Daily Snippets

Date: 02nd January 2024 |

|

|

Technical Overview – Nifty 50 |

|

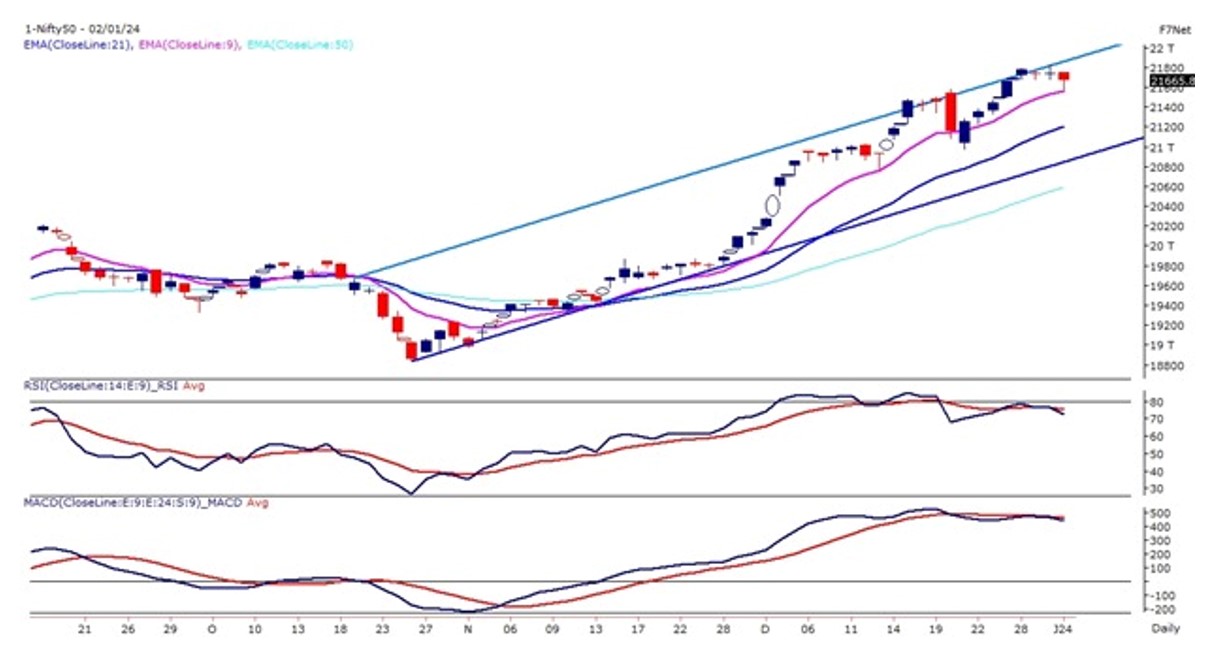

The Benchmark Index started with a bearish note and made an intraday low at 21,555 levels and post that witnessed a smart recovery from the lowest point of the day. The Nifty has taken a pinpoint support near 9 EMA and has formed a bearish candle but with a tall wick which indicates reversal from the lower levels.

The Nifty50 on the daily chart is trading within the rising channel pattern and prices have presently reached near the upper band of the pattern and have formed 2 minor bearish candles on the daily chart. The Index continues to trade in a higher high higher bottom formation and prices are trading above its 9 & 21 EMA. The momentum oscillator RSI (14) is reading near 80 levels and has formed a bearish divergence where prices have made a new high but the oscillator rejected to do so.

Well, if today’s trading action at Dalal Street is described with one word, that would be “volatility”. The immediate support for the Index is placed at 21,550 – 21,500 levels and the upside is capped near 21,850 levels.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty has witnessed a whipsaw of a bullish breakout on the daily chart and prices drift below 48,000 levels. The Banking index has formed a tall red candle stick on the daily chart which indicates a profit booking scenario.

The Banking Index on the daily chart has closed below its 9 EMA and has given a rising channel pattern breakdown on the intraday charts. The selling in the private sector banks was aggressive which led the banking index to drift further lower.

The momentum oscillator RSI (14) is reading near 60 levels and has formed a bearish divergence where prices have made a new high but the oscillator rejected to do so. The immediate support for the Index is placed at 47,500 – 47,300 levels and the upside are capped near 48,500 levels.

|

Indian markets:

- Stock market declined due to profit-booking and concerns over Red Sea disruptions affecting global supply chains and freight costs.

- Nifty closed below 21,700, hitting a high of 21,755.60 earlier; demand surged for pharma, healthcare, and energy stocks but declined for autos, private banks, and IT stocks.

- Expectation of market euphoria waned as investors turned cautious before the Q3 earnings season, commencing with TCS and Infosys on January 11, 2024.

|

Global Markets

- The Dow Jones index futures were down 177 points, indicating a weak opening in the US stocks today.

- European shares declined while most Asian stocks settled lower on the first trading day of the year. Japan was assessing the damage from a powerful earthquake that struck its central region on New Years Day. Markets in the region are closed until January 4.

- A private survey showed manufacturing activity in China expanded in December. The Caixin manufacturing purchasing managers index came in at 50.8 in December, according to a release Tuesday, following a 50.7 reading for November. China’s official PMI fell to 49 in December from 49.4 the previous month, the country’s National Bureau of Statistics said in a Sunday release.

- U.S. markets were closed on Monday for New Year Day.

|

Stocks in Spotlight

- Alok Industries’ stocks soared by 20 percent, hitting the upper circuit, following Reliance Industries’ subscription to non-convertible redeemable preferential shares valued at Rs 3,300 crore.

- Vodafone Idea experienced a 5.59 percent decline in its shares subsequent to the company refuting reports suggesting discussions with Starlink, the service promoted by Elon Musk, for managing its services in India.

- NMDC’s shares climbed 2.81 percent following a hike in prices for lump ores and fines. Additionally, the company’s production in 2023 surged by 18 percent compared to its 2022 levels.

|

News from the IPO world🌐

- Divine Power Energy plans to launch IPO by March, eyes Rs 400 crore turnover by 2026

- Rays Power Infra IPO: Mumbai-based solar EPC company files DRHP

- Engineering solutions provider Diffusion Engineers files DRHP for IPO

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | DIVISLAB | ▲ 3.1 | | ADANIPORTS | ▲ 3 | | SUNPHARMA | ▲ 2.8 | | COALINDIA | ▲ 2.6 | | CIPLA | ▲ 2.6 |

| Nifty 50 Top Losers | Stock | Change (%) | | EICHERMOT | ▼ -3.6 | | M&M | ▼ -2.5 | | ULTRACEMCO | ▼ -2.5 | | LT | ▼ -2.4 | | KOTAKBANK | ▼ -2.3 |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY PHARMA | 2.46 | | NIFTY HEALTHCARE INDEX | 1.91 | | NIFTY OIL & GAS | 0.66 | | NIFTY MEDIA | 0.49 | | NIFTY METAL | 0.3 |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1906 | | Declines | 1904 | | Unchanged | 119 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 37,690 | (0.1) % | 13.7 % | | 10 Year Gsec India | 7.2 | 0.20% | 0.00% | | WTI Crude (USD/bbl) | 72 | (0.2) % | (6.9) % | | Gold (INR/10g) | 63,084 | 0.10% | 13.40% | | USD/INR | 83.04 | (0.1) % | 0.0 % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|