Technical Overview – Nifty 50

The Benchmark Index ended with a gain of more than 150 points in the truncated week and formed a bullish candle on the daily frame. In the last 30 minutes of the trade, the Nifty witnessed a sharp profit booking and price losses of more than 200 points from the high.

After forming a hammer candle stick pattern in its previous week the Index found support at lower levels and witnessed a strong reversal.

The Index on the daily chart has given a strong sustainable V-shape reversal rally from 21,700 levels to 22500 levels in just five trading sessions. The volatility was a hallmark of the March series where prices traded both ways for the majority of the time but finally witnessed a breakout above 22,200 levels.

The bullish golden cross is visible on the daily chart where 9 EMA has crossed above 21 EMA which is an aggressively positive signal for the Nifty50.

From a technical perspective, Nifty’s aggressive upside targets are still at their all-time high at the 22,600 mark. The support for the Index is placed at 22,100 levels.

Technical Overview – Bank Nifty

The Banking Index ended with a gain of more than 250 points in the truncated week and formed a bullish candle on the daily frame. In the last 30 minutes of the trade, the Bank Nifty witnessed a sharp profit booking from the higher levels of more than 400 points.

After forming a hammer candle stick pattern in its previous week the Bank Nifty found support at lower levels and witnessed a strong reversal.

The Bank Nifty on the daily chart has given a smaller degree downward sloping trend line breakout above 47,000 levels. The Banking Index on the daily chart has given a strong sustainable V-shape reversal rally from 46,000 levels to 47,400 levels in just five trading sessions.

The Bank Nifty has closed above its 9, 21, and 50 EMA which is a positive sign for the index. The momentum oscillator RSI (14) has taken support of an upward rising trend line near 50 levels and moved higher with a bullish crossover.

From a technical perspective, Bank Nifty’s aggressive upside targets are placed at the 48,000 mark. The support for the Banking Index is placed at 46,500 levels.

Indian markets:

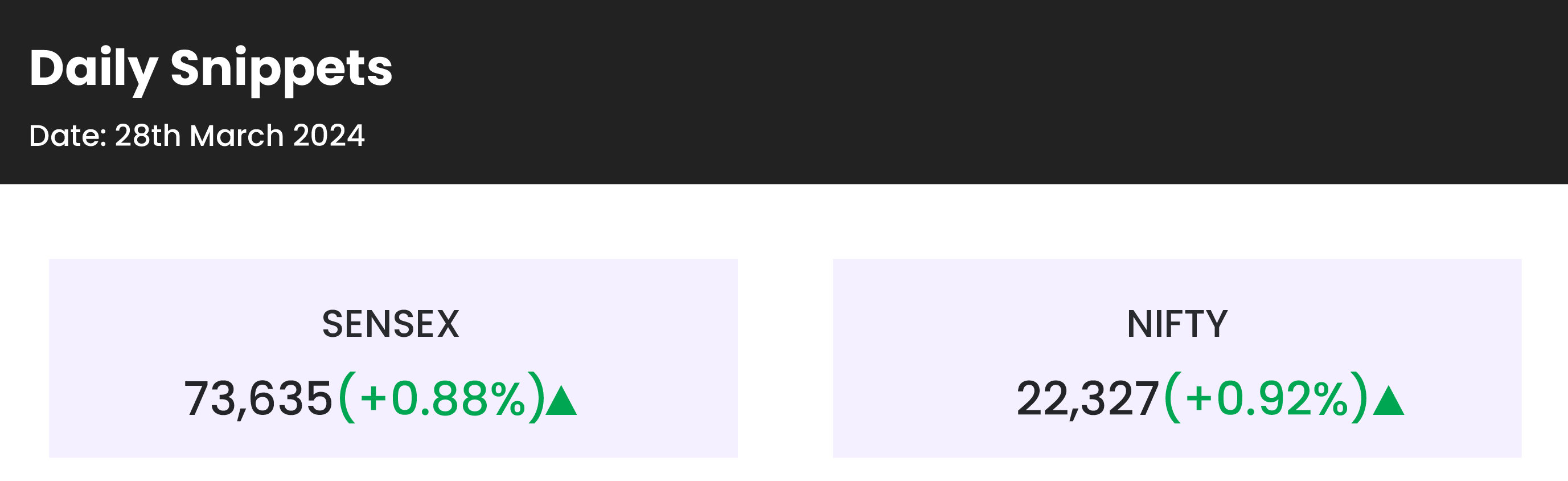

- Indian stock market benchmarks – the Nifty 50 and the Sensex – closed on a positive note on Thursday, March 28, marking the conclusion of the fiscal year 2024 with substantial gains.

- Today, the domestic stock market concluded the final trading day of FY24 on a high, buoyed by favorable global trends.

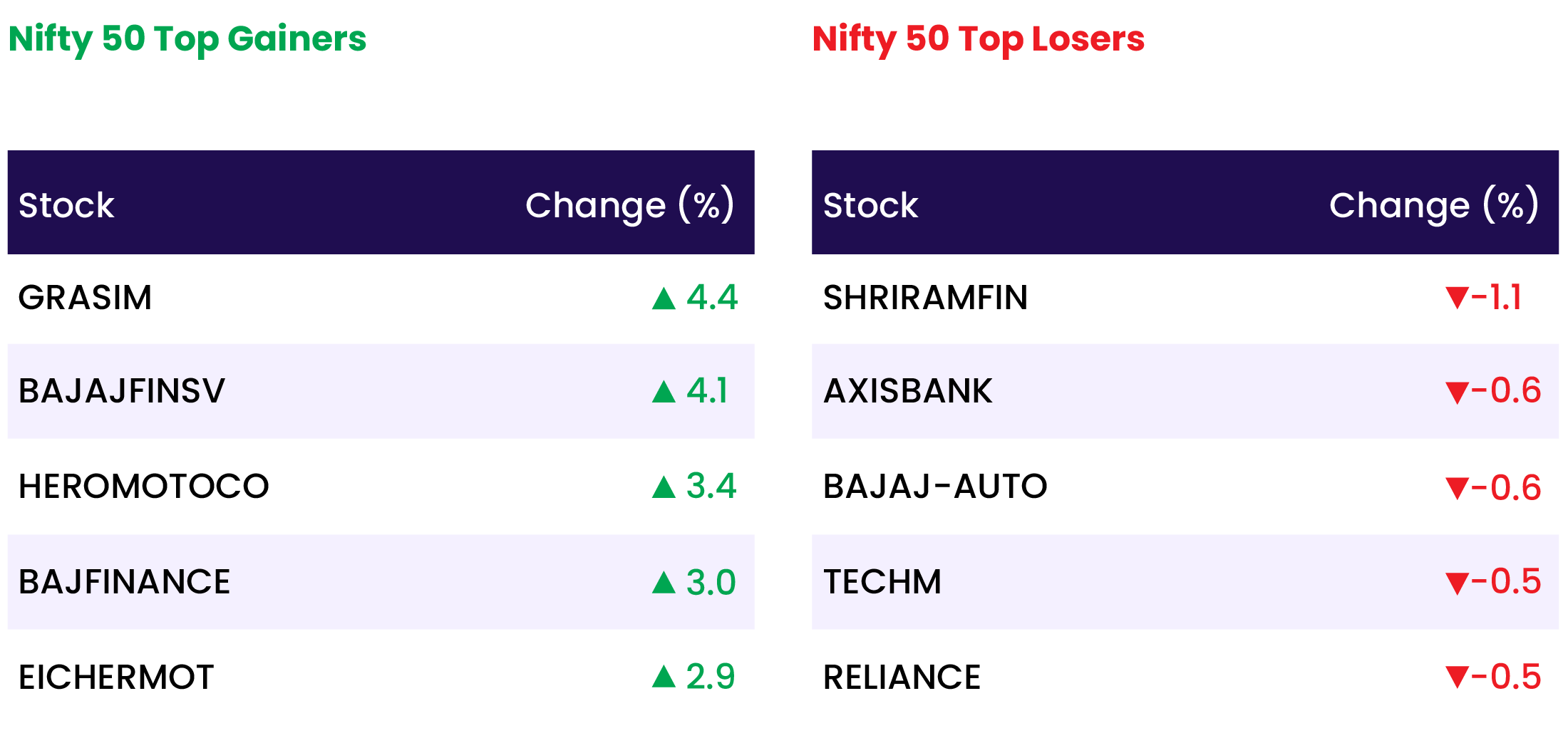

- Across the board, all sectoral indices finished in positive territory, with notable gains seen in auto, healthcare, metal, power, and capital goods, each rising by 1 percent. Additionally, sectors such as oil & gas, Information Technology, banking, real estate, and FMCG saw gains of 0.5 percent each.

- The BSE midcap index recorded an uptick of 0.6 percent, while the smallcap index witnessed a modest rise of 0.3 percent.

Global Markets:

- Japan stocks fell the most among Asian markets Thursday, while Australian stocks hit a record high, helped by a boost from mining shares. The Japanese yen remained near 34-year lows.

- Japan’s Nikkei 225 dropped by 1.46% to 40,168.07, while the broader Topix index retreated by 1.73% to settle at 2,750.81.

- In Australia, the S&P/ASX 200 closed 0.99% higher at 7,896.90 after reaching a peak of 7,901.20 during the trading session.

- China’s CSI 300 index saw a modest increase of approximately 0.52%, reaching 3,520.96. Reports emerged suggesting that China’s central bank might reintroduce treasury bond purchases, a strategy not utilized for over two decades.

- South Korea’s Kospi concluded the day with a marginal decrease of 0.3%, closing at 2,745.82, while the Kosdaq, representing smaller caps, dipped by 0.13% to reach 910.05.

- Hong Kong’s Hang Seng index exhibited a 1% gain, propelled by a notable 2.5% rise in the Hang Seng tech index.

- European markets displayed upward movement on Thursday morning, with consistent progress over the week driving the regional benchmark to its latest intraday peak.

Stocks in Spotlight

- VIP Industries witnessed a remarkable surge of 12.94 percent following the luggage maker’s disclosure of its growth strategy, outlining its primary objective of attaining double-digit revenue growth starting from Q4FY24. Additionally, it articulated an ambitious EBDITA target of 15 percent growth commencing from H2FY25. Subsequent to this announcement, Prabhudas Lilladher upgraded its rating on the stock from “hold” to “buy”.

- Bajaj Finance experienced a notable uptick of 3 percent in response to a Moneycontrol report indicating that its subsidiary, Bajaj Housing Finance, was contemplating a public offering, potentially valuing the company at $9-10 billion. The report, dated March 27, disclosed preliminary discussions initiated by Bajaj Housing Finance with several investment banks regarding a prospective initial public offering.

- Mahindra Lifespace Developers saw its stock surge by 4 percent subsequent to the company’s acquisition of land with an estimated revenue potential of Rs 225 crore. The location boasts favorable connectivity to tech parks and commercial offices, complemented by robust social infrastructure encompassing educational institutions, healthcare amenities, and retail outlets.

News from the IPO world🌐

- TATA Sons eyes mega monetization of assets via stakes sale, IPO

- SRM Contractors IPO marching towards 50x subscription on final day.

- Tata… Hello! Group back on D-Street, plans to launch several IPOs in 2-3 years

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 2.6 |

| NIFTY HEALTHCARE INDEX | 1.4 |

| NIFTY AUTO | 1.3 |

| NIFTY METAL | 1.3 |

| NIFTY PHARMA | 1.2 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1802 |

| Decline | 2024 |

| Unchanged | 112 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,760 | 1.2 % | 5.4 % |

| 10 Year Gsec India | 7.1 | (0.3) % | (0.5) % |

| WTI Crude (USD/bbl) | 81 | (0.3) % | 15.6 % |

| Gold (INR/10g) | 66,844 | 0.8 % | 4.1 % |

| USD/INR | 83.33 | (0.1) % | 0.4 % |

Please visit www.fisdom.com for a standard disclaimer