Key priorities of the budget: Saptarishi

- Inclusive Development

- Reaching Last Mile

- Infrastructure & Investment

- Unleashing The Potential

- Green Growth

- Youth Power

- Financial Sector

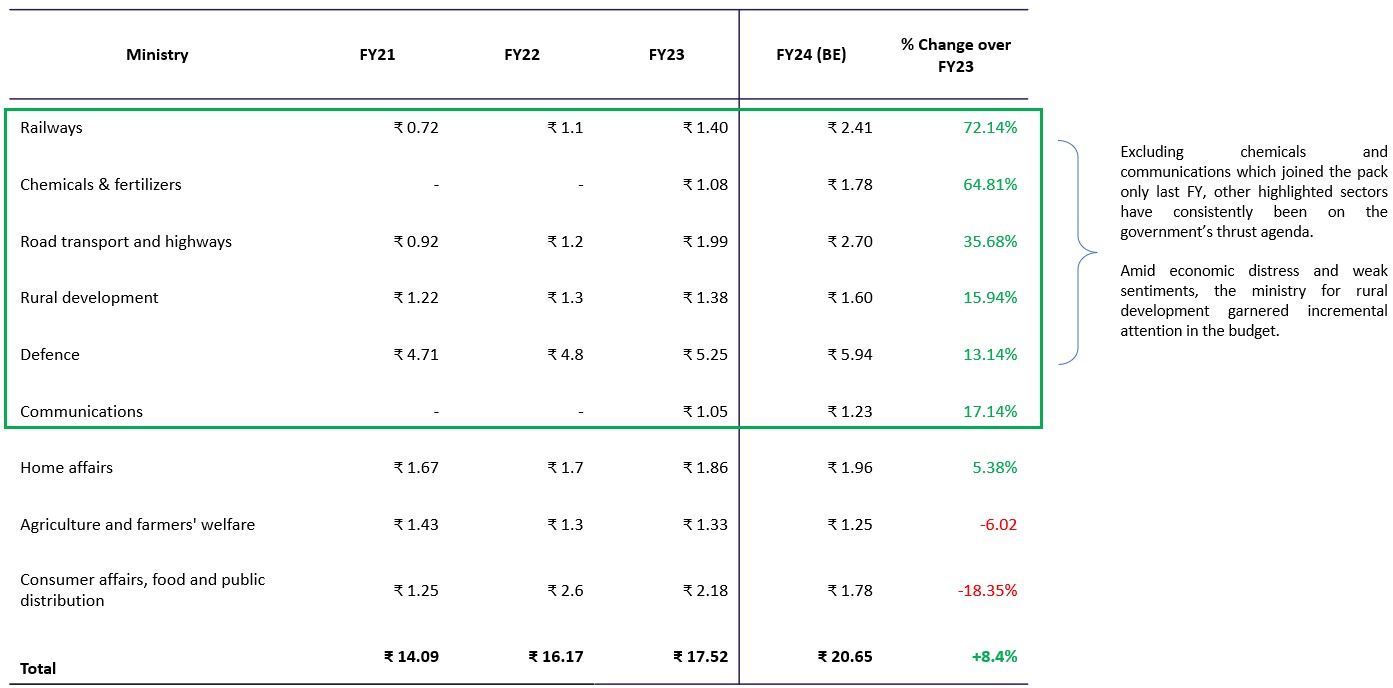

Budget Overview: Incremental capex is well backed by the additional revenue receipts

Railways and Chemicals + Fertilizer segments have been allocated higher funds

Reduction in customs duty to boost domestic manufacturing

| Commodity | From% | To% |

| I Agricultural Products | ||

| Pecan Nuts | 100 | 30 |

| Fish meal for manufacture of aquatic feed | 15 | 5 |

| Krill meal for manufacture of aquatic feed | 15 | 5 |

| Fish lipid oil for manufacture of aquatic feed | 30 | 15 |

| Algal Prime (flour) for manufacture of aquatic feed | 30 | 15 |

| Mineral and Vitamin Premixes for manufacture of aquatic feed | 15 | 5 |

| Crude glycerin for use in manufacture of Epichlorohydrin | 7.5 | 2.5 |

| Denatured ethyl alcohol for use in manufacture of industrial chemicals. | 5 | Nil |

| II Minerals | ||

| Acid grade fluorspar (containing by weight more than 97 per cent of calcium fluoride) | 5 | 2.5 |

| III Gems and Jewellery Sector | ||

| Seeds for use in manufacturing of rough lab-grown diamonds | 5 | Nil |

| IV Capital Goods | ||

| Specified capital goods/machinery for manufacture of lithium-ion cell for use in battery of electrically operated vehicle (EVs) | As Applicable | Nil (Up to 31.03.2024) |

| V IT and Electronics | ||

| Specified chemicals/items for manufacture of Pre-calcined Ferrite Powder | 7.5 | Nil (Up to 31.03.2024) |

| Palladium Tetra Amine Sulphate for manufacture of parts of connectors | 7.5 | Nil (Up to 31.03.2024) |

| Camera lens and its inputs/parts for use in manufacture of camera module of cellular mobile phone | 2.5 | Nil |

| Specified parts for manufacture of open cell of TV panel | 5 | 2.5 |

| VI Electronic Appliances | ||

| Heat coil for manufacture of electric kitchen chimneys | 20 | 15 |

| VII Others | ||

| Warm blood horse imported by sports person of outstanding eminence for training purpose | 30 | Nil |

| Vehicles, specified automobile parts/components, sub-systems and tyres when imported by notified testing agencies, for the purpose of testing and/ or certification, subject to conditions. | As Applicable | Nil |

Changes to the personal income tax

Announcements applicable to those who follow the new tax regime for return filing:

- New tax regime to become the default tax regime. However, investors have the option to file under the old tax regime

- The rebate limit expanded to Rs. 7 lakhs from Rs. 5 lakhs earlier

- Tax exemption limit increased to Rs.3 lakhs from Rs. 2.5 lakhs earlier

- Standard deduction benefit of Rs.50,000 has been extended to the new tax regime as well.

- Surcharge rate on income above Rs. 5 crores reduced to 25% from 37%

Impact:

|

Other key announcements:

- Increased the tax exemption limit to Rs. 25 lakhs on leave encashment on retirement for non-government salaried employees.

- Wherever the aggregate premium for life insurance policies (other than ULIP) issued on or after 1st April 2023 is above Rs.5 lakh, income from those policies with aggregate premiums up to Rs. 5 lakhs shall be exempt.

- The maximum deposit limit for Senior Citizen Savings Scheme will be enhanced from Rs.15 lakh to Rs.30 lakh.

- The maximum deposit limit for Monthly Income Account Scheme will be enhanced from Rs.4.5 lakh to Rs.9 lakh for single account and from Rs.9 lakh to Rs. 15 lakh for joint account

Opportunities: strong fundamentals

| Domestic Demand | Despite challenges due to the elevated rate environment and external risks, India remains committed to robust private and public apex outlay. With a turnaround in the banking system’s health, growing aggregate domestic demand, higher capacity utilization, responsive demand for credit and the government’s ambitious policies on economic development, elements of consumption, investment and government Capex are expected to witness a fillip in the positive direction. |

| Easing Inflationary woes | A favourable base coupled with softening commodity, food, energy and input costs is expected to lower the inflationary heat. While inflation well within the central bank’s tolerance threshold seems Utopian now, a relative improvement in the situation should augur well for the economy. |

| Healthier National Accounts | Rolling back of pandemic-related stimulus, higher tax receipts and reasonable reversal of subsidies should create a path to healthy fiscal consolidation |

| Sustainable debt | With a longer tenured weighted average maturity of ~12 years and diversified debt ownership with majority domestic investors, rollover risk is pegged at relatively lower levels. Fiscal consolidation and expected GDP growth trajectory position make current net debt levels sustainable. |

| Insulation against externalities | Attractive interest rate differentials with most advanced economies and strong fundamentals are expected to attract global investment capital into domestic capital markets, thereby strengthening the currency, forex reserves and capital markets while offering cushion to account deficits. Forex reserves are maintained at healthy levels higher than most EM counterparts while offering significant import cover. |

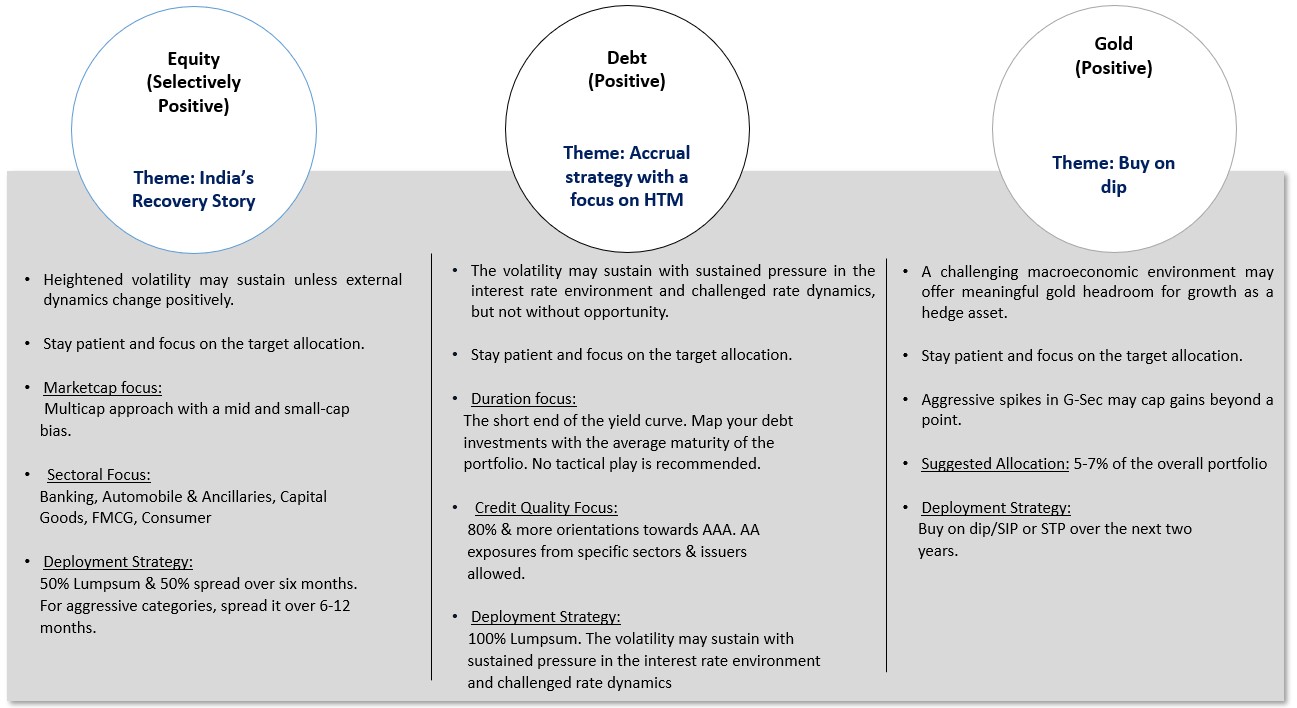

Preferred sectoral bets for CY2023

The current inflationary environment is accompanied by challenged supply chains, higher interest rates and employment woes, especially among advanced consuming economies. Considering the backdrop, we view defensive sectors offering goods and services with demand relatively inelastic to price to hold up. Alongside, sectors least disrupted by global trade disruptions, healthy cash flows and limited or managed sensitivity to the overall cost of debt capital to continue holding promise.

| Banking | With improving credit demand and a promising uptick in the private capex cycle, the turnaround in banks’ earnings are expected to sustain. Fast-paced NPA resolution and healthier balance sheets support the case for shareholder value creation by banks. Particular focus on PSU Banks that hold the potential to be re-rated amid operating and financial turnaround. |

| Automobiles & Ancillaries | Despite headwinds through increased steel, aluminium, nickel and similar feedstock commodity prices, the auto and auto ancillary segments are expected to hold up well in the near term and expand over the medium to longer term as cost effects subside through operating efficiency and higher pass-through. Tiding over commodity cost and semiconductor shortage-related challenges, volumes are returning to pre-pandemic levels. |

| FMCG | In the near term, rising input costs continue to challenge the sector; however, the industry is expected to mount a growth trajectory as it passes through costs efficiently and operating efficiencies start materialising at scale. Earning reports for Q2FY23 have started looking up, indicating further promise. |

| Capital Goods | The confluence of an uptick in private and public Capex in response to expected demand is accretive to the segment. Policy support through Production-linked incentives and National Infrastructure Pipeline supports the sector further. The China plus strategy has been a critical propellor for India to develop domestic strength in manufacturing to secure domestic supply and value chains. |

| Information Technology | We expect IT Sector to benefit from the anticipated vendor consolidation amid changing global dynamics. Bolstering prospects further, the bulk deal pipeline seems to be improving in the wake of a clear increase in focus on automation and cost-efficient programmes. In line, we maintain a positive outlook on the sector from the near to medium-term point of view and recommend proportionate buying-cum-accumulation that can be looked into in this segment for the next six to twelve months. |

Way ahead