Daily Snippets

Date: 01st January 2024 |

|

|

Technical Overview – Nifty 50 |

|

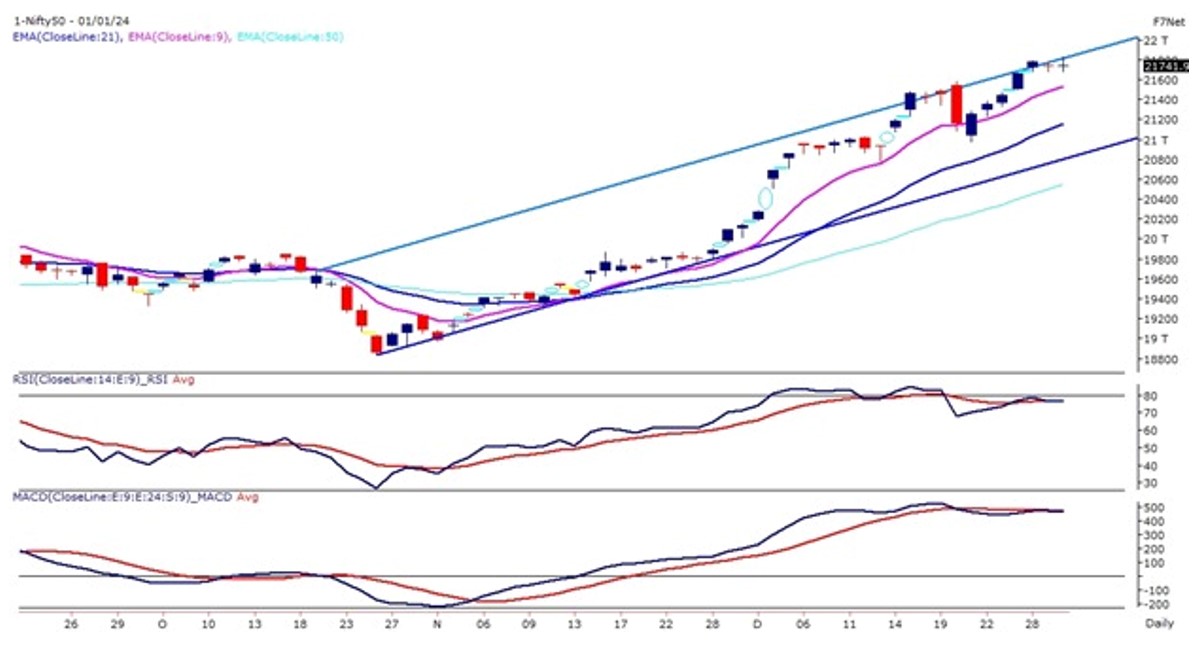

The last 30 minutes of selling forced the index to drift near 21,700 levels and formed a Doji candle stick at the start of 2024. The Nifty50 on the daily chart is trading within the rising channel pattern and prices have presently reached near the upper band of the pattern and have formed 2 minor bearish candles on the daily chart.

The Index continues to trade in a higher high higher bottom formation and prices are trading above its 9 & 21 EMA. The momentum oscillator RSI (14) is reading near 80 levels and has formed a bearish divergence where prices have made a new high but the oscillator rejected to do so.

In the last 30 minutes, the prices witnessed a strong sell-off and the index crossed below 9 EMA on the intraday chart and formed a bearish candle on the daily chart. The immediate support for the Index is placed at 21,550 – 21,500 levels and the upside is capped near 21,850 levels.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty has witnessed a whipsaw of a bullish breakout on the daily chart and prices drift near 48,000 levels. The Banking index has formed a Doji candle stick on the daily chart which indicates a volatile trading session.

The Banking index on the daily chart is trading in a higher high higher low formation indicating a perpetual bullish tone in the market.

The Banking Index continues to trade above the breakout levels and is trading above its 9 & 21 EMA. The momentum oscillator RSI (14) is reading near 65 levels and the momentum is strongly poised towards a bullish stance.

The positive takeaway from today’s trading session was that the Bank Nifty still appears to be the only bullish deal in the town as the index has taken support near 9 EMA. The immediate support for the Index is placed at 48,000 – 47,800 levels and the upside is capped near 48,700 levels.

|

Indian markets:

- Indian equity indices ended the New Year’s first day with minimal change in a highly volatile session, hitting fresh record highs initially.

- The market began with slight losses and mostly stayed negative, but last-hour buying pushed BSE Sensex and Nifty50 to new record levels of 72,561.91 and 21,834.35. However, profit booking wiped out the gains, resulting in a marginal uptick at the close.

- Starting on a cautious note, PSU Banks and IT stocks led the Index’s recovery. FMCG and Metal counters boosted the rally, but steep profit booking in the last session nullified some gains.

- Mid and Smallcaps sustained their morning gains, surpassing the Frontline Index.

|

Global Markets

- Asia-Pacific markets closed mostly lower on 2023’s final trading day. China’s tech stocks rose, but Xiaomi’s electric-vehicle plans caused its Hong Kong shares to fall over 4%. Japan’s Nikkei 225 emerged as the region’s top performer, gaining over 28%.

- China and Hong Kong indexes saw significant losses for the year, with Hang Seng down by 14% and CSI 300 by 11.8%. South Korea and Australia markets ended the year positively.

- US stocks closed modestly lower on Friday, the last trading day of 2023, capping a robust year-end rally as investors eyed easier monetary policy in the year ahead.

|

Stocks in Spotlight

- Vodafone Idea saw a robust surge in its shares, trading with significant volumes as investors anticipate the company’s fundraising strategy amidst its telecom challenges. The stock soared by almost 6 percent, witnessing 188 crore shares traded, a notable increase from the usual weekly average of 69 crore.

- The stock of Yes Bank rose by 4.66 percent following the bank’s receipt of Rs 150 crore from a solitary trust as part of the security receipts portfolio subsequent to the sale of the NPA portfolio.

- GMR Power and Infra experienced a 3 percent intraday increase in its shares after providing corporate guarantees worth Rs 228 crore to the Indian Renewable Energy Development Agency (IREDA) on December 30. However, despite this initial rise, the stock reversed its gains and closed 3.29 percent lower, ending up in negative territory by the end of the trading session.

|

News from the IPO world🌐

- Esconet Technologies IPO: Delhi-based IT company files DRHP

- India emerged as a leader in IPOs in 2023

- Emmforce Autotech files draft papers; to mop-up funds via IPO

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | NESTLEIND | ▲ 3 | | ADANIENT | ▲ 1.9 | | ADANIPORTS | ▲ 1.6 | | COALINDIA | ▲ 1.6 | | TECHM | ▲ 1.6 |

| Nifty 50 Top Losers | Stock | Change (%) | | EICHERMOT | ▼ -2.6 | | BHARTIARTL | ▼ -2 | | M&M | ▼ -1.6 | | BAJAJ-AUTO | ▼ -1.5 | | HINDALCO | ▼ -1.2 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY MEDIA | 1.78 | | NIFTY OIL & GAS | 0.81 | | NIFTY PSU BANK | 0.76 | | NIFTY FMCG | 0.54 | | NIFTY IT | 0.51 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 2509 | | Declines | 1385 | | Unchanged | 153 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,690 | (0.1) % | 13.7 % | | 10 Year Gsec India | 7.2 | 0.30% | -0.20% | | WTI Crude (USD/bbl) | 72 | (5.0) % | (6.7) % | | Gold (INR/10g) | 63,188 | 0.40% | 13.30% | | USD/INR | 83.16 | (0.1) % | 0.6 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|