Market Overview |

|

Source: Trading View, Fisdom Research

Investors, in their endeavour to navigate the market, frequently enter when excitement is at its peak and exit when optimism turns to pessimism. Interestingly, it’s often their hasty exits that lead to significant losses.

Emphasizing only the timing of entry is akin to viewing only half of a painted picture. The other aspect is re-entry because, without it, the financial picture remains incomplete. Even in a contest, receiving a prize necessitates active participation. As you become more acquainted with the concept of “Re-Investment Risk,” you’ll develop a more nuanced understanding of market behaviour.

Investors frequently attribute their exits to market volatility and seek safer alternatives, assuming the market will decline rather than provide returns during their investment horizon. However, our analysis suggests a different perspective.

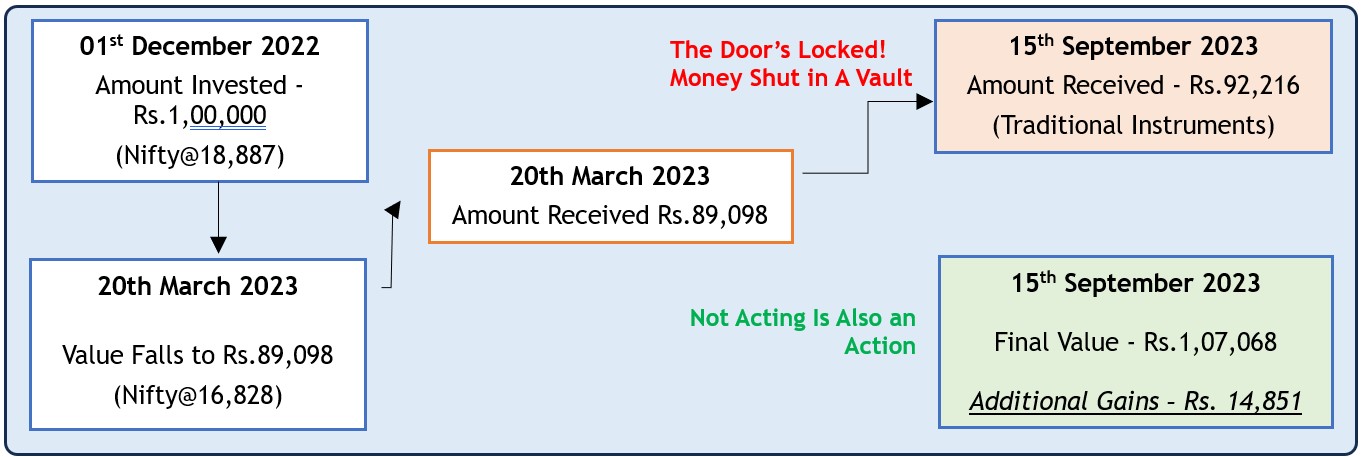

Case in point 1: Year 2023 |

|

Traditional deposit rates have been assumed at 7% annualize & we have considered for six months

| FYI: Investors who chose to remain invested throughout market downturns have achieved returns that are 16 percentage points higher than those who redeemed their investments and reinvested in safer assets. |

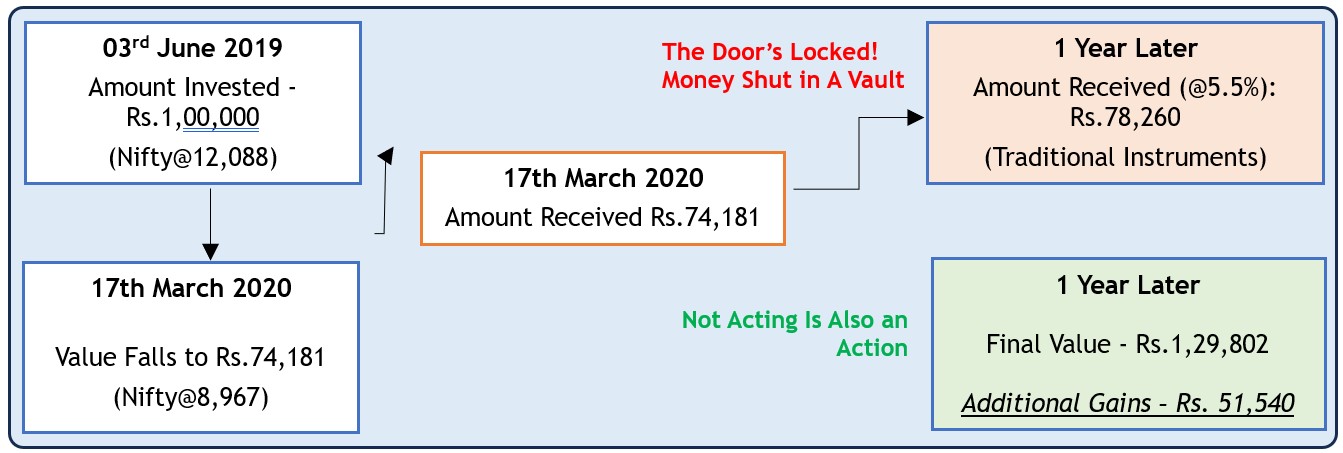

Case in point 2: Year 2020

|

|

| FYI: Investors who chose to remain invested throughout market downturns have achieved returns that are 28 percentage points(annualized) higher than those who redeemed their investments and reinvested in safer assets. |

Then, what is the strategy to adopt in times like this?

While your investment horizon and goals should always be your primary considerations, maximizing returns in volatile markets can be facilitated by two key factors:

1. Step up your SIPs/investments during market drawdowns:

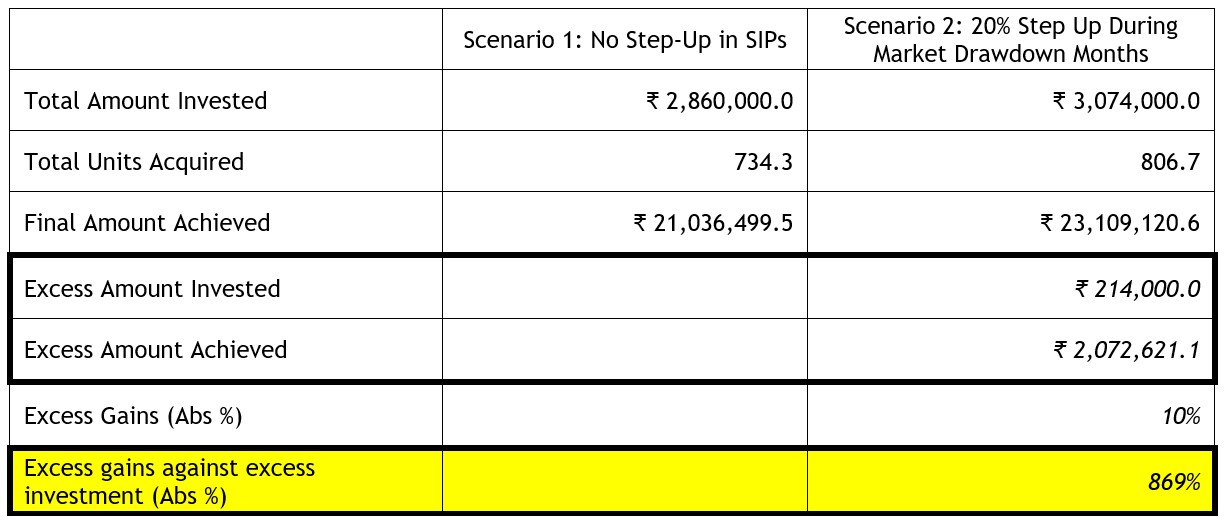

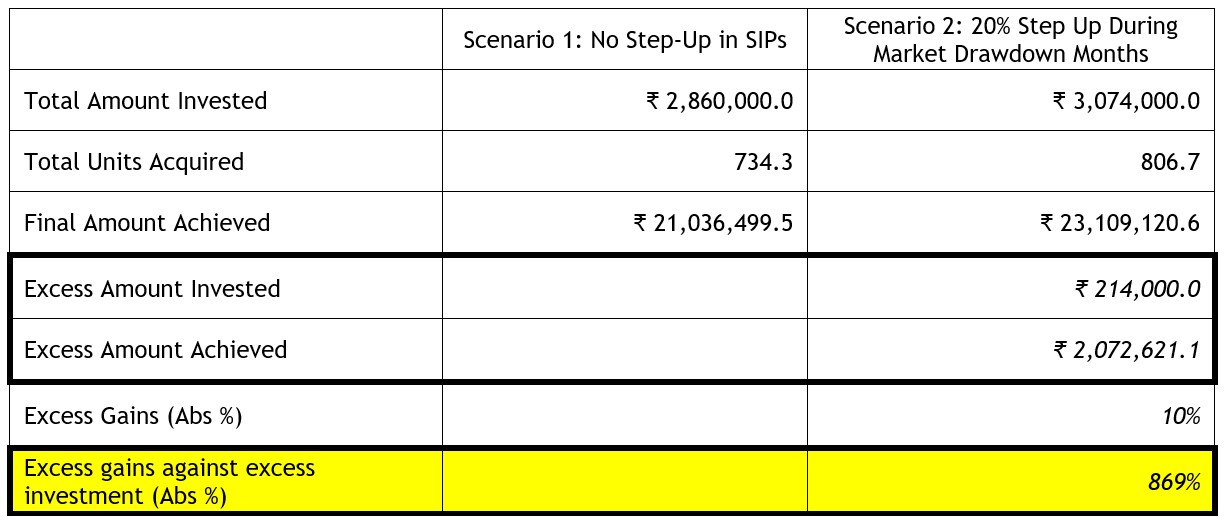

|

|

Source: ACE MF, Fisdom Research. Data for Nifty 50 TRI has been considered. SIP investment of Rs.10,000 has been considered from 01st Jan 2000 till 01st Oct 2023. Market drawdown months has been considered basis the Fisdom research’s internal analytics.

Stepping up investments during market downturns can significantly boost returns, as demonstrated by Scenario 2.

FYI:

- Market downturns are typically characterized by higher volatility. Stepping up your investments during these times allows you to harness this volatility for your benefit, as asset prices can rebound significantly during market recoveries.

- The 869% excess gains against the excess investment illustrate the remarkable potential for substantial growth by capitalizing on market drawdowns. This means that for the additional amount you invested (₹ 214,000.0 in this case), you achieved returns that were nearly nine times that amount (₹ 2,072,621.1).

- By stepping up investments during market downturns, you are enhancing your potential for long-term wealth accumulation. This strategy takes advantage of market cycles and can lead to more robust financial outcomes over time.

2. Follow Asset Allocation Discipline

Asset allocation rebalancing plays a vital role in achieving consistent and sustainable returns in your investment journey. While staying invested for the long term has its merits, actively managing your portfolio through rebalancing is essential to navigate market volatility effectively.

Case in point: How Asset Allocation Contributed to Improved Outcomes in the Past Year

|

| Portfolios | Returns | | E:90%, D:5%, G:5% | 8.40% | | E:70%, D:20%, G:10% | 9.20% | | E:50%, D:30%, G:20% | 10.70% | | E:20%, D:60%, G:20% | 10.80% | | E:100% | 7.60% | | D:100% | 8.20% | | G:100% | 22.00% |

|

Source: ACE MF, Fisdom Research. E represents Nifty 50 TRI; D represents Nifty 10 Year Benchmark G-sec & G represents gold international.

Rebalancing isn’t just about shifting assets around; it’s also about adding more to your investments. This approach encourages saving consistently and contributes to your ability to earn more returns for incremental investments. It instills the habit of regular saving and disciplined wealth accumulation.

Whether you’re a seasoned investor or just beginning your financial journey, adopting this approach can significantly impact your long-term success.

With this We wrap up our short overview of the most frequently asked question this week: “What strategies can help us make the most of this market volatility?

Keep writing/sharing to/with us and we shall incorporate your thoughts in our weekly newsletter!

Happy Weekend!

|

Markets this Week | | 30th Oct 2023 (Open) | 3rd Nov 2023 (Close) | %Change | | Nifty 50 | ₹19,013 | ₹19,230 | 1.15% | | Sensex | ₹63,492 | ₹64,364 | 1.37% |

Source: BSE and NSE |

- Domestic market benchmarks Nifty 50 and the Sensex ended higher for the second consecutive session on Friday, November 3, amid broadly positive global cues as the risk appetite of investors improved on hopes that the end of monetary policy tightening is near.

- The world’s major central banks, including the US Federal Reserve, the Bank of England and the European Central Bank, left rates unchanged this month, fueling hopes that interest rates have peaked.

- All sectoral indices ended in the green on the NSE, with Nifty Realty jumping 2.54 percent.

- The BSE midcap index rose 0.7% and the smallcap index a Percent

- Foreign institutional investors (FIIs) extended their selling spree on Friday, November 3, even as domestic markets rose for the second consecutive session amid positive cues. The domestic institutional investors (DIIs) infused ₹403 crore in Indian stocks today.

- FIIs cumulatively bought ₹7,739.00 crore of Indian equities, while they sold ₹7,751.43 crore , resulting in an outflow of ₹12 crore on Friday.

- Meanwhile, DIIs infused ₹7,932.73 crore and offloaded ₹7,530.04 crore, registering an inflow of ₹402.69 crore.

|

|

Weekly Leader Board

NSE Top Gainers | Stock | Change (%) | | Bharat Petroleum | ▲ 7.9 | | Apollo Hospitals | ▲ 6.7 | | Titan Company | ▲ 4.9 | | Hindalco Indus | ▲ 4.2 | | UltraTech Cement | ▲ 3.8 |

| NSE Top Losers | Stock | Change % | | Mahindra & Mahindra | ▼ -2.8 | | Maruti Suzuki India | ▼ -2.7 | | Dr. Reddy’s Labs | ▼ -2.5 | | Tata Steel | ▼ -2.2 | | Bajaj Finserv | ▼ -1.9 |

|

Source: BSE |

Stocks that made the news this week:

- Zomato share prices gained more than 10% and scaled 52-week highs of ₹120 on Friday after the company reported a net profit of ₹36 crores during July-September quarter for fiscal 2023-24 (Q2FY24) against a net loss of ₹251 crores in the corresponding period last year.

- InterGlobe Aviation, the company behind IndiGo, reported a profit of Rs 188.9 crore in Q2 2023, a significant improvement from the Rs 1,583.33 crore loss in the same period the previous year. Revenue from operations for IndiGo, India’s largest airline, increased by 19.5% to Rs 14,943 crore, driven by a surge in domestic travel demand over the past three quarters.

- Titan Company Ltd. reported a consolidated net profit of Rs 916 crore for Q2 FY24, a 9.7% increase from the same quarter in the previous fiscal year. The company also saw a 21.16% rise in profit from the previous quarter. Total consolidated revenue reached Rs 12,529 crore, marking a 36.73% increase from the year-ago quarter and a 5.31% increase from the previous quarter. Earnings before interest, tax, depreciation, and amortization (EBIDTA) grew by 9.8% to Rs 1,355 crore, with an EBIDTA margin of 11.6%, down from 14.1% in the previous year

|

|

Please visit www.fisdom.com for a standard disclaimer.

|