Daily Snippets

Date: 03rd August 2023 |

|

|

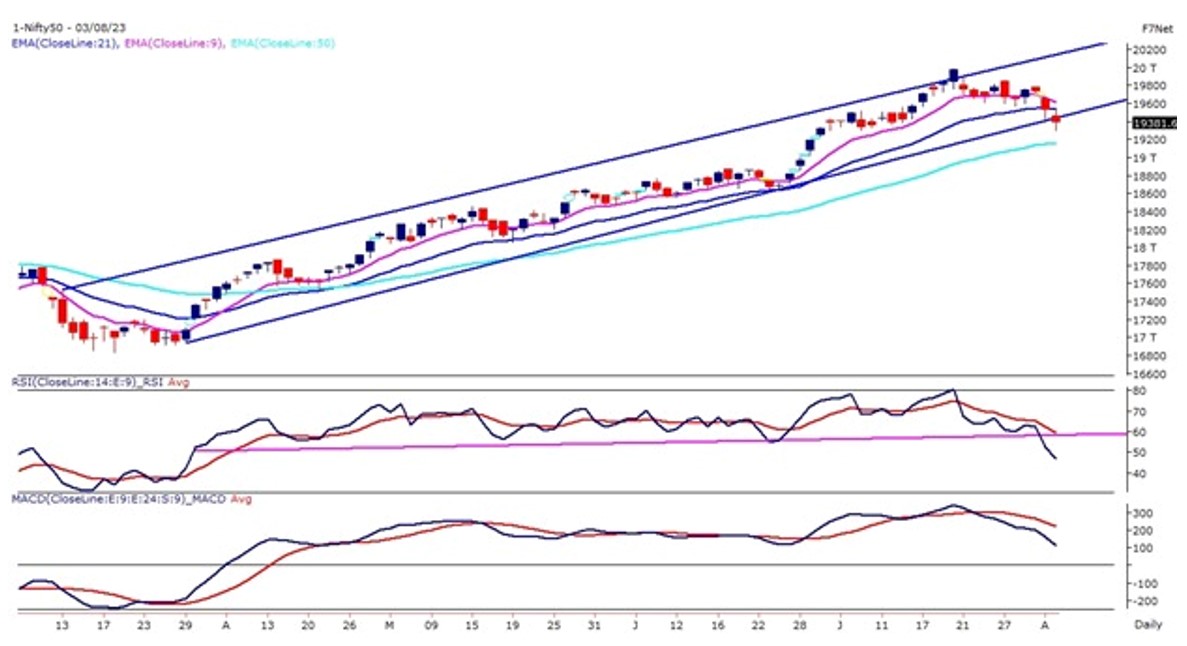

Technical Overview – Nifty 50 |

|

Nifty50 on the weekly expiry day witnessed a flat opening near 19,500 levels and manages to hover within the range for the majority of the time in the first half of the session. But as the day progressed index breached below its previous day’s low and witnessed a strong selling and prices recorded a low at 19,296.45 levels.

Post recording a day’s low prices took support near 19,300 levels and witnessed sharp short covering towards the close. The index on the daily chart has formed a spinning top candle stick pattern near the lower band of the rising channel pattern.

On the weekly chart, the benchmark is in the throwback mode of its bullish triangle pattern. The momentum oscillator RSI (14) has formed a bullish divergence on the intraday chart, suggesting that immediate bounce back cannot be ruled out.

Maximum Call Open Interest Build Up witnessed in 19700-19600 Call & on the Put Side Maximum Open Interest is being witnessed in 19500-19400 levels. The PCR ratio holds at 0.86. Presently the Benchmark index is at a make-or-break level, if prices closed below 19,300 levels we will be witnessing a bearish breakdown in the index. If prices sustain above 19,400 levels, then the immediate upside will likely be open till 19,600.

|

Technical Overview – Bank Nifty |

|

The Bank Nifty witnessed a 1% loss for the second consecutive day and prices closed at 44513 levels. The Bank Nifty on the daily chart has closed below its 50-day exponential moving average but witnessed a 200 points recovery towards the end.

The Banking index on the 60 mins charts has formed a bullish anti-bat harmonic pattern at 44,300 levels and presently trading within its PRZ levels. AN oversold oscillator and harmonic pattern on the smaller time frames indicate a possibility of a short covering in the coming trading sessions.

Maximum Call Open Interest Build Up witnessed in 45000-44500 Call & on the Put Side Maximum Open Interest is being witnessed in 44500-43500 call sellers implies 45000 to act as resistance while 44400 – 44200 will act as strong support.

The momentum oscillator RSI (14) has drifted below its trend line support which is placed at 50 levels and closed below the same on the daily time frame. The immediate support for the Bank Nifty stands at 44,200 levels and the index is likely to face resistance near 45,000 – 45,300 levels.

|

Indian markets:

- Domestic equity indices witnessed significant declines on Thursday, extending the three-day losing streak.

- The Nifty index dropped below the 19,400 level, with trading showing volatility due to the expiry of weekly index options on the NSE.

- Global stock markets were also impacted by Fitch’s recent downgrade of the US credit rating, contributing to the negative sentiment.

- Pharma and healthcare stocks experienced increased demand, while banks and financial services stocks faced a decline.

|

Global Markets

- Markets in Europe and Asia tumbled on Thursday, adding to steep losses in the previous session following a U.S. credit rating downgrade from Fitch and better-than-expected ADP employment data.

- The Bank of England on Thursday hiked its key interest rate for a 14th time in a row, by a quarter-point to 5.25% as UK inflation stays high. BoE hiked the rate to a 15-year peak and gave a new warning that borrowing costs were likely to stay high for some time.

- U.S. stocks suffered a wave of selling on Wednesday after a surprise downgrade of the countrys debt rating by Fitch, citing fiscal deterioration and repeated debt ceiling standoffs. Also, data showed U.S. private sector employment jumped by much more than expected in July, reviving Fed rate hike bets.

- U.S. private sector employment increased by 324000 jobs in July, and annual pay was up 6.2% year-over-year, adding to pressure on the Federal Reserve to maintain restrictive policy.

|

Stocks in Spotlight

- Vedanta, a major metal company, experienced a significant 7 percent slump in its stock price. This was the largest single-day fall since June 2022. The decline came after a large number of shares were sold in block deals by one of Vedanta’s promoter entities, Twinstar. The transaction, valued at $500 million or Rs 4,130 crore, had a floor price of Rs 258.5, which was a 5 percent discount to its previous closing price. As a result, the stock dropped as much as 9 percent during the trading session on that day.

- Dixon Technologies saw a significant 8 percent increase in its stock price. This jump came after the government announced restrictions on the import of electronic items like laptops, tablets, and personal computers. The government stated that these items can now be imported only with a license, and certain use cases have been exempted from the restrictions. This move by the government has positively impacted Dixon Technologies’ stock performance on the market.

- HPCL’s stock dropped nearly 2 percent following the release of its Q1 results, along with a series of brokerage downgrades. Despite this, the state-owned oil retailer reported a standalone profit of Rs 6,203.9 crore for the quarter ending June FY24, showing a significant 92.5 percent increase compared to the previous quarter, driven by strong operational performance. Additionally, the revenue from operations stood at Rs 1,11,960.6 crore in Q1FY24, marking a 3.7 percent rise over the previous quarter’s revenue of Rs 1,07,928 crore.

|

News from the IPO world🌐

- Concord Biotech, backed by Rakesh Jhunjhunwala’s firm sets IPO price band at Rs. 705-741

- Ashish Kacholia backed Aeroflex Industries gets SEBI nod for Rs. 350 crore IPO

- Textile Manufacturer Shri Techtex to roll out IPO

|

|

Day Leader Board

Nifty 50 Top Gainers | Stock | Change (%) | | ADANIENT | ▲ 2.50% | | ADANIPORTS | ▲ 2.00% | | EICHERMOT | ▲ 1.50% | | DIVISLAB | ▲ 0.90% | | HINDALCO | ▲ 0.60% |

| Nifty 50 Top Losers | Stock | Change (%) | | TITAN | ▼ -2.40% | | ONGC | ▼ -2.40% | | BAJAJFINSV | ▼ -2.40% | | ICICIBANK | ▼ -2.10% | | NESTLEIND | ▼ -1.90% |

| |

Sectoral Performance | Top Sectors | Day change (%) | | NIFTY PHARMA | 1.04% | | NIFTY MEDIA | 0.91% | | NIFTY HEALTHCARE INDEX | 0.68% | | NIFTY IT | -0.24% | | NIFTY CONSUMER DURABLES | -0.29% |

|

Advance Decline Ratio | Advance/Declines | Day change (%) | | Advances | 1717 | | Declines | 1846 | | Unchanged | 152 |

|

Numbers to track | Indices Name | Latest | % 1D | % YTD | | Dow Jones (US) | 35,283 | (1.0) % | 6.5 % | | 10 Year Gsec India | 7.2 | 0.60% | 4.20% | | WTI Crude (USD/bbl) | 79 | (2.3) % | 3.3 % | | Gold (INR/10g) | 59,117 | 0.10% | 7.90% | | USD/INR | 82.25 | (0.1) % | (0.5) % |

|

|

Please visit www.fisdom.com for a standard disclaimer.

|