen recovery rally post GFC but rest in all cases it looks like India’s strong fundamentals have taken over the El Nino impact.

It is still early to call out an El Nino, and a more accurate forecast will be made available by April. But it is always exemplary to factor in such possible risks early & align the portfolios accordingly. We suggest investors to focus on target asset allocation basis their risk profile, time horizon.

Another food for thought is, staying out of the market may not be right option instead managing the asset allocation will be an important task that investors need to undertake.

Markets this week

| 06th March 2023 (Open) | 10th March 2023 (Close) | %Change | |

| Nifty 50 | 17,680 | 17,413 | -1.5% |

| Sensex | 60,007 | 59,135 | -1.5% |

Source: BSE and NSE

- Markets witnessed volatility and ended on a negative note.

- The market started off the week on a positive note however all gains were erased on Thursday raising concerns over Fed rate hike and again on Friday following concerns around Silicon Valley Bank.

- Investors sentiment took a hit after Fed Chair Jerome Powell’s stated that the central bank will likely need to raise interest rates for a longer period. He said that the Fed is all set to take larger rate hikes following strong economic data and will likely move in larger steps if future economic data indicates tougher measures to control inflation.

- On Friday, US banks witnessed $50 bn sell off prompted by the crisis at Silicon Valley Bank. Along with this US payroll data also worried investors globally.

- Surprisingly, foreign investors bought equities worth Rs. 1770 crore and DIIs also bought equities worth Rs. 1212 crore during the week. In March 2023 so far, FII’s and DII’s bought equities worth Rs. 14,362 crore and Rs. 6929 crores respectively.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| NTPC | ▲ +4.72% | Bajaj Finance | ▼ -3.70% |

| Bajaj Auto | ▲ +2.41% | M&M | ▼ -3.30% |

| Power Grid Corporation | ▲ +2.00% | ICICI Bank | ▼ -2.98% |

| Adani Ports and SEZ | ▲ +1.92% | Kotak Mahindra Bank | ▼ -2.95% |

| TATA Motors | ▲ +1.83% | SBI Life Insurance | ▼ -2.95% |

Source: BSE

Stocks that made the news this week:

?NTPC stock price rallied 4.72 percent in the week gone and have been rallying since past one month. The reason for this incessant rally can be attributed to surge in demand for power in the last two months. Power generation in the last two months has seen double digit growth. NTPC also aims to add more than 5 GW of new commercial capacities in the next couple of years which according to brokerages is a key positive trigger for further rally in the stock.

?Mahanagar Gas announced acquisition of Unison Enviro for Rs. 531 crores. The acquired company is a city gas distribution company just like Mahanagar Gas. Citi has maintained a ‘buy’ call on the stock as the brokerage believes the acquisition has the potential to improve the long-term growth.

?Wipro announced that it has been selected by Menzies Aviation, the world’s largest aviation services company, to transform its air cargo management services. The cargo handling tech of Wipro will be implemented for Menzines Aviation to improve business efficiencies, enhance employee experience and automate customer services.

?Adani group has prepaid loans worth Rs 7,374 crore, which were taken against company shares as collateral, ahead of the maturity as the conglomerate tries to assuage investor concerns over its ability to manage debt obligations.